- United States

- /

- Electrical

- /

- NasdaqGM:SHLS

Why Shoals Technologies Group (SHLS) Is Up 17.5% After Analysts Highlight Battery Storage and Data Center Expansion

Reviewed by Sasha Jovanovic

- In recent days, analysts at Barclays and UBS highlighted Shoals Technologies Group's potential growth from expanding into battery energy storage and data center markets, with multiple firms revising their forecasts upward. These upgrades spotlight Shoals' ability to adapt its product offerings to meet rising electricity demand linked to technological infrastructure expansion.

- The surge in analyst confidence around Shoals' entry into battery energy storage and data centers signals a potential turning point for the company's growth outlook.

- We'll examine how analyst optimism about Shoals' battery storage and data center initiatives could influence its investment narrative going forward.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Shoals Technologies Group Investment Narrative Recap

To be a Shoals Technologies Group shareholder, you generally need to believe in the company's ability to capture growing demand for advanced solar and energy storage solutions, particularly as data center and AI infrastructure expansion drives up electricity needs. The latest upgrades from Barclays and UBS reinforce the view that Shoals' push into battery energy storage and data centers is its key short-term catalyst, though persistent margin pressure from competitive pricing remains a significant risk; the recent news, while positive, does not yet resolve profitability concerns.

The most relevant recent announcement is Shoals' September patent issuance covering its Big Lead Assembly (BLA) portfolio, which further strengthens its value proposition as the company targets new storage and data center applications. This development directly relates to Shoals’ efforts to defend and expand its market share at a time when the company is betting on new, higher-growth segments to offset margin challenges and support its catalyst of revenue and earnings growth.

However, investors should also be alert to ongoing risks around sustained gross margin compression and competitive pricing, particularly if higher sales volumes from data center or battery storage deals come at the expense of profitability...

Read the full narrative on Shoals Technologies Group (it's free!)

Shoals Technologies Group's narrative projects $589.7 million revenue and $80.2 million earnings by 2028. This requires 13.8% yearly revenue growth and a $59.1 million earnings increase from current earnings of $21.1 million.

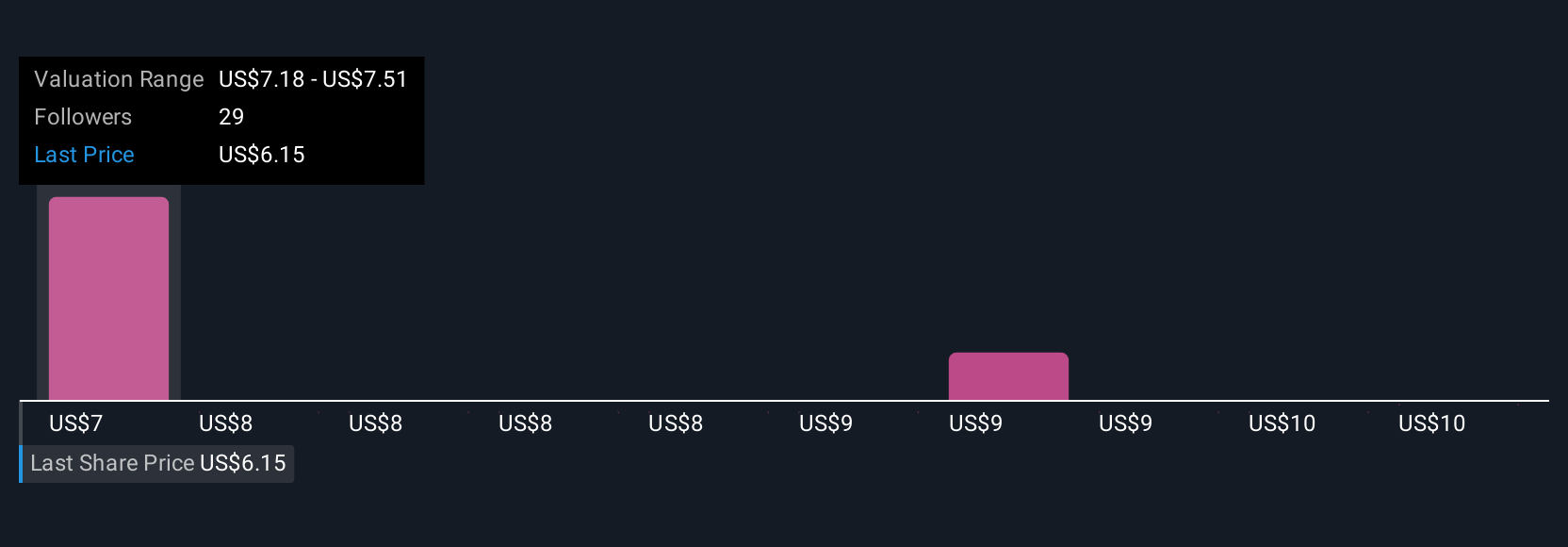

Uncover how Shoals Technologies Group's forecasts yield a $7.34 fair value, a 18% downside to its current price.

Exploring Other Perspectives

Two community members from the Simply Wall St Community have estimated Shoals’ fair value in a wide band from US$7.34 to US$10.30 per share. As analysts highlight revenue opportunities in battery energy storage and data centers, investors are encouraged to consider how margin pressure could influence longer-term performance.

Explore 2 other fair value estimates on Shoals Technologies Group - why the stock might be worth as much as 16% more than the current price!

Build Your Own Shoals Technologies Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Shoals Technologies Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Shoals Technologies Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Shoals Technologies Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SHLS

Shoals Technologies Group

Provides electrical balance of system (EBOS) solutions and components in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives