- United States

- /

- Construction

- /

- NasdaqGS:STRL

Sterling Infrastructure, Inc.'s (NASDAQ:STRL) 30% Price Boost Is Out Of Tune With Earnings

Sterling Infrastructure, Inc. (NASDAQ:STRL) shareholders have had their patience rewarded with a 30% share price jump in the last month. The last month tops off a massive increase of 195% in the last year.

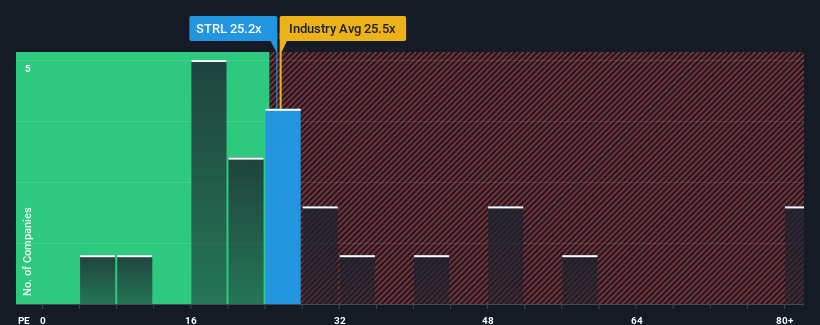

Following the firm bounce in price, Sterling Infrastructure's price-to-earnings (or "P/E") ratio of 25.2x might make it look like a sell right now compared to the market in the United States, where around half of the companies have P/E ratios below 16x and even P/E's below 9x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Sterling Infrastructure has been doing quite well of late. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Sterling Infrastructure

How Is Sterling Infrastructure's Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like Sterling Infrastructure's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 41% gain to the company's bottom line. Pleasingly, EPS has also lifted 190% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 10% as estimated by the two analysts watching the company. With the market predicted to deliver 11% growth , the company is positioned for a comparable earnings result.

In light of this, it's curious that Sterling Infrastructure's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Final Word

Sterling Infrastructure's P/E is getting right up there since its shares have risen strongly. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Sterling Infrastructure currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Sterling Infrastructure you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:STRL

Sterling Infrastructure

Engages in the provision of e-infrastructure, transportation, and building solutions in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives