- United States

- /

- Packaging

- /

- NasdaqGS:TRS

The TriMas Share Price Has Gained 92% And Shareholders Are Hoping For More

Want to participate in a short research study? Help shape the future of investing tools and receive a $20 prize!

By buying an index fund, investors can approximate the average market return. But many of us dare to dream of bigger returns, and build a portfolio ourselves. Just take a look at TriMas Corporation (NASDAQ:TRS), which is up 92%, over three years, soundly beating the market return of 53%. On the other hand, the returns haven't been quite so good recently, with shareholders up just 27%.

See our latest analysis for TriMas

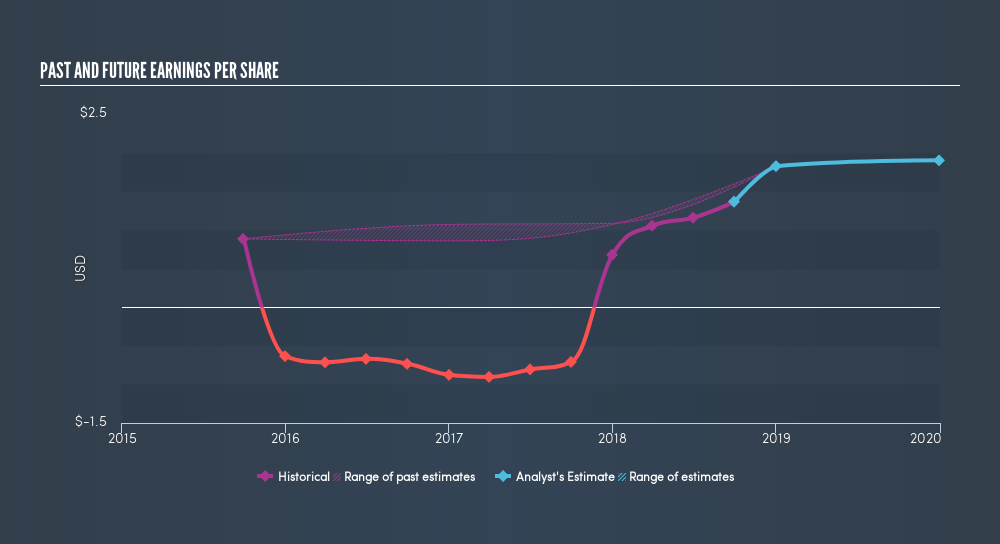

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed, is to compare the earnings per share (EPS) with the share price.

TriMas became profitable within the last three years. That would generally be considered a positive, so we'd expect the share price to be up.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that TriMas has improved its bottom line lately, but is it going to grow revenue? This freereport showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between TriMas's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. We note that TriMas's TSR, at 92% is higher than its share price rise of 92%. When you consider it hasn't been paying a dividend, this data suggests shareholders may have had the opportunity to acquire attractively priced shares in the business.

A Different Perspective

We're pleased to report that TriMas shareholders have received a total shareholder return of 27% over one year. That's better than the annualised return of 3.1% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. If you would like to research TriMas in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

But note: TriMas may not be the best stock to buy. So take a peek at this freelist of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:TRS

TriMas

Engages in the design, development, manufacture, and sale of products for consumer products, aerospace, and industrial markets worldwide.

Moderate growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives