- United States

- /

- Trade Distributors

- /

- NYSE:AER

AerCap (AER) Net Profit Margin Boosted by $1.5B One-Off Gain, Challenging Earnings Quality Narratives

Reviewed by Simply Wall St

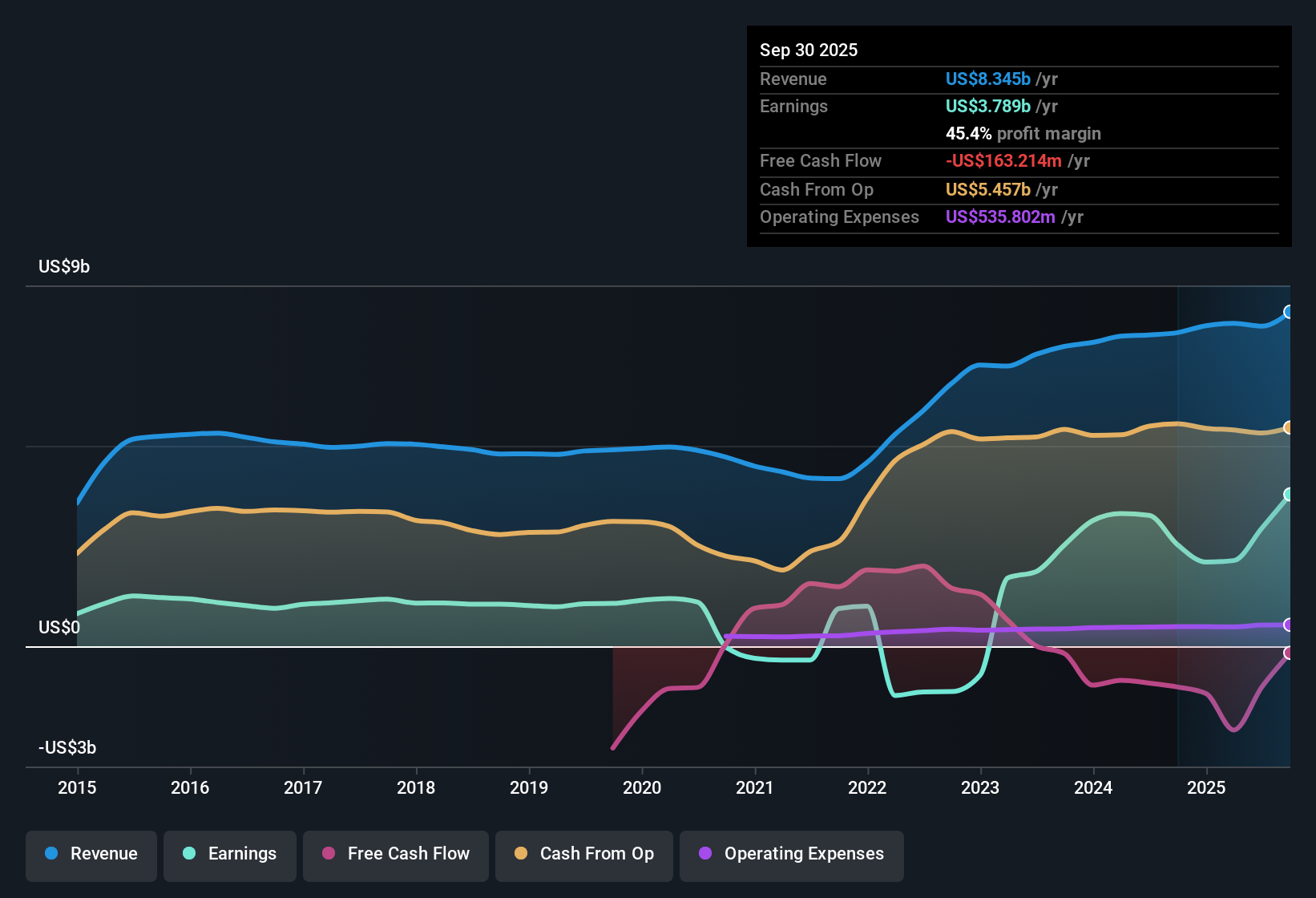

AerCap Holdings (AER) reported a striking net profit margin of 45.4% with EPS growth over the past year at 49.6%. The latest figures include a one-off gain of $1.5 billion, greatly influencing profits for the period. While the company has become profitable over the last five years, both revenue and earnings are forecast to decline from here. This sets up a challenging backdrop despite current margins.

See our full analysis for AerCap Holdings.Next, we’ll see how these headline numbers measure up against the key market narratives. Some long-held views could be affirmed, while others might need rethinking.

See what the community is saying about AerCap Holdings

Lease Rates Climb on Tight Supply

- Aircraft and engine supply remains tight due to ongoing OEM production delays. This is fueling higher lease rates and expanding asset values across AerCap’s portfolio.

- Analysts' consensus view highlights that strong global passenger growth, especially in APAC and the Middle East, is driving high aircraft utilization (99%) and lease extension rates (97%), supporting lease revenues.

- Consistent lease extensions, particularly for new and widebody aircraft, provide long-term visibility into future revenue streams and support higher average lease rate factors.

- Sustained demand and constrained supply enhance AerCap’s ability to secure premium rates. This aligns with consensus expectations for stable net margins despite future margin compression.

Consensus says recent numbers add weight to the view that tight markets still have room to run. 📊 Read the full AerCap Holdings Consensus Narrative.

Non-Recurring Gains Skew Profit Quality

- The latest net profit margin of 45.4% received a material boost from a $1.5 billion one-off gain. This means reported profits overstate the underlying operational earnings power.

- Analysts' consensus narrative urges investors to dig deeper, noting that non-recurring items have an outsized effect on headline profitability and that future earnings may be less robust as these fade.

- Forecasts show profit margins are expected to shrink from 36.9% today to 16.9% in three years, reflecting a return to a more typical earnings pattern as one-time gains subside.

- Sharp swings in non-operating income caution investors against extrapolating recent strong profit margins too far into future periods, as they may not be sustainable.

Share Price Trades at a Discount to Analyst Target

- AerCap’s current share price of $130.38 sits below the analyst price target of $138.88 and remains far under the DCF fair value estimate of $270.08. This suggests the market prices in elevated risks or skepticism about forward earnings and margins.

- According to the analysts' consensus narrative, AerCap is regarded as good value versus peers, trading on a PE multiple of 6.8x compared to the US Trade Distributors industry at 22.7x, even as future earnings are projected to decline.

- This valuation gap reflects concern about forecasted revenue and earnings pressure, but analysts believe the price still underestimates AerCap’s normalized earnings power.

- The consensus view points out that, despite muted earnings growth expectations, analysts see more upside than implied by the current share price, a tension investors may want to investigate further.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for AerCap Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you have a different take on the data? Use your perspective to craft a unique narrative in just a few minutes. Do it your way

A great starting point for your AerCap Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

AerCap’s declining revenue outlook and shrinking profit margins highlight a risk of inconsistent performance in the coming years.

If stable growth matters to you, check out stable growth stocks screener (2113 results) to find companies that consistently deliver dependable earnings and revenue expansion even when others face headwinds.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AER

AerCap Holdings

Engages in the lease, financing, sale, and management of commercial flight equipment in the United States, China, and internationally.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives