- United States

- /

- Construction

- /

- NYSE:ACM

AECOM (ACM): Evaluating Valuation After Strong Annual Revenue and Net Income Growth

Reviewed by Simply Wall St

See our latest analysis for AECOM.

AECOM’s share price has surged this year, notching a 22.5% year-to-date gain that reflects strong investor sentiment following the company’s healthy top- and bottom-line growth. While the stock pulled back slightly in the last week, the one-year total shareholder return stands at a solid 24.7%. Momentum is also highlighted by an impressive 84% total return over three years. Recent price action suggests investors are recognizing AECOM’s improving fundamentals and growth prospects, which may contribute to sustained long-term outperformance.

If you’re considering where similar growth could emerge next, now’s the perfect moment to discover fast growing stocks with high insider ownership

With AECOM's shares already reflecting robust gains and steady financial growth, the key question now is whether the current price still offers value for new investors or if future growth has already been fully accounted for by the market.

Most Popular Narrative: 7.4% Undervalued

With AECOM’s current share price around $130, the most widely followed narrative places the company's fair value higher, implying more room for upside given analyst expectations. As excitement builds over recent financial wins, investors are turning to the core drivers behind this optimistic valuation.

Accelerating global and U.S. government-backed infrastructure spending, especially in transportation, water, energy, and data centers, provides multi-year revenue visibility and a record backlog. This should support top-line growth and backlog-driven earnings expansion.

Want to know the blueprint fueling this bullish outlook? The price projection is built on aggressive assumptions for future revenue, profit margins, and a valuation multiple that is rarely seen in the sector. Curious which financial levers analysts think will push the stock higher? Find out how these critical estimates shape the future AECOM story.

Result: Fair Value of $140.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in government spending or rising operational costs could quickly challenge AECOM’s growth projections and put pressure on both revenue and margins.

Find out about the key risks to this AECOM narrative.

Another View: SWS DCF Model Suggests a Different Story

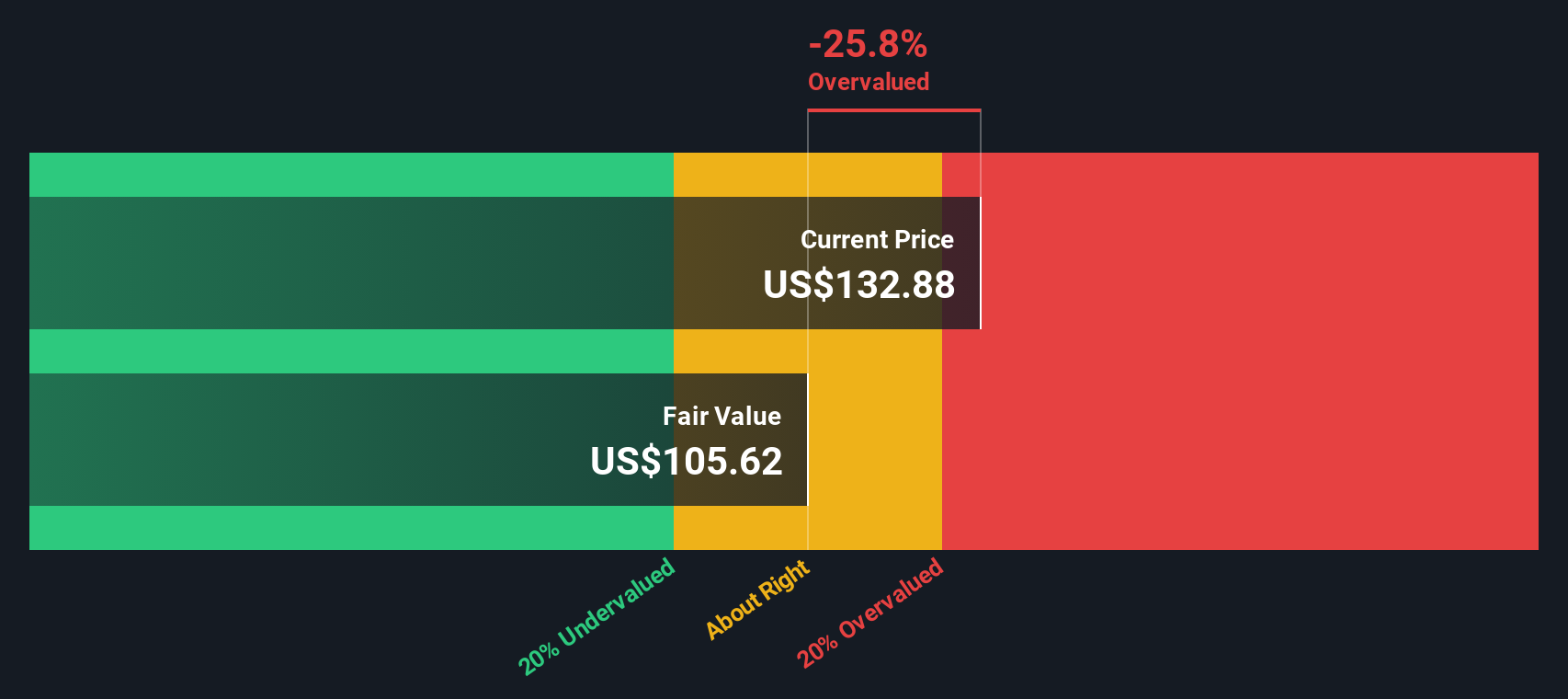

While analysts see AECOM as modestly undervalued based on earnings and market comparisons, our DCF model challenges this optimism. It suggests shares are trading above intrinsic value, with the fair value estimated at $105.69. This could signal possible overvaluation if growth targets fall short. Which story convinces you more?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AECOM for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AECOM Narrative

If you see things differently or want to dig deeper yourself, you can quickly build your own view using our tools. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding AECOM.

Looking for more investment ideas?

Smart investors know opportunity rarely knocks the same way twice. Make your next big move by exploring specialized lists designed to help you spot tomorrow's winners before the crowd catches on.

- Tap into potential with these 874 undervalued stocks based on cash flows that are currently flying under the radar and offer strong prospects based on cash flow analysis.

- Target growing demand by searching these 26 AI penny stocks that are transforming industries with artificial intelligence innovation and robust business models.

- Maximize your passive income by selecting from these 17 dividend stocks with yields > 3% featuring yields above 3% and supported by sustainable fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACM

AECOM

Provides professional infrastructure consulting services for governments, businesses, and organizations worldwide.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives