- United States

- /

- Machinery

- /

- NasdaqCM:UGRO

Not Many Are Piling Into urban-gro, Inc. (NASDAQ:UGRO) Stock Yet As It Plummets 25%

Unfortunately for some shareholders, the urban-gro, Inc. (NASDAQ:UGRO) share price has dived 25% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 73% loss during that time.

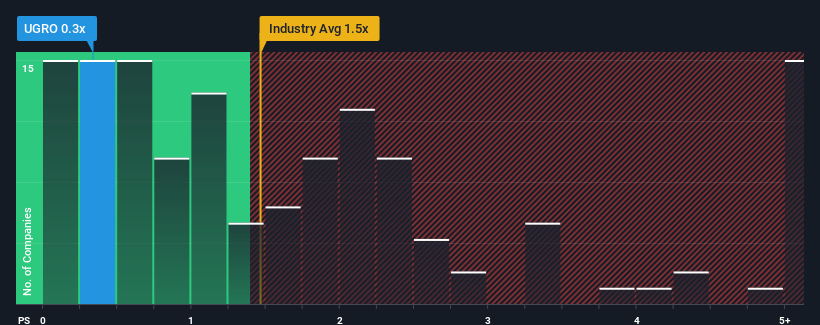

Following the heavy fall in price, considering around half the companies operating in the United States' Machinery industry have price-to-sales ratios (or "P/S") above 1.5x, you may consider urban-gro as an solid investment opportunity with its 0.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for urban-gro

How urban-gro Has Been Performing

With revenue growth that's inferior to most other companies of late, urban-gro has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on urban-gro.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as urban-gro's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 7.9%. The latest three year period has also seen an excellent 177% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 57% during the coming year according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 6.5%, which is noticeably less attractive.

With this information, we find it odd that urban-gro is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From urban-gro's P/S?

The southerly movements of urban-gro's shares means its P/S is now sitting at a pretty low level. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A look at urban-gro's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 5 warning signs for urban-gro (1 is potentially serious) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade urban-gro, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if urban-gro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:UGRO

urban-gro

Engages in the designing, engineering, building, and integrating complex environmental equipment systems for indoor controlled environment agriculture (CEA) cultivation and retail facilities in the United States, Canada, and Europe.

Very undervalued with mediocre balance sheet.

Market Insights

Community Narratives