- United States

- /

- Construction

- /

- NasdaqCM:WSC

WillScot Holdings (WSC) Is Down 11.8% After Softer Revenue Guidance and Institutional Selling – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

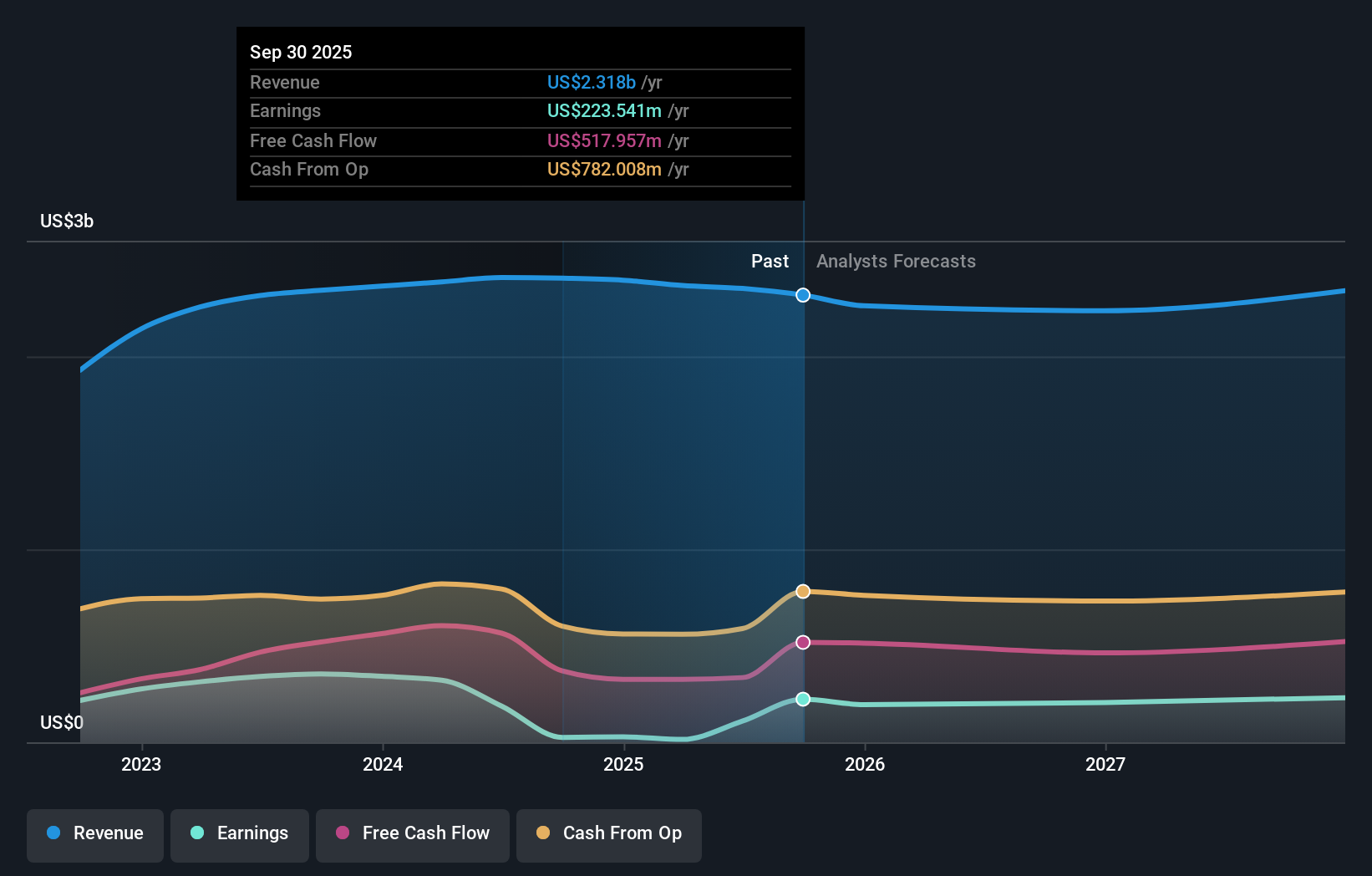

- WillScot Holdings Corporation recently reported third-quarter 2025 results, with revenue of US$566.84 million and net income of US$43.33 million, alongside updated guidance projecting full-year 2025 revenue of US$2.26 billion and a declared quarterly dividend of US$0.07 per share.

- Institutional selling, analyst downgrades, and cautious company guidance are creating a more pressure-filled outlook, despite ongoing share buybacks and a major shareholder emphasizing the firm's industry position and potential for long-term growth.

- We'll explore how the company's softer revenue forecast and institutional investor exit could affect WillScot Holdings' previous growth-focused investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

WillScot Holdings Investment Narrative Recap

To be a shareholder in WillScot Holdings, you have to believe in the company’s ability to capitalize on scalable space solutions amid ongoing industry consolidation and increasing demand for modular and climate-controlled offerings. However, recent events including weaker revenue guidance, notable institutional selling, and several analyst downgrades have added uncertainty to the near-term outlook, making slow recovery in smaller projects and local demand the most significant risk ahead. At this stage, these developments materially affect expectations for a catalyst linked to an inflection in demand. The company’s downward revision to full-year 2025 revenue guidance, now set at US$2.26 billion, is particularly relevant as it signals management’s more cautious stance on market conditions and could delay a rebound previously anticipated by the investment community. In contrast, investors should be aware that ongoing softness in local and small project demand may mean the anticipated recovery could be further pushed out…

Read the full narrative on WillScot Holdings (it's free!)

WillScot Holdings' narrative projects $2.5 billion in revenue and $363.1 million in earnings by 2028. This requires 2.5% yearly revenue growth and a $253.4 million increase in earnings from the current $109.7 million level.

Uncover how WillScot Holdings' forecasts yield a $30.70 fair value, a 78% upside to its current price.

Exploring Other Perspectives

Two distinct fair value estimates from the Simply Wall St Community place WillScot Holdings’ worth between US$29.63 and US$30.70 per share. Many are focused on slow revenue growth and continued volume headwinds, showing how future expectations can vary widely from current performance.

Explore 2 other fair value estimates on WillScot Holdings - why the stock might be worth as much as 78% more than the current price!

Build Your Own WillScot Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WillScot Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free WillScot Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WillScot Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WillScot Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:WSC

WillScot Holdings

Provides turnkey temporary space solutions in the United States, Canada, and Mexico.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives