- United States

- /

- Trade Distributors

- /

- NYSE:AER

Should FlySafair’s Boeing 737 Lease Deal Boost Confidence in AerCap Holdings' (AER) Growth Prospects?

Reviewed by Sasha Jovanovic

- At the Dubai Airshow 2025, FlySafair announced it has signed lease agreements with AerCap Holdings for three Boeing 737 MAX 8 aircraft, scheduled for delivery beginning in the first quarter of 2028, and two Boeing 737-800NG aircraft, set to deliver from the third quarter of 2026.

- This transaction highlights ongoing demand for next-generation, fuel-efficient jets from airline operators in fast-growing international markets.

- We'll look at how these new lease agreements may strengthen AerCap's forward revenue visibility and support its expansion narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

AerCap Holdings Investment Narrative Recap

To be a shareholder in AerCap Holdings means believing that resilient long-term aircraft leasing demand, especially for new, fuel-efficient jets in international markets, can offset sector volatility and cyclical risks. The FlySafair lease agreements announced at the Dubai Airshow 2025 marginally enhance AerCap’s forward revenue visibility but are not material enough to affect the most important near-term catalyst, tight aircraft supply and robust lease renewal rates. Likewise, these deals do not alter the biggest risk: potential competitive pressure if OEM deliveries accelerate and leasing market conditions soften.

The most relevant recent announcement to this news is AerCap’s July 2025 delivery of the first Airbus A321LR to Etihad Airways, reflecting significant ongoing activity to meet continued demand for next-generation aircraft across regions. Such transactions reinforce the underlying catalyst of high utilization rates and lease renewals, which are currently a core driver of AerCap’s positive earnings trend.

But investors should be aware that, in contrast to today’s tight supply, the risk of OEM delivery ramp-up potentially flooding the market with new aircraft is still on the horizon...

Read the full narrative on AerCap Holdings (it's free!)

AerCap Holdings' narrative projects $8.4 billion revenue and $1.4 billion earnings by 2028. This requires 1.7% yearly revenue growth and a $1.5 billion earnings decrease from $2.9 billion.

Uncover how AerCap Holdings' forecasts yield a $148.00 fair value, a 11% upside to its current price.

Exploring Other Perspectives

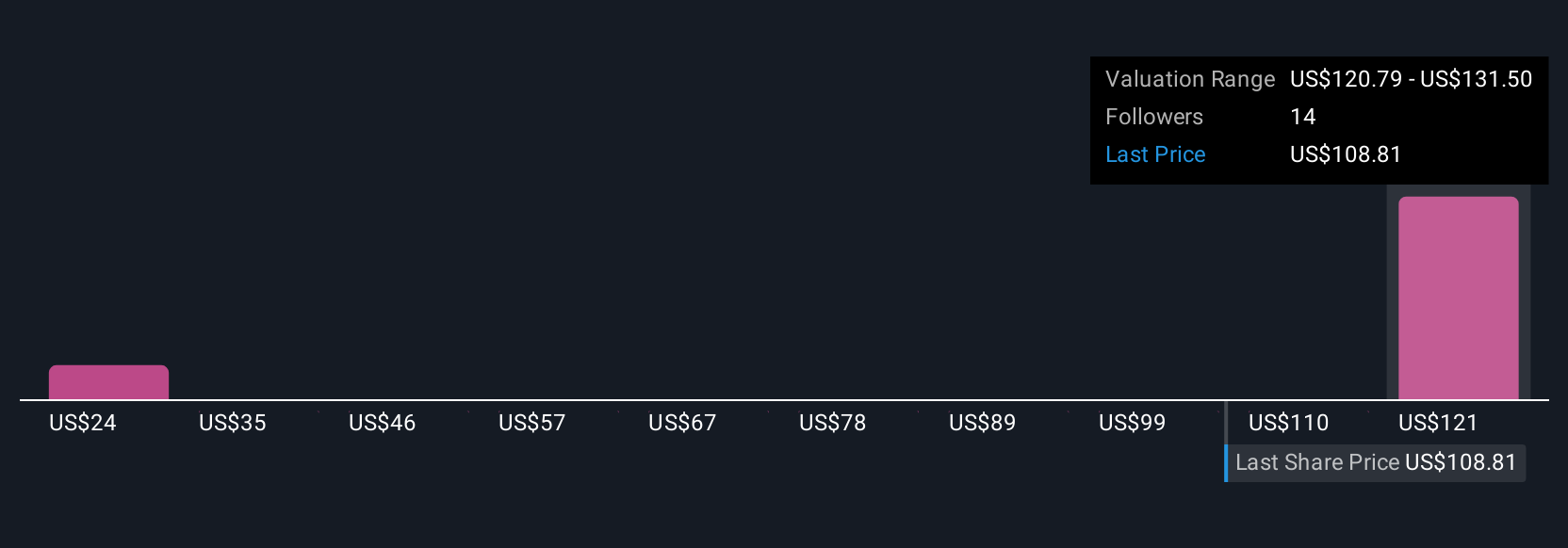

Simply Wall St Community fair value estimates for AerCap Holdings range widely from US$148 to US$530, with 2 recent perspectives. While many market participants see robust catalysts supporting lease revenue, you can explore multiple points of view here.

Explore 2 other fair value estimates on AerCap Holdings - why the stock might be worth over 3x more than the current price!

Build Your Own AerCap Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AerCap Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free AerCap Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AerCap Holdings' overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AER

AerCap Holdings

Engages in the lease, financing, sale, and management of commercial flight equipment in the United States, China, and internationally.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success