- United States

- /

- Electrical

- /

- NasdaqGS:VICR

Why Vicor (VICR) Is Up 22.6% After Q3 Earnings Jump and Share Buyback

Reviewed by Sasha Jovanovic

- Vicor Corporation reported third quarter 2025 results, with revenue rising to US$110.42 million and net income increasing to US$28.29 million compared to the same period last year.

- The company also completed a share buyback, repurchasing 747,124 shares for US$33.82 million under its ongoing program, signaling strong recent financial capacity and confidence.

- We'll explore how Vicor's sharp year-on-year earnings growth could affect its investment narrative and industry outlook.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Vicor Investment Narrative Recap

To own Vicor stock, you have to believe in the company’s ability to capture sustained demand for advanced power delivery systems in fast-growing, innovation-driven markets such as AI-enabled data centers and electric vehicles. While the strong Q3 results highlight encouraging earnings momentum, underlying risks tied to booking patterns and uncertain near-term demand signal that sequential consistency remains a key catalyst, and possible concern, going forward; the recent news does not materially reduce that short-term demand risk.

The company’s completed share buyback, totaling 747,124 shares for US$33.82 million, draws attention as a signal of financial flexibility, but its relevance is limited for now in the context of immediate revenue catalysts, which instead hinge on order stability and customer adoption cycles for Vicor’s core power modules. In contrast, those looking at the stock should also consider …

Read the full narrative on Vicor (it's free!)

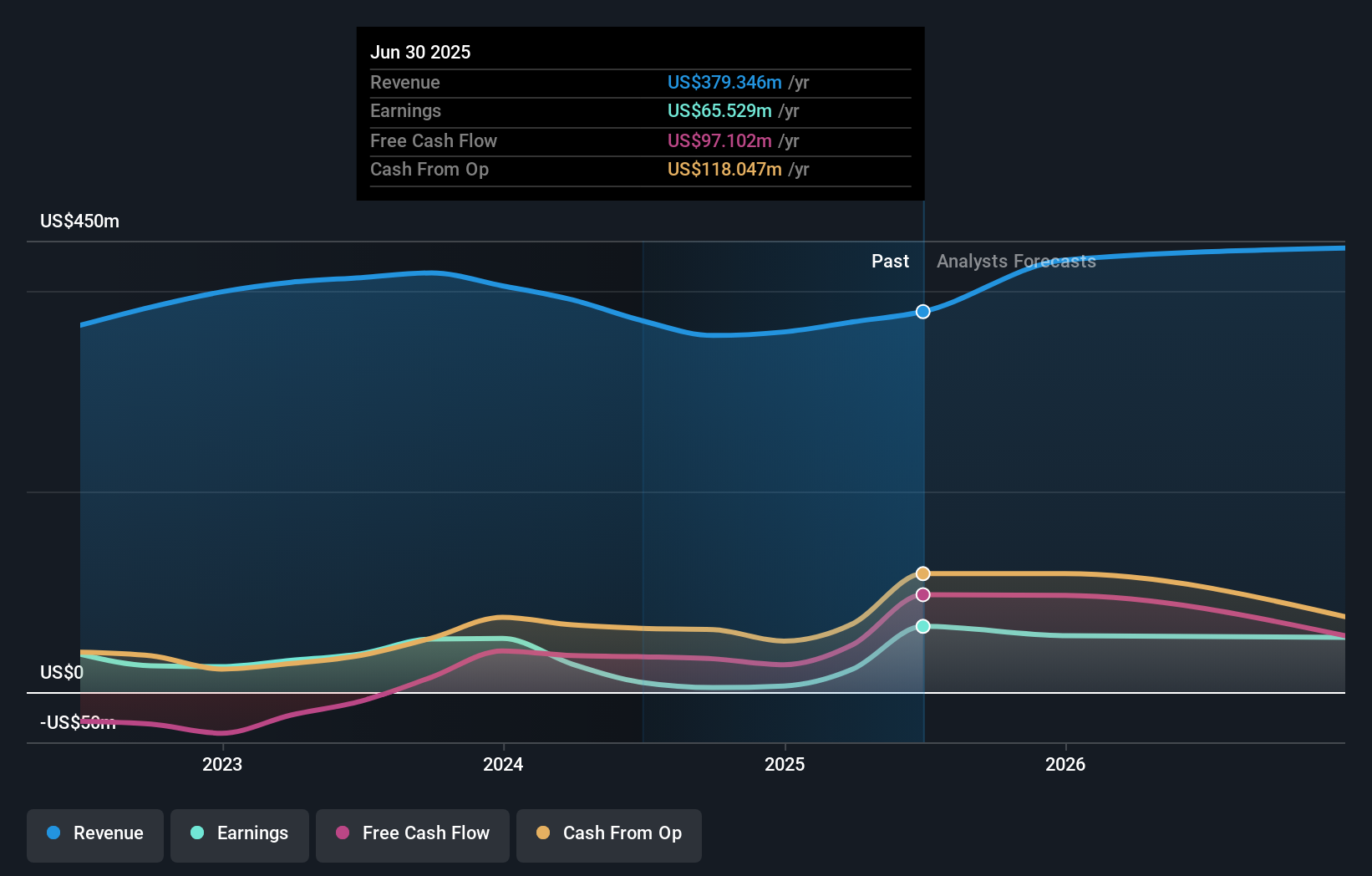

Vicor's narrative projects $523.8 million revenue and $45.4 million earnings by 2028. This requires 11.4% yearly revenue growth and a $20.1 million earnings decrease from $65.5 million.

Uncover how Vicor's forecasts yield a $52.50 fair value, a 20% downside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community members estimate fair value between US$12.03 and US$52.50, underscoring wide disagreement on Vicor’s outlook. Against this diversity of opinion, caution around the company’s book-to-bill ratio and sequential backlog decline takes on added significance for understanding near-term financial outcomes.

Explore 2 other fair value estimates on Vicor - why the stock might be worth as much as $52.50!

Build Your Own Vicor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vicor research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Vicor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vicor's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VICR

Vicor

Designs, develops, manufactures, and markets modular power components and power systems for converting electrical power for use in electrically-powered devices.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives