- United States

- /

- Construction

- /

- NasdaqGS:STRL

Sterling Infrastructure (STRL): Examining Valuation Potential After Recent Strong Share Price Gains

Reviewed by Kshitija Bhandaru

See our latest analysis for Sterling Infrastructure.

Sterling Infrastructure’s latest surge is part of an impressive run, with momentum clearly building as the 1-year total shareholder return stands at 136%. Steady gains over the past three and five years signal investors are taking note of its sustained growth story. Recent performance hints at increasing optimism around its pipeline and future outlook, putting the company front and center for those watching US infrastructure plays.

If Sterling’s growth streak has your attention, it might be time to broaden your scope and discover fast growing stocks with high insider ownership

With shares near all-time highs and analysts’ price targets only slightly above the current level, the question for investors is whether Sterling Infrastructure’s rapid rise still leaves room for upside or if all the good news is already priced in.

Most Popular Narrative: 1.6% Undervalued

With Sterling Infrastructure’s consensus fair value landing just above its last close, the latest narrative points to a valuation edge that is slim yet meaningful. The discussion now shifts to what could propel the next move in the stock.

The upcoming acquisition of CEC Facilities Group will enable Sterling to deliver integrated, higher-value electrical and mechanical services alongside site development. This supports geographic expansion, project cycle efficiency, and "stickier" customer relationships, positioning the company for above-trend margin and earnings growth over time.

Want to know which bold assumptions back up this fair value? The real story involves aggressive expansion bets and future profitability levels you might not expect. Find out why analysts are raising their targets, and the numbers behind this confident valuation.

Result: Fair Value of $355 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if mega-project awards slow or government funding becomes stricter, Sterling’s margins could come under pressure and experience more volatility than current estimates suggest.

Find out about the key risks to this Sterling Infrastructure narrative.

Another View: Testing Value with Multiples

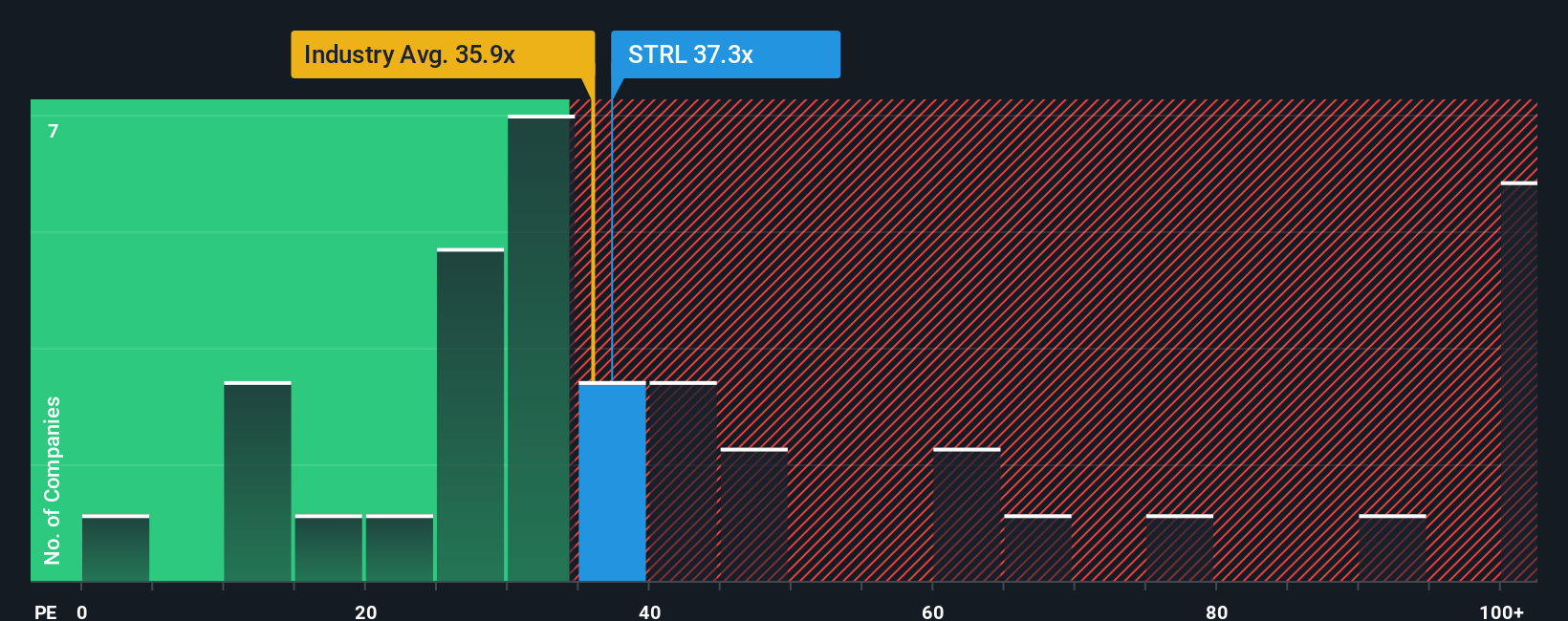

While analysts see Sterling as fairly valued based on earnings expectations, a look at its price-to-earnings ratio presents a more complex picture. Sterling trades at 37.3 times earnings, which is higher than the industry average of 35.9 and above the fair ratio of 34.3. This premium suggests investors must believe in continued outperformance, or risk disappointment if growth slows. Is the market’s optimism justified, or is too much hope already priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sterling Infrastructure for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sterling Infrastructure Narrative

If you want to see what the data says for yourself, you can quickly dive in and shape a narrative with your own perspective in just a few minutes. Do it your way

A great starting point for your Sterling Infrastructure research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let your next great opportunity slip by. Expand your watchlist now and tap into fresh market trends with these unique stock ideas.

- Capture high yields and steady passive income by checking out these 19 dividend stocks with yields > 3% delivering rising payouts and strong fundamentals.

- Ride the AI innovation wave by reviewing these 24 AI penny stocks at the frontline of machine learning, automation, and next-generation tech breakthroughs.

- Take a bold approach and target potential game-changers among these 3563 penny stocks with strong financials showing remarkable growth stories and financial resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STRL

Sterling Infrastructure

Engages in the provision of e-infrastructure, transportation, and building solutions in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives