- United States

- /

- Trade Distributors

- /

- NYSE:AER

Did GE Aerospace’s New GE9X Engine Deal Just Shift AerCap Holdings’ (AER) Investment Narrative?

Reviewed by Sasha Jovanovic

- On October 15, 2025, GE Aerospace announced it had signed a seven-year agreement with AerCap Holdings for lease pool management services supporting the GE9X engine and extended AerCap's role in managing several other major GE engine platforms.

- This agreement positions AerCap as an integral partner as the GE9X engine nears entry into service, reflecting the growing importance of comprehensive aftermarket support in the aviation sector.

- We'll examine how this expanded partnership with GE Aerospace could enhance AerCap's service portfolio and reinforce its investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

AerCap Holdings Investment Narrative Recap

To own AerCap Holdings stock, investors need to believe in the durability of aircraft leasing demand, the company's ability to adapt to cycles, and the long-term value creation from expanding services. The recent GE Aerospace partnership brings new revenue opportunities from aftermarket engine support, but does not materially change the most immediate catalysts, tight lease rates from supply constraints, or blunt the biggest risk of future oversupply and rate compression as OEM deliveries ramp up in coming years.

One recent announcement that connects with this theme is AerCap’s June 2025 move to enter exclusive negotiations with Air France Industries KLM Engineering & Maintenance for a LEAP engine joint venture. Much like the new GE9X partnership, it reflects AerCap’s push to diversify revenue through ancillary services, a catalyst that could help soften the impact if leasing market conditions eventually turn less favorable.

However, if the strong market for lease extensions and engine demand starts to ease, investors should be aware that...

Read the full narrative on AerCap Holdings (it's free!)

AerCap Holdings' narrative projects $8.4 billion revenue and $1.4 billion earnings by 2028. This requires 1.7% yearly revenue growth and a $1.5 billion decrease in earnings from $2.9 billion today.

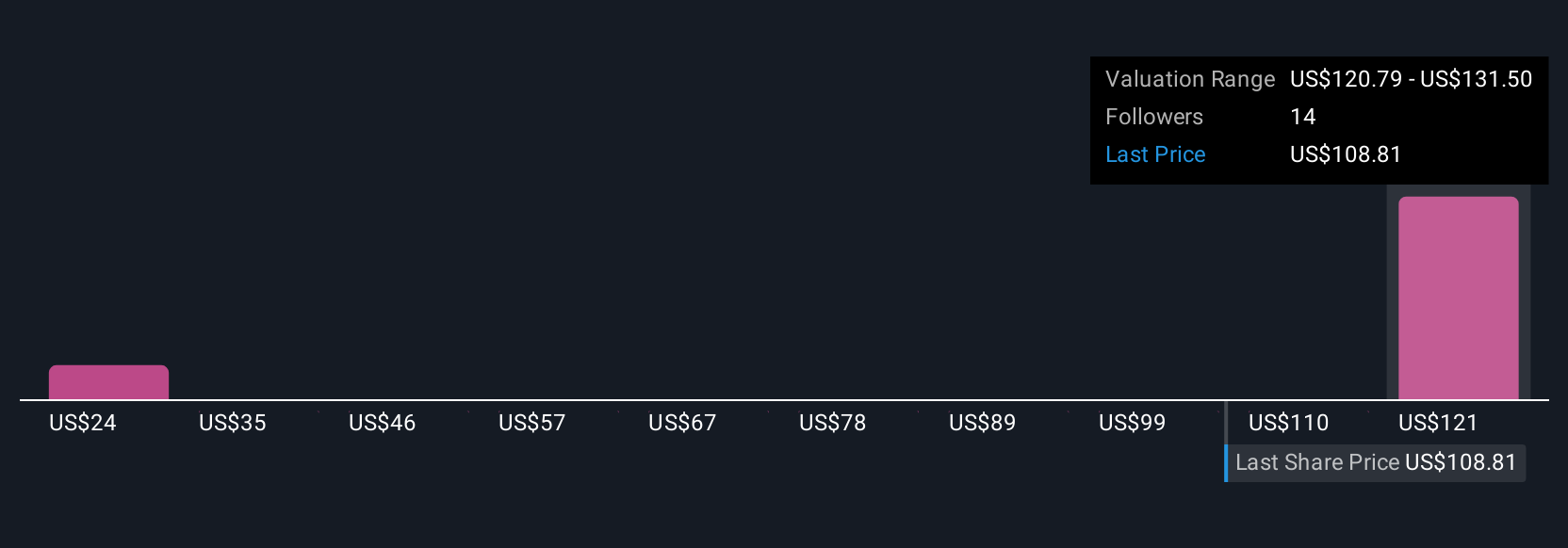

Uncover how AerCap Holdings' forecasts yield a $133.12 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided just 2 fair value estimates for AerCap, ranging widely from US$133.13 to US$270.79. While some participants see substantial upside, current analyst forecasts warn of declining earnings over the next three years, creating very different expectations for the company's outlook.

Explore 2 other fair value estimates on AerCap Holdings - why the stock might be worth just $133.12!

Build Your Own AerCap Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AerCap Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free AerCap Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AerCap Holdings' overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AER

AerCap Holdings

Engages in the lease, financing, sale, and management of commercial flight equipment in the United States, China, and internationally.

Undervalued with low risk.

Similar Companies

Market Insights

Community Narratives