- United States

- /

- Machinery

- /

- NasdaqCM:TAYD

Taylor Devices (TAYD): Profit Margin Decline Challenges Recent Growth Expectations

Reviewed by Simply Wall St

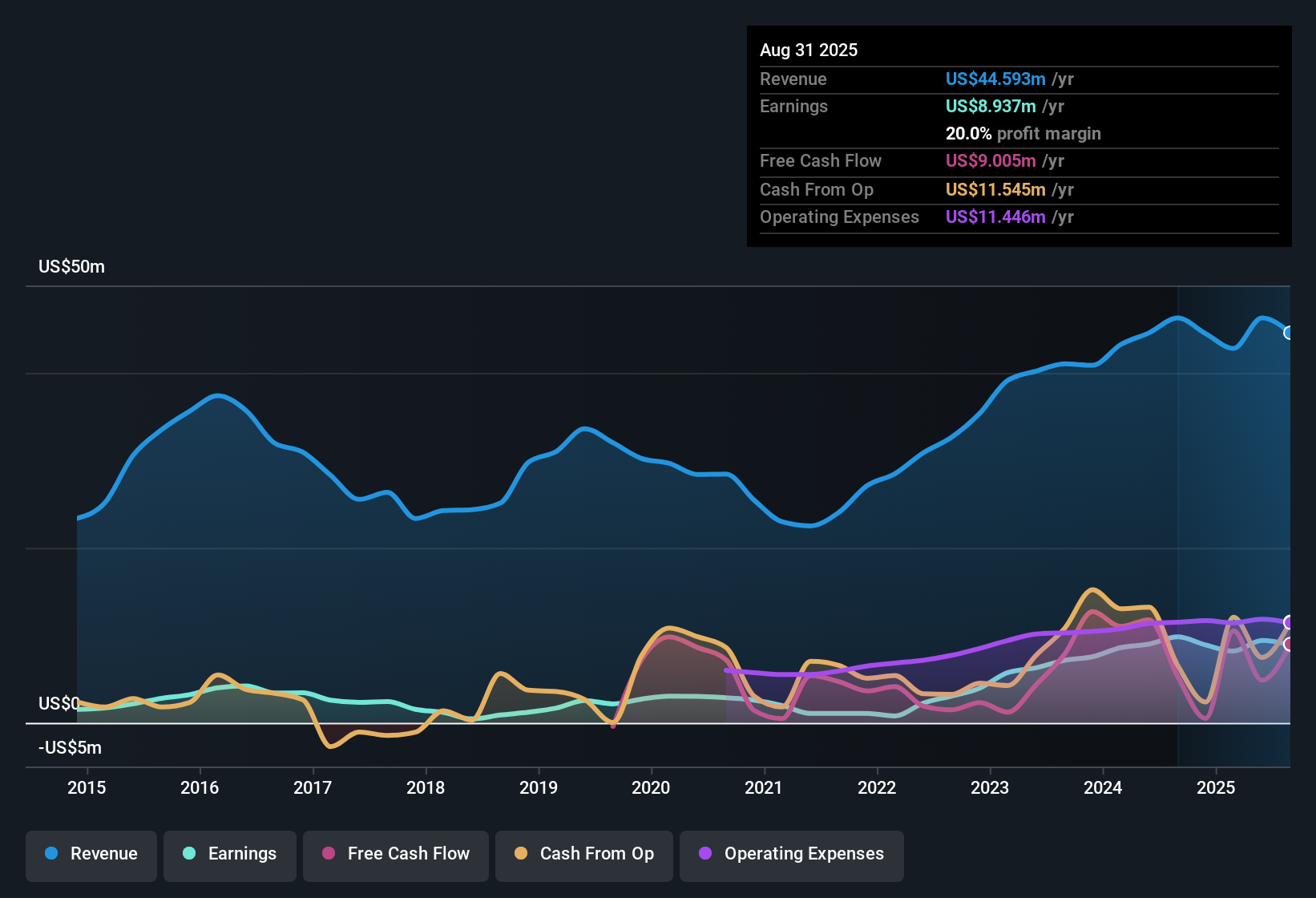

Taylor Devices (TAYD) posted net profit margins of 20%, reflecting a dip from 21.2% in the prior period and signaling lower profitability this time around. The last five years saw average annual earnings growth of 37.3%, but that momentum reversed in the most recent year as earnings growth turned negative. With revenue forecast to climb 9.7% per year—just under the US market’s 9.8% pace—and the stock trading below its estimated fair value at $45.14 per share, investors are likely weighing the company’s historical earnings strength against the current pullback.

See our full analysis for Taylor Devices.Next, we will put these fresh results side by side with the core narratives investors are tracking. We will highlight where expectations match reality and where the latest numbers might spark fresh debate.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Slide to 20% as Recent Growth Slows

- Net profit margins dropped to 20%, down from 21.2% in the prior period, signaling a decline in profitability even as the company comes off a five-year stretch where average annual earnings grew by 37.3%.

- What’s notable is that, despite proven long-term earnings strength rooted in specialized engineering, the most recent year saw that growth streak turn negative. This contradicts the idea that Taylor Devices is a guaranteed compounder.

- Investors looking for consistent profit expansion will pay close attention to the fact that profit margins are now trending below recent highs.

- Despite historical resilience, the reversal in earnings momentum creates tension for those expecting uninterrupted uptrends from the company’s core business.

Valuation Multiple Sits Below Industry Average

- Taylor Devices trades at a price-to-earnings ratio of 15.9x, which is slightly above direct peers at 15.5x, but well below the US Machinery industry’s 24.1x average. This suggests the market is not pricing in significant sector upside for this niche player.

- Bulls argue that the current share price of $45.14, far below the DCF fair value of $75.41, strengthens the value case for Taylor Devices.

- With the company also displaying good value characteristics (as flagged in risk/reward data), the combination of modest peer premium and large industry discount supports bullish optimism for longer-term upside.

- However, the lack of recent earnings growth serves as a caution, highlighting that value may take time to be realized unless future catalysts emerge.

Revenue Growth Lags Slightly Behind Market Pace

- Revenue is projected to increase at 9.7% per year going forward, falling just short of the broader US market’s forecasted growth rate of 9.8%.

- The prevailing market view sees Taylor Devices as a stable niche company whose moderate revenue outlook, while a positive sign in a volatile sector, may make it harder for the stock to break out without new contract wins or sector-wide catalysts.

- A solid product reputation and track record for quality underpin the growth estimate, but sector momentum and contract timing remain crucial swing factors.

- Thin trading volume and less analyst coverage compared to larger rivals could limit immediate upside from these growth forecasts.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Taylor Devices's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Taylor Devices is experiencing margin contraction, stalling earnings growth, and projected revenue that lags the broader market. These factors raise concerns about consistent future performance.

If stable, predictable returns matter most to you, look to stable growth stocks screener where you’ll find companies consistently expanding both revenue and earnings, cycle after cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taylor Devices might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:TAYD

Taylor Devices

Designs, develops, manufactures, and markets shock absorption, rate control, and energy storage devices for use in machinery, equipment, and structures in the United States, Asia, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives