- United States

- /

- Building

- /

- NasdaqGS:UFPI

Should UFP Industries' (UFPI) EvoTrim Award Recognition Influence Investor Views on Innovation and Market Position?

Reviewed by Sasha Jovanovic

- Edge recently announced that EvoTrim™, a high-performance engineered wood trim from UFP Industries, was named a 2026 Good Housekeeping Home Reno Awards winner in the Exterior Enhancements category for its durability and advanced protection features.

- This recognition emphasizes the growing appeal and industry validation of UFP Industries’ innovative exterior building products designed to withstand demanding environmental conditions.

- We'll explore how national accolades for product innovation, like the EvoTrim award, may impact UFP Industries’ future growth prospects and investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

UFP Industries Investment Narrative Recap

Owning shares in UFP Industries means believing in the company’s ability to transform construction with branded, high-value building products while navigating a cyclical housing market and strong competitive pressures. The recent EvoTrim™ Good Housekeeping award highlights product innovation, which could reinforce UFP’s push into premium markets, but this news alone is unlikely to materially shift the near-term catalyst, cost reductions targeting margin improvement, or offset persistent risks tied to soft residential construction demand.

The most relevant recent announcement to this industry recognition is the October 2025 launch of ProWood TrueFrame™ Joists, another engineered wood solution. Both EvoTrim and TrueFrame support the company’s strategy of shifting toward value-added, engineered offerings to sustain pricing power and profit margins as consumer and builder demand for product durability continues to influence buying decisions.

However, even as UFP earns industry accolades for innovation, investors should be aware that ongoing volume and pricing pressure in the Site Built segment could...

Read the full narrative on UFP Industries (it's free!)

UFP Industries' narrative projects $7.1 billion revenue and $443.8 million earnings by 2028. This requires 2.8% yearly revenue growth and a $109.6 million earnings increase from $334.2 million.

Uncover how UFP Industries' forecasts yield a $113.17 fair value, a 22% upside to its current price.

Exploring Other Perspectives

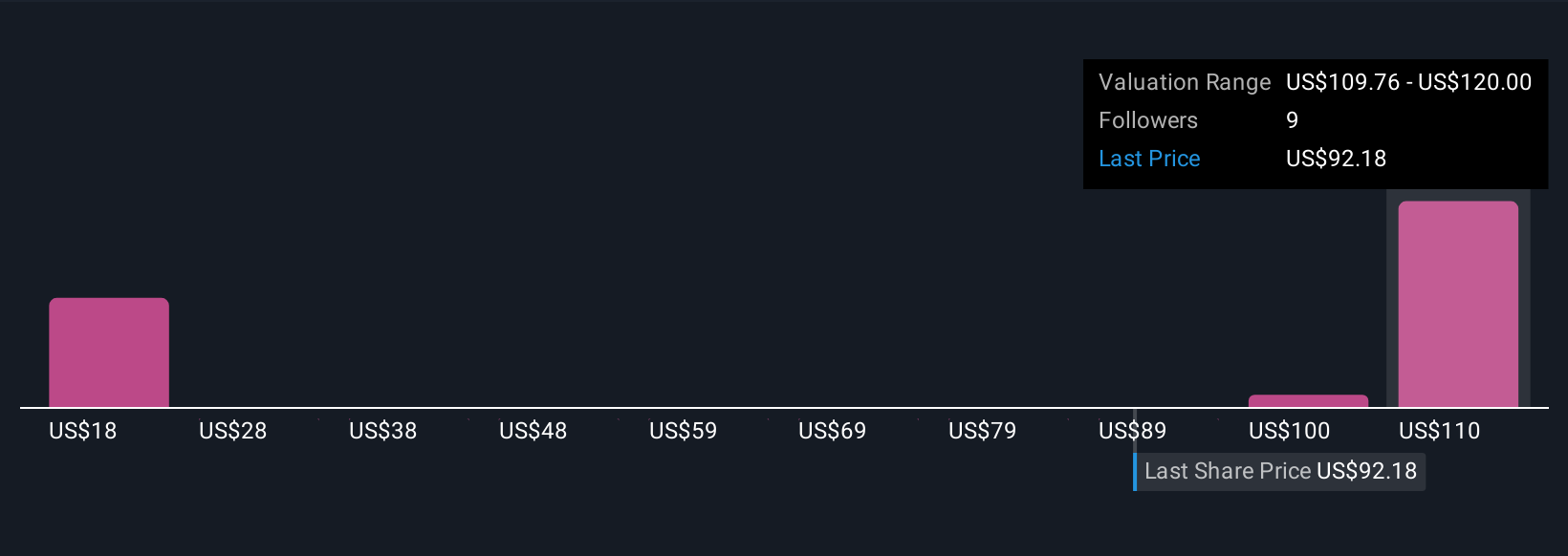

Four community fair value estimates for UFP Industries range from US$68 to US$120, showing broad differences on its potential. While many see upside in engineered products, the current weak revenue trends are a central point for discussion among market participants, consider these perspectives as you evaluate your own outlook.

Explore 4 other fair value estimates on UFP Industries - why the stock might be worth as much as 29% more than the current price!

Build Your Own UFP Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UFP Industries research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free UFP Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UFP Industries' overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UFPI

UFP Industries

Designs, manufactures, and supplies wood and non-wood composites, and other materials in the United States and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success