- United States

- /

- Building

- /

- NasdaqGS:UFPI

The Bull Case For UFP Industries (UFPI) Could Change Following Major $60 Million Restructuring Initiative

Reviewed by Sasha Jovanovic

- In recent months, UFP Industries announced a US$60 million cost reduction initiative featuring restructuring and automation efforts after experiencing two years of falling unit sales and earnings per share.

- This move highlights the company's attempt to address growing market concerns about its shrinking profitability and competitive position amid sustained operational headwinds.

- To assess the impact of these recent cost-cutting measures, we'll explore how they might influence UFP Industries' plan to restore profitability and market strength.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

UFP Industries Investment Narrative Recap

To remain confident in UFP Industries, investors need to believe that recent cost-cutting and automation efforts will stabilize margins and restore earnings growth despite ongoing demand and pricing challenges in the construction sector. The US$60 million initiative aims to counteract shrinking profitability and could be a pivotal short-term catalyst, yet the main risk continues to be relentless price competition and persistent weakness in core markets. In the short term, the impact of these efforts on margins will likely receive considerable investor scrutiny.

Among recent company announcements, UFP Industries' Q2 earnings revealed another year-over-year decline in both revenue and earnings per share, reflecting the pressure that prompted its cost reduction program. This result underscores the urgent need for operational improvements and highlights why investors are closely watching management's promise to expand margins by 2026 as a primary catalyst.

By contrast, investors need to be aware that growing price competition could continue to affect net margins...

Read the full narrative on UFP Industries (it's free!)

UFP Industries' outlook forecasts $7.1 billion in revenue and $443.8 million in earnings by 2028. Achieving this would require a 2.8% yearly revenue growth and an earnings increase of $109.6 million from the current $334.2 million.

Uncover how UFP Industries' forecasts yield a $114.50 fair value, a 28% upside to its current price.

Exploring Other Perspectives

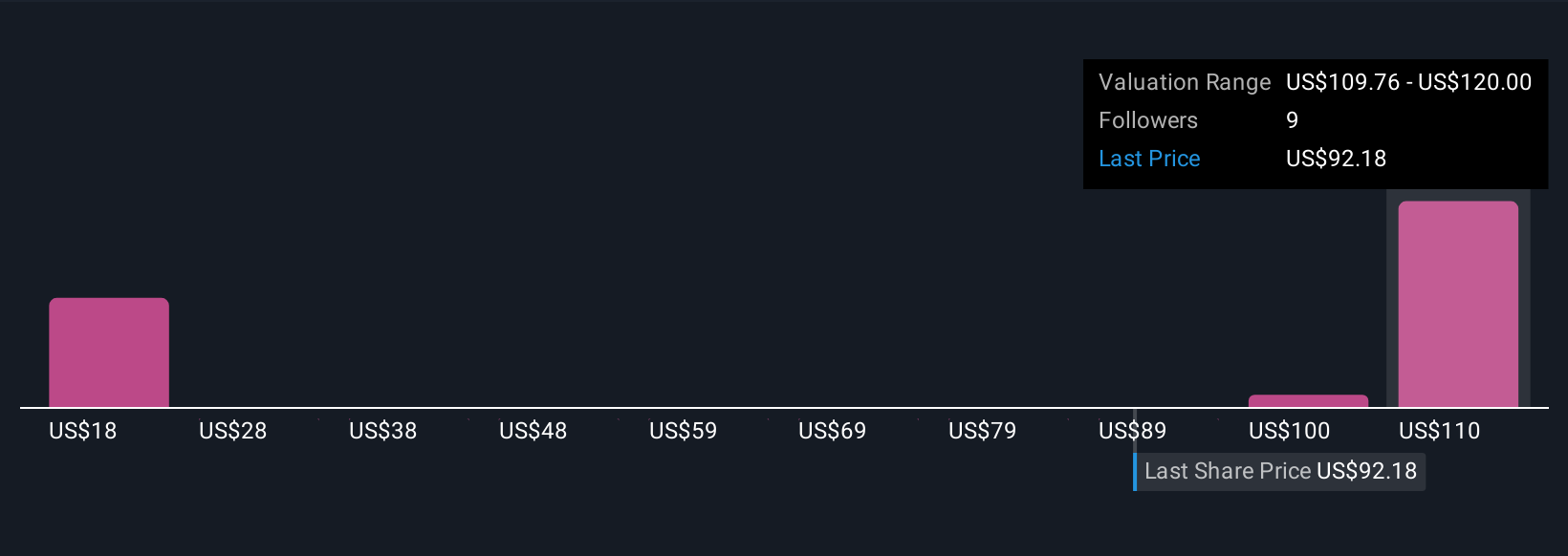

Simply Wall St Community members see fair values for UFP Industries ranging from US$17.63 to US$120, based on 4 distinct perspectives. Opinions diverge widely just as price competition and volatile demand remain key issues for the company’s financial health.

Explore 4 other fair value estimates on UFP Industries - why the stock might be worth less than half the current price!

Build Your Own UFP Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UFP Industries research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free UFP Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UFP Industries' overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UFPI

UFP Industries

Designs, manufactures, and supplies wood and non-wood composites, and other materials in the United States and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives