- United States

- /

- Aerospace & Defense

- /

- NYSE:ACHR

Archer Aviation (ACHR): Assessing Valuation After Midnight Aircraft’s Record Altitude Test and Osaka Air Taxi Partnership

Reviewed by Kshitija Bhandaru

Archer Aviation (ACHR) is making headlines after its Midnight aircraft broke altitude records. The company also secured a key partner role in Osaka’s air taxi rollout, fueled by its alliance with Soracle in Japan.

See our latest analysis for Archer Aviation.

Momentum is gradually building for Archer Aviation as headline-making technical milestones and new partnerships keep optimism afloat. While the stock’s recent share price moves have been modest, a 1-year total shareholder return of 2.5% points to steady progress as the company strengthens its footing in the eVTOL market.

If the story of Archer’s record-setting Midnight aircraft has you thinking bigger, now is the perfect time to broaden your search and discover See the full list for free.

With Archer Aviation trading significantly below analyst targets but delivering clear advancements and strategic wins, the question remains for investors: is there a real buying opportunity here, or is the market already pricing in all that future growth?

Price-to-Book of 3.9x: Is it justified?

Archer Aviation trades at a price-to-book ratio of 3.9x, just below the peer average of 4.2x but above the broader industry average of 3.6x. With the last close at $10.18, the stock appears reasonably valued compared to similar companies in the aerospace and defense sector, yet slightly expensive relative to industry benchmarks.

The price-to-book ratio compares a company’s market value to its net assets. In capital-intensive sectors like aerospace, this metric can provide insight into whether investors are paying a premium for intangible potential, innovation, or rapid growth prospects.

For Archer, positioning between peer and sector averages may reflect investor enthusiasm for its unique position and headline-grabbing achievements. However, the current multiple suggests the market is factoring in elevated expectations for accelerated growth and future execution rather than profitability in the near term. If the fair ratio becomes a more meaningful comparison in the future, it is a level the market could adjust toward.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 3.9x (ABOUT RIGHT)

However, Archer’s lack of revenue and ongoing net losses remain significant risks that could quickly shift sentiment and challenge the growth narrative.

Find out about the key risks to this Archer Aviation narrative.

Another View: Discounted Cash Flow Paints a Different Picture

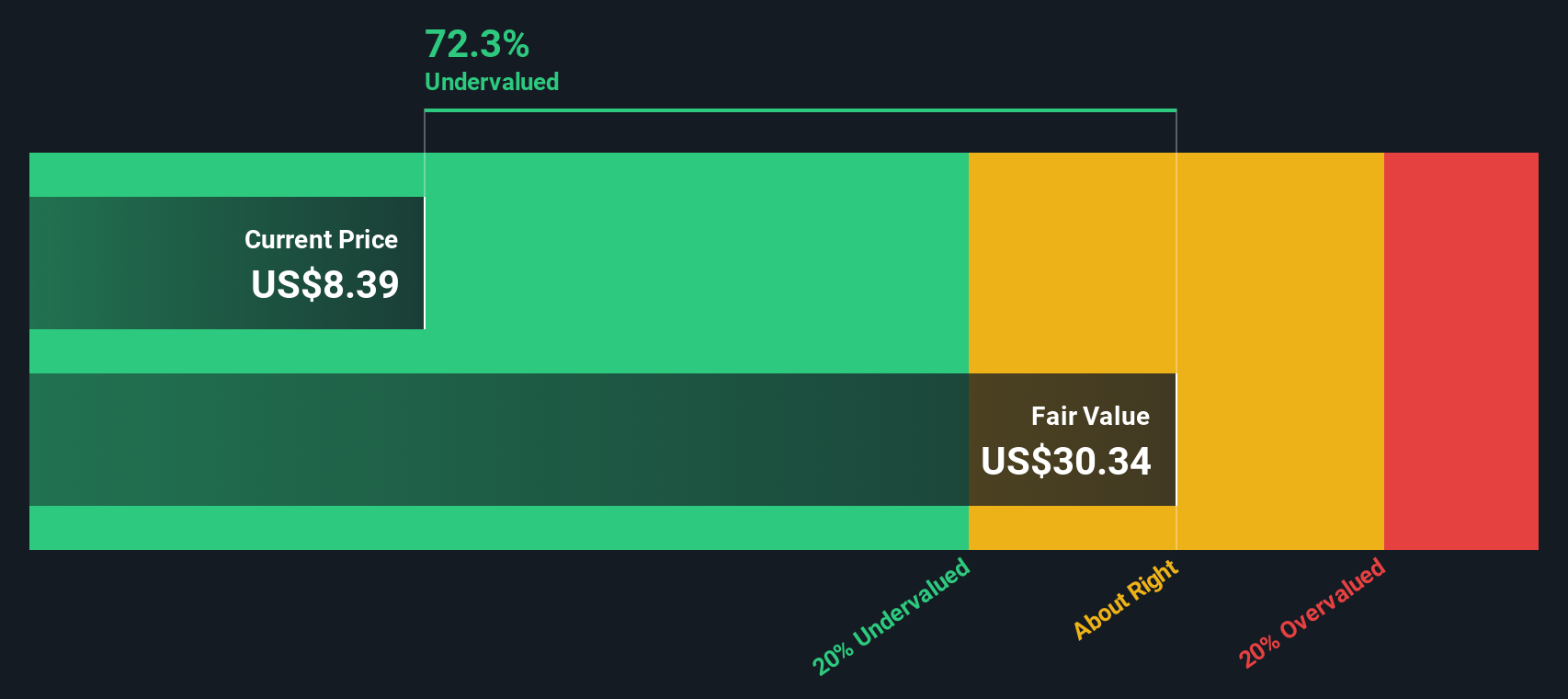

While Archer Aviation’s price-to-book ratio may appear reasonable compared to its peers, our DCF model suggests a different perspective. The SWS DCF model estimates fair value at $29.95, indicating the shares are trading at a steep 66% discount. Is the market being too pessimistic about Archer’s future, or does this gap reflect real risks that justify the lower price?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Archer Aviation for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Archer Aviation Narrative

If you see the story differently or want to dig into the numbers yourself, you can craft your own narrative in just a few minutes. Do it your way.

A great starting point for your Archer Aviation research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Investors rarely win by standing still. Seize this opportunity to uncover bold new stocks that could shape your financial future and help you stay ahead.

- Catch the surge in digital finance by reviewing these 78 cryptocurrency and blockchain stocks, which is taking blockchain and crypto innovation mainstream.

- Find underappreciated gems and boost your potential returns using these 909 undervalued stocks based on cash flows, highlighted for attractive valuations.

- Capitalize on AI’s explosive growth with these 24 AI penny stocks, transforming how businesses and industries operate globally.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACHR

Archer Aviation

Designs and develops aircraft and related technologies and services in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives