- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:TATT

A Look at TAT Technologies (NasdaqGM:TATT) Valuation After Launching FutureWorks Aerospace Innovation Center

Reviewed by Simply Wall St

Most Popular Narrative: 3.2% Undervalued

The prevailing view among analysts is that TAT Technologies has moderate upside from current levels, with a fair value slightly above today's price.

Heightened global focus on sustainability and regulatory pressures on airlines to improve energy efficiency is accelerating the need for upgrades and advanced thermal management solutions. TAT specializes in these areas, which expands its addressable market and supports future revenue growth.

What are the key numbers behind this discounted valuation? There is one core assumption about TAT's future profit power and margin boost that you will want to understand. Curious which financial leap forward is powering this fair value and what ambitious forecast has analysts excited? Take a closer look. The full narrative outlines the aggressive targets that shape this bullish outlook.

Result: Fair Value of $37.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, TAT’s outlook could change if global travel demand weakens or if supply chain issues persist. This could potentially impact the company’s earnings trajectory.

Find out about the key risks to this TAT Technologies narrative.Another View: Discounted Cash Flow Says Otherwise

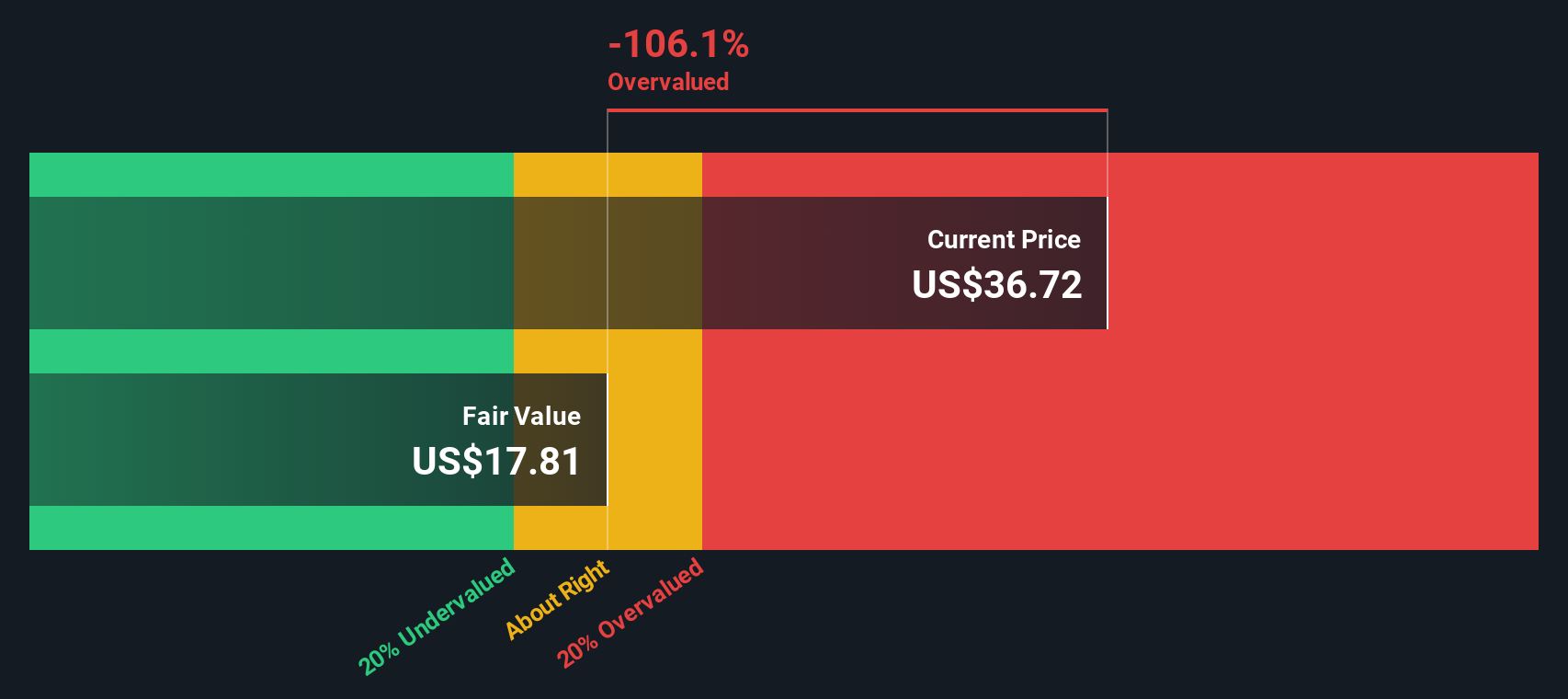

While analysts see TAT Technologies as undervalued based on earnings potential, our DCF model suggests the current share price may actually exceed its estimated fair value. Could the market be pricing in too much optimism?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding TAT Technologies to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own TAT Technologies Narrative

If you have a different take or want to dive into the details yourself, crafting your own perspective is quick and straightforward. You can put it together in just a few minutes. Do it your way

A great starting point for your TAT Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Want to supercharge your portfolio? Gain an edge with the tools investors are using right now to uncover fresh opportunities before others catch on.

- Tap into fast-moving market upstarts by checking out penny stocks with strong financials, which are making waves with resilient financials and real growth prospects.

- Stay ahead of tech trends and see which innovators are shaping the future with AI penny stocks as they deliver breakthroughs in AI and automation.

- Secure tomorrow’s winners by finding dividend stocks with yields > 3% that offer strong yield potential and the reliability every investor craves.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TAT Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TATT

TAT Technologies

Provides solutions and services to the commercial and military aerospace and ground defense industries in the United States, Israel, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives