- United States

- /

- Machinery

- /

- NasdaqGS:TWIN

Twin Disc (TWIN) Valuation Discount Challenges Bearish Narratives Despite Prolonged Unprofitability

Reviewed by Simply Wall St

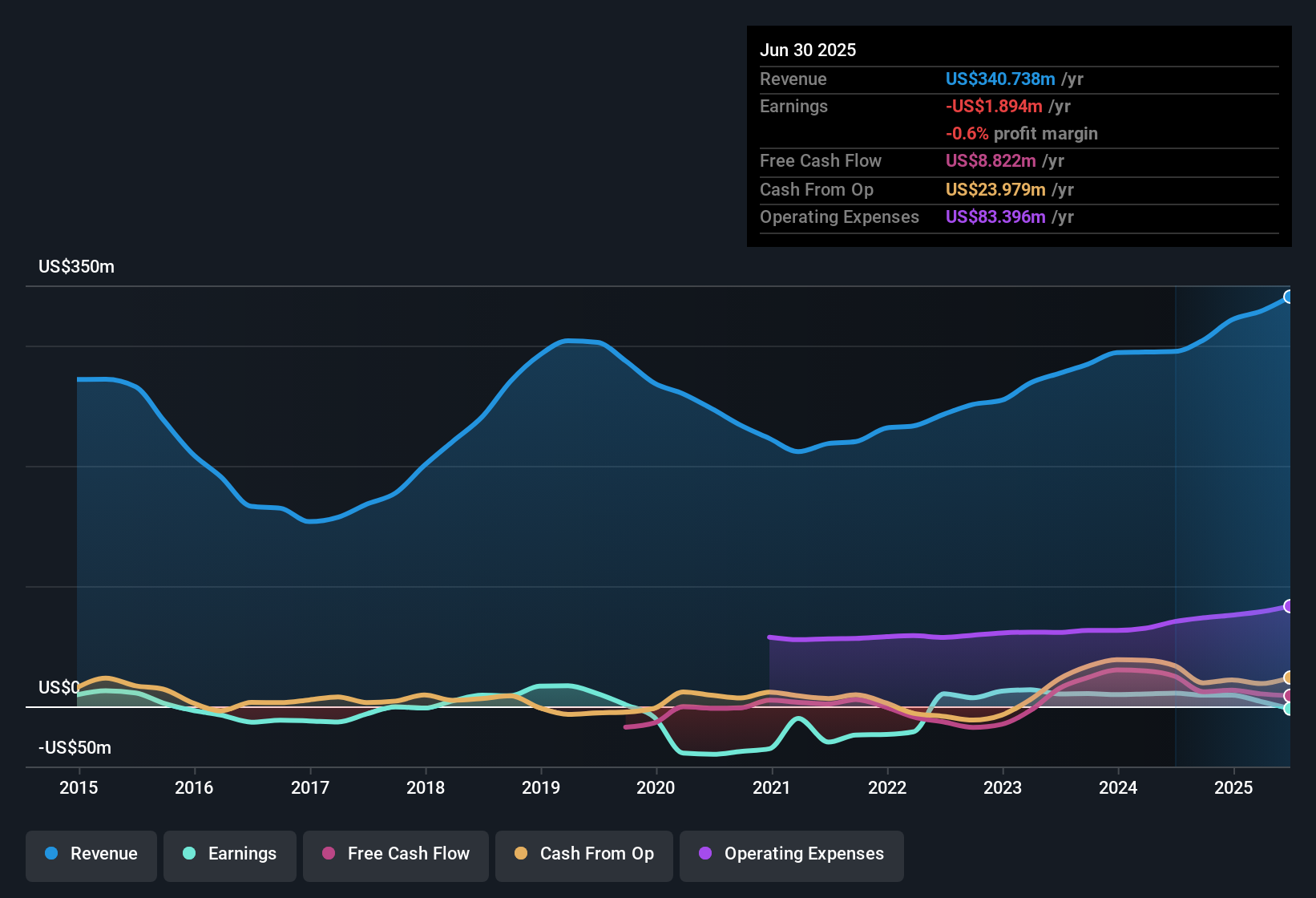

Twin Disc (TWIN) remains unprofitable, but the company has reduced its losses at an average annual rate of 61% over the past five years. While year-over-year net profit margin and earnings growth comparisons are limited due to ongoing unprofitability, investors tracking longer-term trends may view these shrinking losses as an encouraging sign.

See our full analysis for Twin Disc.Next, let’s see how these latest results compare with the most widely held narratives on Twin Disc and where the numbers might change the story.

See what the community is saying about Twin Disc

Margins Targeting 30% by 2030

- Management has set a goal to reach 30% gross margins by 2030, aiming for at least 60% free cash flow conversion according to the consensus narrative.

- Analysts’ consensus underscores that recurring revenue from growing aftermarket services and higher-margin hybrid/electrified solutions should help drive profitability,

- Record product backlog and defense opportunities, such as the $50–75 million pipeline tied to marine modernization, reinforce the bullish assumption on margins improving as volumes rise.

- However, margin pressure from rising operating costs and wage inflation counters the upside, especially after the company’s net income swung to a $1.9 million loss in FY25 despite higher sales.

Valuation at a Discount to Industry

- Twin Disc’s price-to-sales ratio is just 0.7x, substantially lower than both the US machinery industry average of 1.9x and the peer group average of 4.1x. The consensus narrative claims this reinforces its value appeal.

- Consensus narrative notes that at a current share price of $15.77, Twin Disc is trading below both the analyst price target of $17.50 and the DCF fair value of $16.31. This gives it room for potential re-rating if execution on cost control and growth initiatives holds.

- This gap stands out because future projections have Twin Disc potentially earning $2.66 per share by 2028 and trading at a forward PE of 8.5x, meaning the present price could represent good value if those targets are hit.

- Yet, ongoing unprofitability and integration risks create a tension. If underlying growth or margin expansion stalls, the valuation discount may persist or widen.

Acquisitions and Integration Risks

- Recent acquisitions like Katsa and Kobelt are meant to broaden Twin Disc’s engineering capabilities and increase recurring aftermarket revenue, but the analysts’ consensus highlights that organic sales outside of acquisitions declined 8.4% in Q4 2025.

- What is surprising is the heavy reliance on acquisition-fueled growth, with bears raising concerns that failing to deliver expected synergies or underestimating integration challenges could result in higher-than-anticipated costs.

- Net income swung from an $11 million profit in FY24 to a $1.9 million loss in FY25 even as total sales increased, which adds weight to the bearish argument around execution risk.

- Persistent exposure to cyclical end markets, like oil and gas, further exposes earnings to macroeconomic swings and commodity price shocks.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Twin Disc on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique perspective on the numbers? Share your outlook and shape your personal narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Twin Disc.

See What Else Is Out There

Twin Disc continues to struggle with consistent profitability and integration risks. Reliance on acquisitions has not offset volatility in organic growth.

If you want more reliable results and fewer earnings surprises, check out stable growth stocks screener (2074 results) for a list of companies that have demonstrated steady, cycle-resistant growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Twin Disc might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TWIN

Twin Disc

Engages in the design, manufacture, and sale of marine and heavy duty off-highway power transmission equipment in the United States, the Netherlands, China, Australia, Finland, Italy, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives