- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:WWD

Will Woodward’s (WWD) Conference Insights Reveal a New Focus for Long-Term Innovation?

Reviewed by Simply Wall St

- On September 10, 2025, Woodward, Inc. presented at Morgan Stanley’s 13th Annual Laguna Conference in Dana Point, California, sharing insights with investors and industry peers.

- This annual event often attracts attention as a forum where companies can provide updates on strategy, innovation, and outlook, which may lead to heightened anticipation about Woodward's future direction.

- We’ll explore how anticipation around Woodward's conference presentation may influence perceptions of its long-term growth initiatives and innovation pipeline.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Woodward Investment Narrative Recap

To be a Woodward shareholder, you need confidence in the company’s ability to capture growth from aviation electrification and advanced actuator demand while successfully executing new manufacturing ramp-ups. While Woodward’s September 10 presentation at the Laguna Conference may provide incremental updates, it is unlikely to meaningfully shift the most important near-term catalyst, successful onboarding of new programs like the A350 spoiler actuator, or outweigh the ongoing risk of margin pressure from heavy capital investment and potential supply chain disruptions.

One recent announcement that stands out is Airbus’s selection of Woodward for the A350 Spoiler Actuation System, disclosed in June 2025. This program is directly tied to the company’s growth narrative and represents a crucial step in expanding its presence in next-generation aerospace platforms, reinforcing investor focus on execution risks and eventual free cash flow returns from major new projects.

On the flip side, investors should pay close attention to how the company manages potential cash flow strain from...

Read the full narrative on Woodward (it's free!)

Woodward's outlook anticipates $4.2 billion in revenue and $562.8 million in earnings by 2028. This is based on a projected annual revenue growth rate of 7.2% and an earnings increase of $175 million from the current earnings of $387.8 million.

Uncover how Woodward's forecasts yield a $285.88 fair value, a 20% upside to its current price.

Exploring Other Perspectives

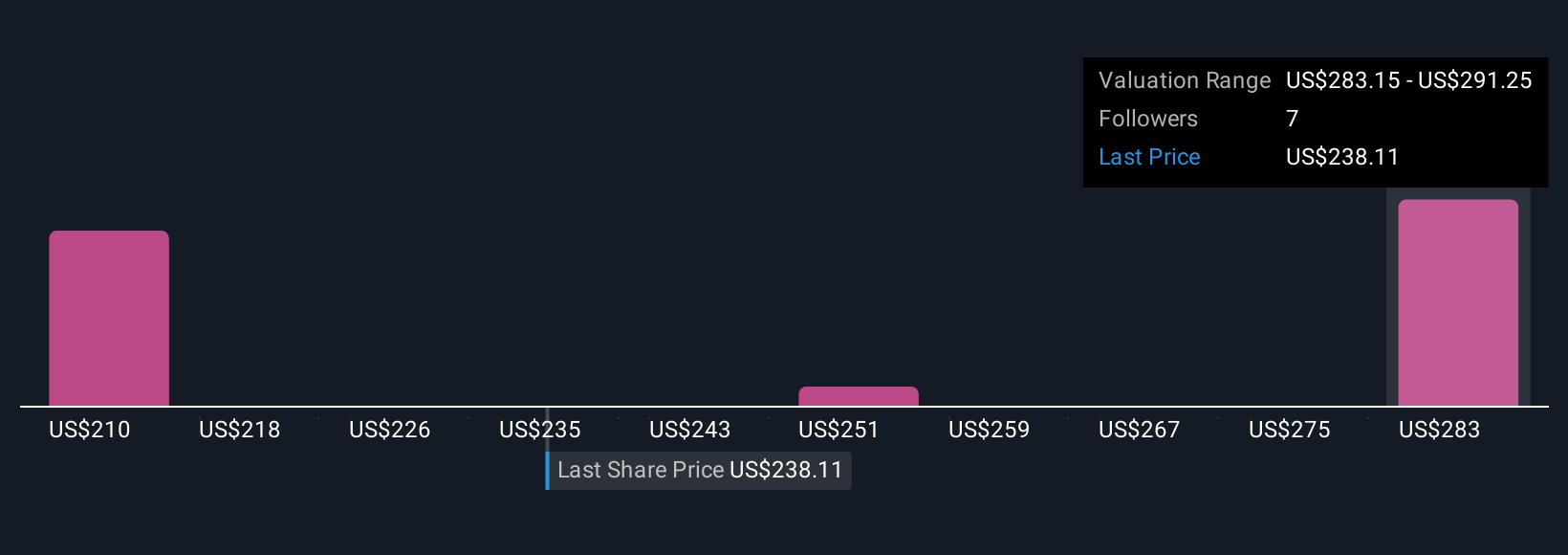

Four community members on Simply Wall St provided fair value estimates for Woodward, ranging from US$188 to US$286 per share. With such differing views, it's essential to consider how execution risks tied to new capital projects could impact growth and valuation over time.

Explore 4 other fair value estimates on Woodward - why the stock might be worth 21% less than the current price!

Build Your Own Woodward Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Woodward research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Woodward research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Woodward's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 29 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Woodward might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WWD

Woodward

Designs, manufactures, and services control solutions for the aerospace and industrial markets worldwide.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives