- United States

- /

- Construction

- /

- NasdaqCM:WSC

WillScot (WSC) Cuts Borrowing Costs, but Does Lower Debt Signal a Shift in Growth Strategy?

Reviewed by Sasha Jovanovic

- In recent days, WillScot Holdings announced it amended its asset-based lending facility to reduce borrowing costs, lower facility size, and extend the maturity date to October 2030, with further potential interest rate reductions based on financial performance conditions.

- This adjustment enables immediate and future savings on interest and fees, while increasing financial flexibility through a higher accordion feature and a syndicate of major financial institutions supporting the facility.

- We'll explore how these improved credit terms may enhance WillScot's investment narrative by supporting future profitability and growth ambitions.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

WillScot Holdings Investment Narrative Recap

To be a shareholder in WillScot Holdings, you generally need to believe in long-term growth driven by demand for scalable, flexible modular and storage solutions, supported by investments in higher-margin services and digital optimization. The recent amendment to its asset-based lending facility reduces interest expenses and extends financial runway, but it does not materially alter the immediate risk: weak local and regional project demand that continues to pressure rental volumes and revenue. Short-term catalysts remain linked to broader market recovery and sustained improvement in smaller customer segments.

Among recent announcements, WillScot's upcoming Q3 2025 earnings release may offer the most direct read-through to whether the improved credit terms are helping offset ongoing volume headwinds, especially as year-on-year revenue and sales have declined in previous quarters. This context makes monitoring near-term financial results critical for anyone tracking the turning points in demand and margin trends.

In contrast, as borrowing costs come down, investors should be aware of the persistent risk that...

Read the full narrative on WillScot Holdings (it's free!)

WillScot Holdings' outlook projects $2.5 billion in revenue and $363.1 million in earnings by 2028. This implies a 2.5% annual revenue growth rate and an earnings increase of $253.4 million from the current level of $109.7 million.

Uncover how WillScot Holdings' forecasts yield a $30.70 fair value, a 37% upside to its current price.

Exploring Other Perspectives

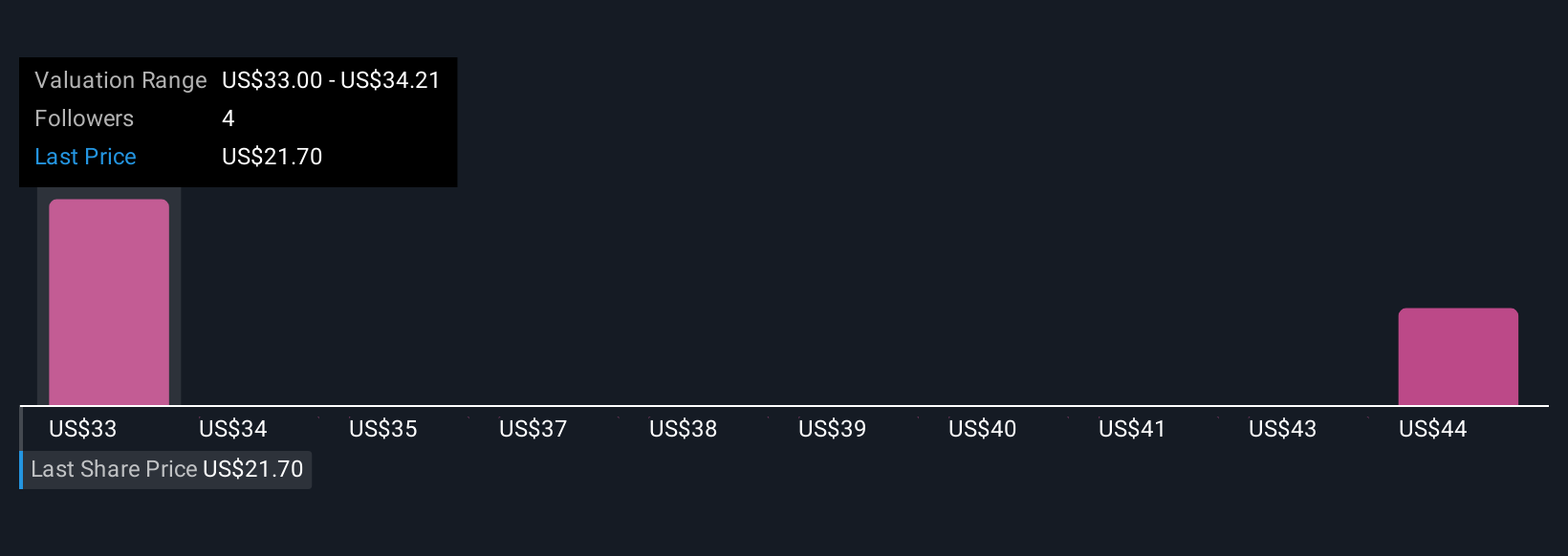

Simply Wall St Community members produced two fair value estimates for WillScot ranging from US$30.70 to US$45.69 per share. While some anticipate recovery helped by growth in value-added services, ongoing softness in core rental demand remains a focus for many and could affect company prospects in various ways.

Explore 2 other fair value estimates on WillScot Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own WillScot Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WillScot Holdings research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free WillScot Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WillScot Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WillScot Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:WSC

WillScot Holdings

Provides turnkey temporary space solutions in the United States, Canada, and Mexico.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives