- United States

- /

- Machinery

- /

- NasdaqCM:ZJK

There's Reason For Concern Over ZJK Industrial Co., Ltd.'s (NASDAQ:ZJK) Massive 28% Price Jump

Those holding ZJK Industrial Co., Ltd. (NASDAQ:ZJK) shares would be relieved that the share price has rebounded 28% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

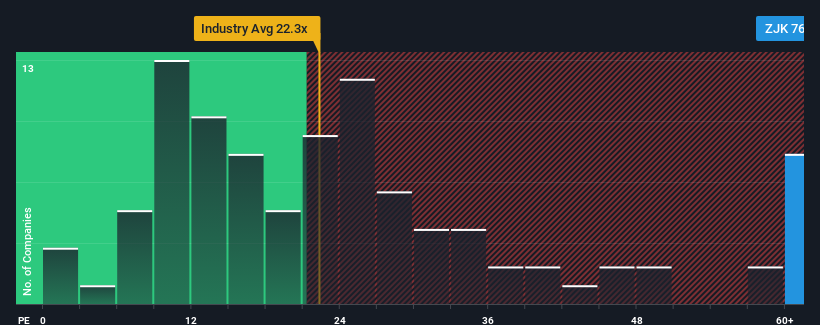

Following the firm bounce in price, given close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 17x, you may consider ZJK Industrial as a stock to avoid entirely with its 76.7x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

We've discovered 2 warning signs about ZJK Industrial. View them for free.For example, consider that ZJK Industrial's financial performance has been poor lately as its earnings have been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for ZJK Industrial

How Is ZJK Industrial's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like ZJK Industrial's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 52%. Regardless, EPS has managed to lift by a handy 20% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 13% shows it's noticeably less attractive on an annualised basis.

In light of this, it's alarming that ZJK Industrial's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Bottom Line On ZJK Industrial's P/E

ZJK Industrial's P/E is flying high just like its stock has during the last month. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that ZJK Industrial currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It is also worth noting that we have found 2 warning signs for ZJK Industrial that you need to take into consideration.

If you're unsure about the strength of ZJK Industrial's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if ZJK Industrial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ZJK

ZJK Industrial

Through its subsidiaries, manufactures and sells precision fasteners, structural parts, and other precision metal parts products in the People’s Republic of China, Taiwan, the United States, and internationally.

Excellent balance sheet very low.

Market Insights

Community Narratives