- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:SPAI

Will Safe Pro Group’s (SPAI) New Funding Strategy Redefine Its Approach to Long-Term Growth?

Reviewed by Sasha Jovanovic

- On October 20, 2025, Safe Pro Group Inc. announced a private placement of 2,000,000 common shares at US$7 per share for gross proceeds of US$14,000,000, with Ondas Holdings Inc. as the lead new investor and expected closing on October 22, 2025, subject to standard conditions.

- In addition, Safe Pro Group recently filed a US$100 million shelf registration, opening the door to a broad range of potential future securities offerings that could support the company's funding needs.

- We'll explore how this combination of fresh capital infusion and expanded fundraising flexibility may alter Safe Pro Group's investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is Safe Pro Group's Investment Narrative?

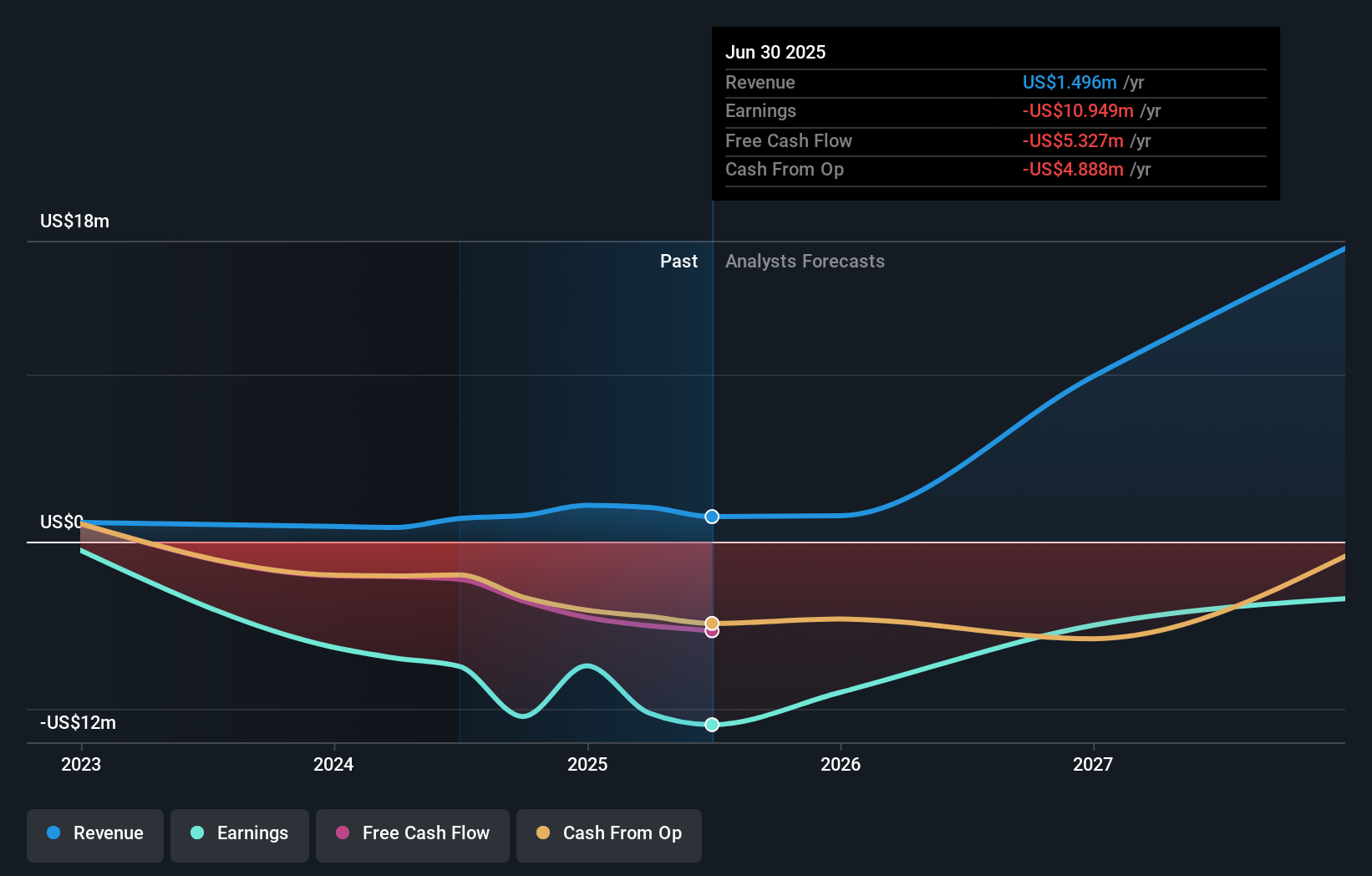

For shareholders of Safe Pro Group, the core thesis rests on the company’s ability to turn cutting-edge AI and drone technologies into real-world contracts and revenue, especially in defense and humanitarian settings. The latest US$14,000,000 private placement and expanded shelf registration signal growing investor confidence and, at least in the near term, should reduce immediate funding pressures. These moves may accelerate product development and help land new partnerships, both considered key short-term catalysts before today’s announcement. However, the ongoing history of losses, lack of profitability forecasts, and a very high price-to-book ratio remain ever-present risks, along with substantial dilution which may impact future share value. The latest capital raise may ease some financial strain, but the overarching challenge of converting innovation into stable, recurring revenue is unchanged and remains pivotal. Yet with new funding comes a risk you shouldn't overlook: dilution’s effect on shareholder value.

Our valuation report unveils the possibility Safe Pro Group's shares may be trading at a premium.Exploring Other Perspectives

Explore another fair value estimate on Safe Pro Group - why the stock might be worth as much as $1.36!

Build Your Own Safe Pro Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Safe Pro Group research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Safe Pro Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Safe Pro Group's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SPAI

Safe Pro Group

Provides security and protection products in the United States, Europe, Asia, and the Pacific.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives