- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:WWD

Woodward (WWD): Exploring Valuation After Forbes’ Best Companies Recognition and Growth Outlook

Reviewed by Simply Wall St

Woodward (WWD) has just earned a place on Forbes America’s Best Companies for 2026 list, highlighting the company’s solid reputation and operational strengths. This recognition comes as Woodward is also expected to deliver considerable year-over-year growth in earnings and revenues.

See our latest analysis for Woodward.

Woodward’s robust business updates, combined with recognition from Forbes, appear to have reinforced positive investor sentiment. The company’s 51.37% year-to-date share price return highlights strong momentum, while its three-year total shareholder return of 168.76% points to sustained long-term growth.

If this level of performance has you thinking about what’s possible elsewhere in the market, now is a great moment to broaden your outlook and discover fast growing stocks with high insider ownership

With soaring returns and analysts projecting further gains, the key question emerges: Is Woodward’s current price tag justified by future prospects, or could this be a rare window to buy before the market catches up?

Most Popular Narrative: 13.2% Undervalued

At $259.41, Woodward’s last close is notably below the narrative’s fair value estimate of $298.75. This spread is drawing attention as investors watch to see if current market optimism matches future potential.

Woodward's recent wins in electric and hybrid aircraft propulsion components (A350 spoiler actuator program, Safran electromechanical actuation acquisition) position it for outsize long-term growth as the aerospace industry shifts toward cleaner and more energy-efficient platforms. This indicates higher future revenue and recurring aftermarket streams. The global push for decarbonization and rising energy efficiency standards is accelerating demand for high-tech propulsion, actuation, and energy management systems in both aviation and industrial markets. This supports Woodward's revenue growth and expands its addressable market over the coming years.

Want to see which future financial leaps justify a valuation above today’s price? This narrative hinges on ramped-up high-tech contracts and a bolder margin outlook. Ready for the growth and profitability projections behind that bullish target? Find out what sets this company apart from its peers.

Result: Fair Value of $298.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained momentum is not guaranteed. Execution risks from supply chain pressures or unforeseen cost overruns could dampen Woodward’s long-term growth outlook.

Find out about the key risks to this Woodward narrative.

Another View: A Look at Valuation Ratios

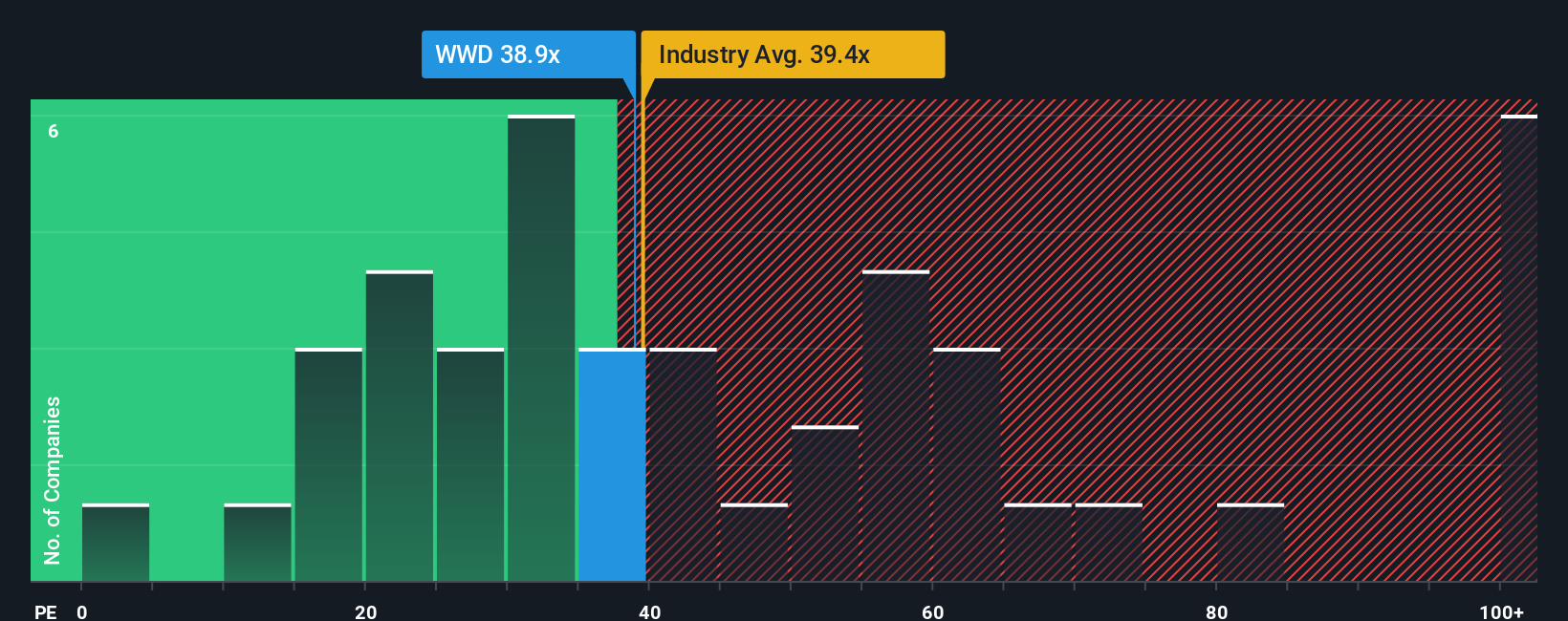

While the fair value narrative suggests Woodward is undervalued, the company's price-to-earnings ratio tells a more cautious story. At 40.1x, it sits well above both the Aerospace & Defense industry average of 36x and the peer average of 38.3x. It is also significantly higher than the fair ratio of 27.2x. This premium signals investors may be pricing in growth optimism well ahead of reality. Is the stock’s momentum getting ahead of its fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Woodward Narrative

If you want to challenge the consensus or dig deeper into the figures behind the story, you can craft your own compelling perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Woodward.

Looking for More Smart Investment Opportunities?

Hundreds of stocks across different sectors are gaining momentum right now. Give yourself the best chance to benefit by checking out these timely ideas:

- Unlock reliable income streams by targeting companies offering robust yields through these 15 dividend stocks with yields > 3%.

- Spot undervalued gems brimming with growth potential when you use these 898 undervalued stocks based on cash flows.

- Jump on the cutting edge and back innovation with these 27 AI penny stocks as these companies lead the AI transformation across industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Woodward might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WWD

Woodward

Designs, manufactures, and services control solutions for the aerospace and industrial markets worldwide.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives