- United States

- /

- Electrical

- /

- NasdaqGM:SHLS

Shoals Technologies Group (SHLS): Evaluating Valuation Following Recent Share Price Momentum

Reviewed by Kshitija Bhandaru

Shoals Technologies Group (SHLS) has seen its stock gain momentum recently, and investors are keeping a close eye on its performance. The company’s share price has climbed about 33% over the past month, outpacing many peers.

See our latest analysis for Shoals Technologies Group.

Shoals Technologies Group’s recent 30-day share price return of 33% reflects renewed confidence in its growth story, especially after a stretch of middling performance. While longer-term total shareholder returns have not kept pace, this new wave of momentum suggests shifting sentiment and optimism about where the company could be headed next.

If you want to see what else is catching attention as momentum builds, it is a great time to broaden your investing horizons and discover fast growing stocks with high insider ownership

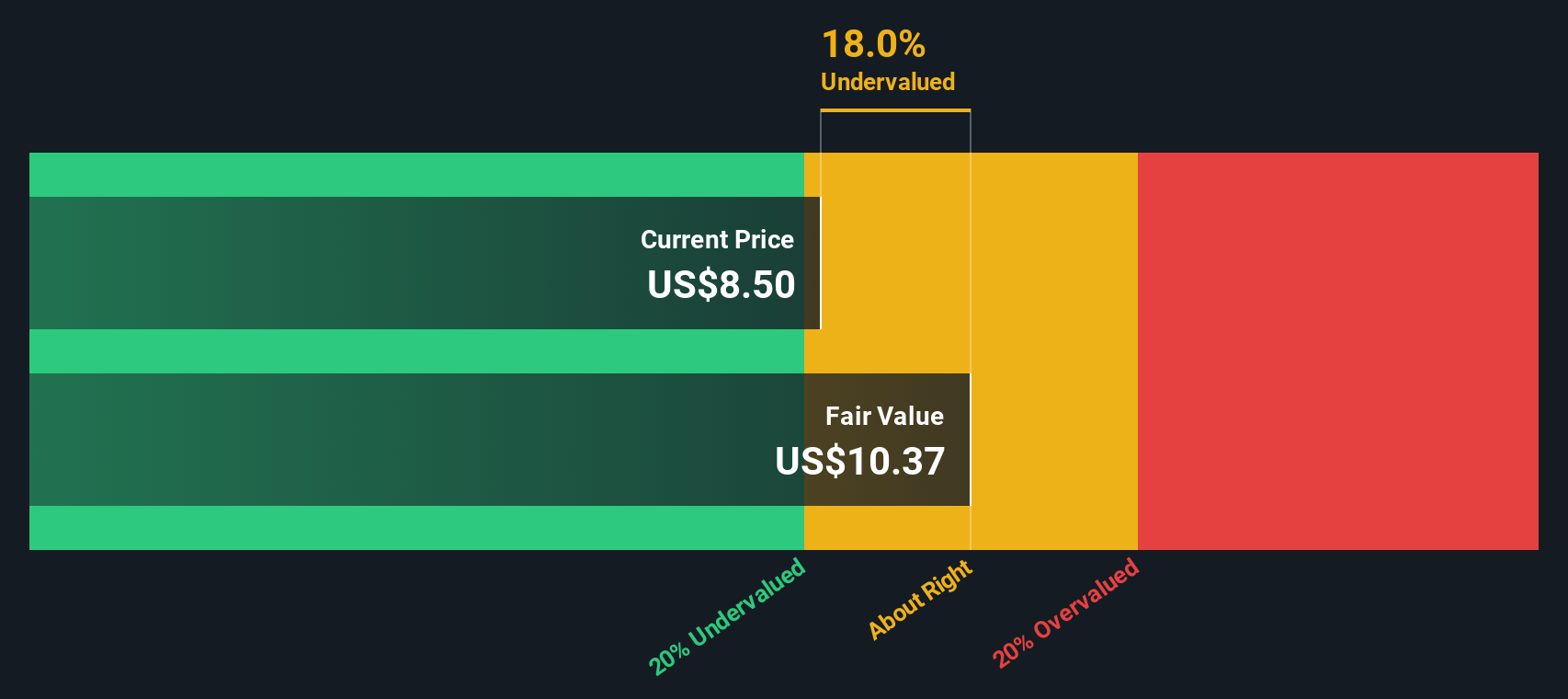

With shares on the rise, the key question for investors now is whether Shoals Technologies Group is still undervalued based on its fundamentals, or if the recent rally means the market has already factored in future growth potential.

Most Popular Narrative: 21% Overvalued

With Shoals Technologies Group's widely-followed narrative fair value sitting noticeably below its last closing price, there is a sharp disconnect between valuation assumptions and current market enthusiasm. This contrast sets the stage for a closer look at the market drivers behind such a bold price gap.

Shoals is actively expanding its product suite into fast-growing adjacent markets, such as battery energy storage systems (BESS) and international solar projects. This positions the company to capture new revenue streams and reduce dependency on U.S. policy, which is expected to support top-line growth and diversification.

Is Shoals truly at an inflection point, or is this optimism running ahead of reality? The narrative’s fair value leans heavily on aggressive targets for revenue, margins and scale. Want to see which assumptions could actually transform today’s business, and just how bullish this vision gets? Dive into the full story and find out what numbers fuel this price target.

Result: Fair Value of $7.34 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing margin pressure and high legal costs remain risks that could quickly challenge even the most optimistic growth assumptions for Shoals Technologies Group.

Find out about the key risks to this Shoals Technologies Group narrative.

Another View: SWS DCF Model Says the Stock May Be Undervalued

While the analyst price targets suggest Shoals Technologies Group is overvalued, our SWS DCF model offers a different perspective. It estimates a fair value of $10.30 per share, which is above the current price. This contrast highlights how much the future depends on growth and profitability actually materializing. Which view will the market side with?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Shoals Technologies Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Shoals Technologies Group Narrative

If you think the story goes deeper or want to follow your own path, you can easily build your own narrative using the same data in just a few minutes, and Do it your way

A great starting point for your Shoals Technologies Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Stay ahead of the curve with these unique market themes that could uncover your next great investment. The right stock might be just one smart move away, so don't let these opportunities pass you by.

- Capture long-term income growth and stability when you review these 19 dividend stocks with yields > 3%, featuring yields that outpace the average savings account.

- Power up your portfolio by jumping into the latest breakthroughs with these 24 AI penny stocks, which are shaping the future of automation and intelligence.

- Tap into sectors transforming healthcare by checking out these 31 healthcare AI stocks, where innovation meets real-world solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SHLS

Shoals Technologies Group

Provides electrical balance of system (EBOS) solutions and components in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives