- United States

- /

- Trade Distributors

- /

- NasdaqGS:XMTR

Xometry (XMTR) Valuation in Focus After Goldman Sachs Downgrade Spurs Shift in Investor Sentiment

Reviewed by Simply Wall St

Investors in Xometry (XMTR) woke up to a shift in sentiment this week following Goldman Sachs’ move to downgrade the stock from ‘Buy’ to ‘Neutral.’ While the raised price guidance caught some eyes, most of the market chatter focuses on the implications of this rating change for future returns.

See our latest analysis for Xometry.

Xometry’s latest share price sits at $48.69, and the market certainly noticed Goldman Sachs’ recent rating shift. After a huge rally, with its 90-day share price return soaring 54% and total shareholder return over the past year reaching a remarkable 143%, momentum has slowed this month as investor optimism cooled. The stock’s short-term pullback follows an extended surge, leaving it well above where it started the year, though still below its longer-term highs.

If the changing sentiment around Xometry has you thinking about fresh opportunities, it might be the perfect moment to explore fast growing stocks with high insider ownership.

With sentiment shifting but shares still near recent highs, the big question is whether Xometry is undervalued at current levels or if the market has already priced in all the company’s projected growth. Is this a real buying opportunity, or are investors simply paying for future potential?

Most Popular Narrative: 2.8% Undervalued

Xometry’s current share price sits just below the narrative’s fair value estimate of $50.11, suggesting the market is nearly aligned with this outlook.

Ongoing trends toward supply chain localization and resiliency are pushing more manufacturers, especially large enterprise customers, to seek flexible, domestic, and diversified sourcing solutions. This increases dependence on Xometry's platform and boosts high-value customer acquisition and revenue per customer.

Curious why analysts are assigning such a premium? Deep in this narrative lie bold growth forecasts and margin expectations that set Xometry apart from the rest. Want to know what financial milestones must be hit for this number to make sense? Tap to uncover which vital assumptions are driving this high-stakes valuation call.

Result: Fair Value of $50.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering concerns about ongoing losses and the risk of over-expansion, especially in new markets, could quickly challenge the optimistic outlook for Xometry.

Find out about the key risks to this Xometry narrative.

Another View: Valuing Xometry with Multiples

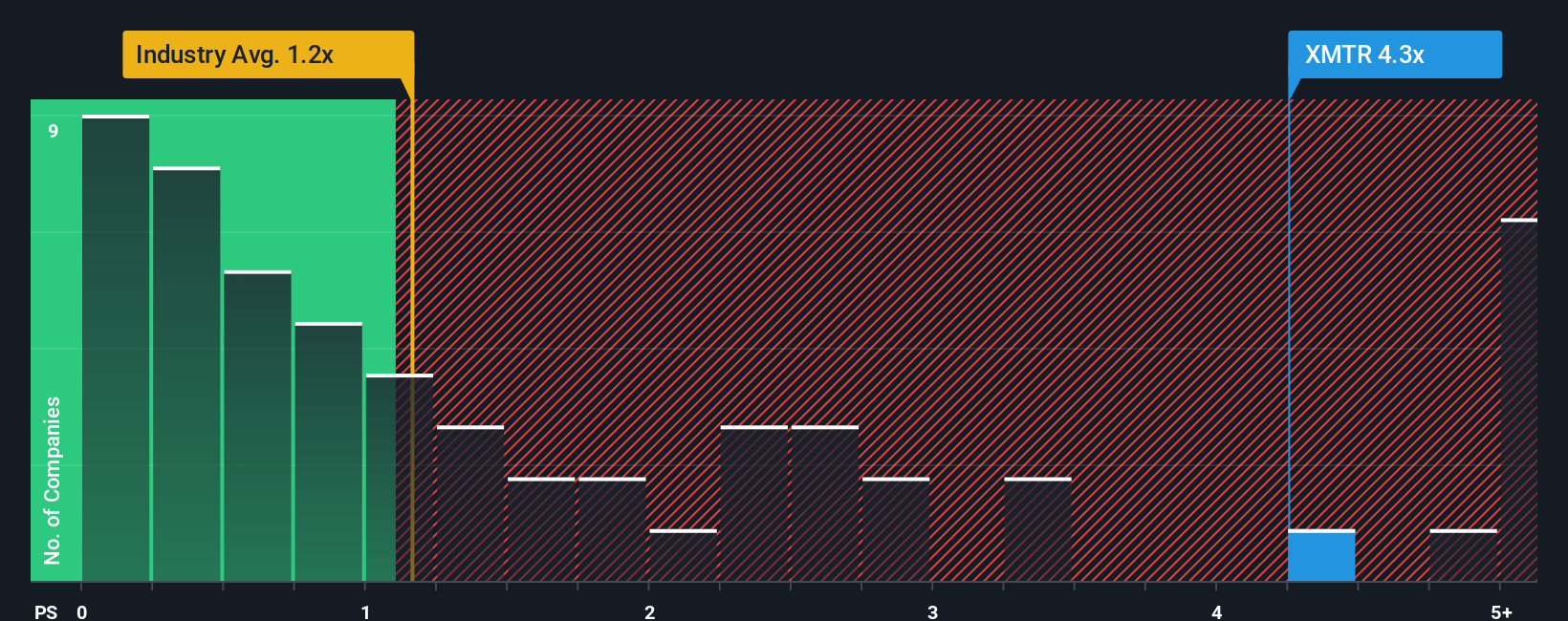

Taking a different approach, our multiples analysis paints a more cautious picture. Xometry is trading at 4.1 times its sales, which is well above both the industry average of 1.2x and the peer average of 1.5x. Even our fair ratio suggests it should be closer to 3.2x. This premium means investors are paying up for growth that may not materialize. Does the stock deserve this elevated price, or is there hidden risk in chasing momentum?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Xometry Narrative

If you want a fresh perspective or trust your own analysis, you can craft your own take on Xometry in just a few minutes. Do it your way.

A great starting point for your Xometry research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t miss smarter opportunities. Use the Simply Wall Street Screener to find stocks primed for your portfolio before the crowd spots them.

- Uncover future leaders in medicine by searching these 33 healthcare AI stocks focused on life-saving breakthroughs and cutting-edge healthcare innovation.

- Cash in on regular returns with these 17 dividend stocks with yields > 3% offering attractive yields above 3% and robust financial footing.

- Get ahead of the next investment wave by targeting these 872 undervalued stocks based on cash flows poised for significant upside based on strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:XMTR

Xometry

Operates an artificial intelligence (AI) powered online manufacturing marketplace in the United States and internationally.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives