- United States

- /

- Aerospace & Defense

- /

- NYSE:ACHR

A Look at Archer Aviation’s Valuation Following Korean Air Deal and Patent Acquisition

Reviewed by Simply Wall St

Archer Aviation (NYSE:ACHR) just signed a significant agreement with Korean Air to bring its Midnight electric air taxis to South Korea, starting with government-oriented projects. The deal includes potential purchases of up to 100 aircraft.

See our latest analysis for Archer Aviation.

Momentum has been building for Archer Aviation, with its total shareholder return soaring 245.76% over the past year as the company lands groundbreaking global partnerships and expands its intellectual property through major patent acquisitions. While short-term share price returns can be choppy, these recent wins suggest growing confidence in Archer’s future market position.

If you’re intrigued by the rapid innovation in aviation, it’s a great moment to discover See the full list for free.

With Archer’s shares up nearly 250% in the past year and the stock trading about 9% below its average analyst price target, investors may wonder if there is more upside ahead or if future growth is already fully reflected in the stock price.

Price-to-Book of 4.4x: Is it justified?

At a price-to-book ratio of 4.4x, Archer Aviation trades well below its peer average of 10.7x. This hints at compelling relative value for investors seeking exposure to the sector. The last close was $11.41, providing a notable discount compared to similar companies in the market.

The price-to-book ratio compares a company’s stock price with the book value of its assets. This highlights what investors are willing to pay for the company’s net assets. In the capital-intensive aerospace and defense sector, this multiple can highlight underappreciated growth potential, especially for younger disruptors with scalable intellectual property, like Archer.

However, Archer’s price-to-book multiple is higher than the broader US Aerospace & Defense industry average of 3.6x. This signals that while the market places a premium on its potential, it is less expensive relative to direct peers but more expensive when compared to the broader industry.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 4.4x (UNDERVALUED)

However, steep net losses and zero reported revenue remain key risks that could derail Archer Aviation’s bullish thesis if not addressed in coming quarters.

Find out about the key risks to this Archer Aviation narrative.

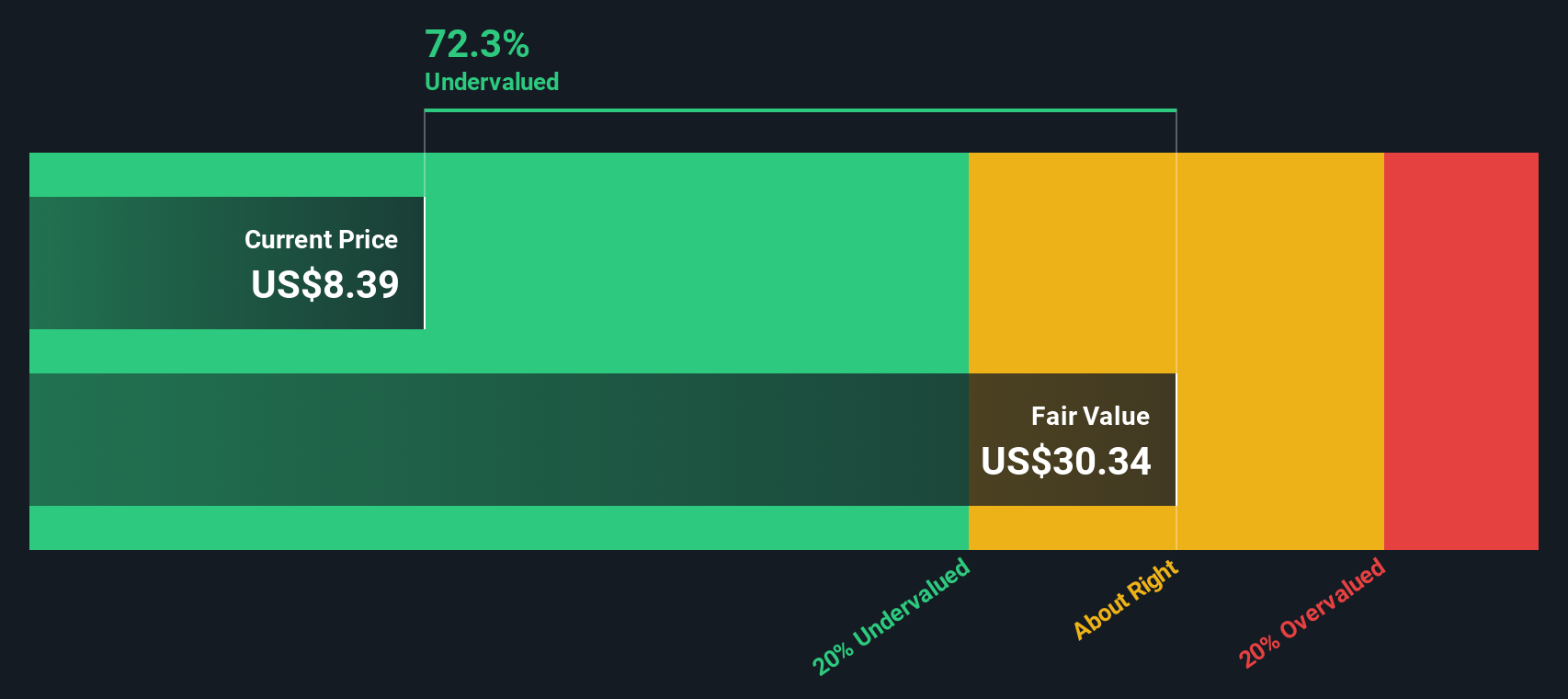

Another View: The SWS DCF Model Suggests Even Greater Discount

While Archer looks undervalued relative to peers using the price-to-book ratio, the SWS DCF model points to an even deeper discount. Based on our DCF approach, Archer’s shares trade at over 60% below their estimated fair value, indicating there could be significantly more upside than what multiples suggest. However, does this model capture the full story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Archer Aviation for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Archer Aviation Narrative

If you want to dive deeper or form your own perspective, you can quickly analyze the numbers and build a custom view in just a few minutes with Do it your way.

A great starting point for your Archer Aviation research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t wait for the next headline to find you. Supercharge your portfolio today by targeting opportunities other investors might overlook using the Simply Wall Street Screener.

- Tap into overlooked value by tracking these 879 undervalued stocks based on cash flows where discounted stocks could offer significant potential for future gains.

- Spot the next wave of technological disruption by reviewing these 24 AI penny stocks featuring companies transforming industries with artificial intelligence advances.

- Boost your passive income by filtering for robust yield opportunities with these 17 dividend stocks with yields > 3% and uncover stocks with attractive, sustainable dividends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACHR

Archer Aviation

Designs and develops aircraft and related technologies and services in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives