- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:VTSI

If EPS Growth Is Important To You, VirTra (NASDAQ:VTSI) Presents An Opportunity

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like VirTra (NASDAQ:VTSI). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for VirTra

VirTra's Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. Shareholders will be happy to know that VirTra's EPS has grown 29% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

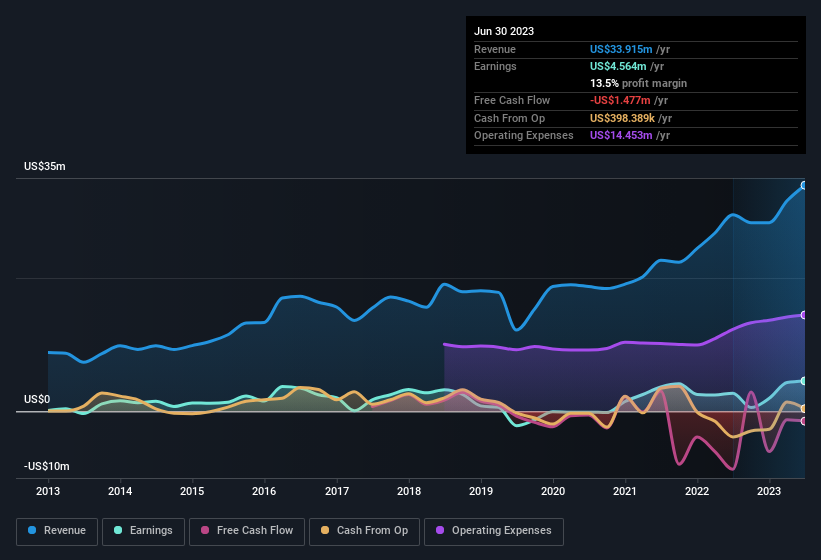

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. VirTra shareholders can take confidence from the fact that EBIT margins are up from 6.2% to 18%, and revenue is growing. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for VirTra's future profits.

Are VirTra Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's nice to see that there have been no reports of any insiders selling shares in VirTra in the previous 12 months. With that in mind, it's heartening that John Givens, the CEO & Director of the company, paid US$30k for shares at around US$4.65 each. It seems that at least one insider is prepared to show the market there is potential within VirTra.

It's commendable to see that insiders have been buying shares in VirTra, but there is more evidence of shareholder friendly management. Namely, VirTra has a very reasonable level of CEO pay. The median total compensation for CEOs of companies similar in size to VirTra, with market caps under US$200m is around US$765k.

VirTra's CEO took home a total compensation package worth US$683k in the year leading up to December 2022. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Does VirTra Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into VirTra's strong EPS growth. To add to the positives, VirTra has recorded instances of insider buying and a modest executive pay to boot. All in all, this stock is worth the time to delve deeper into the details. However, before you get too excited we've discovered 2 warning signs for VirTra (1 makes us a bit uncomfortable!) that you should be aware of.

The good news is that VirTra is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:VTSI

VirTra

Provides use of force training and firearms training simulators for the law enforcement, military, and commercial markets worldwide.

Reasonable growth potential slight.

Market Insights

Community Narratives