- United States

- /

- Electrical

- /

- NasdaqGM:SHLS

Shoals Technologies Group (SHLS): Evaluating Valuation After New Pacific Leadership and Australian Project Progress

Reviewed by Simply Wall St

Most Popular Narrative: 6.3% Undervalued

According to the most widely followed narrative, Shoals Technologies Group is currently trading at a discount to its estimated fair value. This analysis sees the stock as modestly undervalued, with expectations rooted in a robust growth outlook and key industry catalysts.

"Rapidly increasing power demand from AI/data centers and infrastructure onshoring is driving a surge in utility-scale solar project development, directly supporting Shoals' robust backlog ($671 million) and new order growth, which are set to bolster revenue through at least 2026."

How do electrification trends and commercial momentum turn into analyst conviction for Shoals' upside? The secret lies in profit growth forecasts and a bold reduction in future earnings multiples. Want to know what revenue and margin outlooks are sparking this consensus? Prepare for some surprising projections and forward-thinking calculations—numbers that may redefine how Shoals is valued in this fast-changing sector.

Result: Fair Value of $7.34 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent margin compression and ongoing legal costs could quickly unravel Shoals' upbeat outlook if profitability remains pressured or if cash reserves continue to shrink.

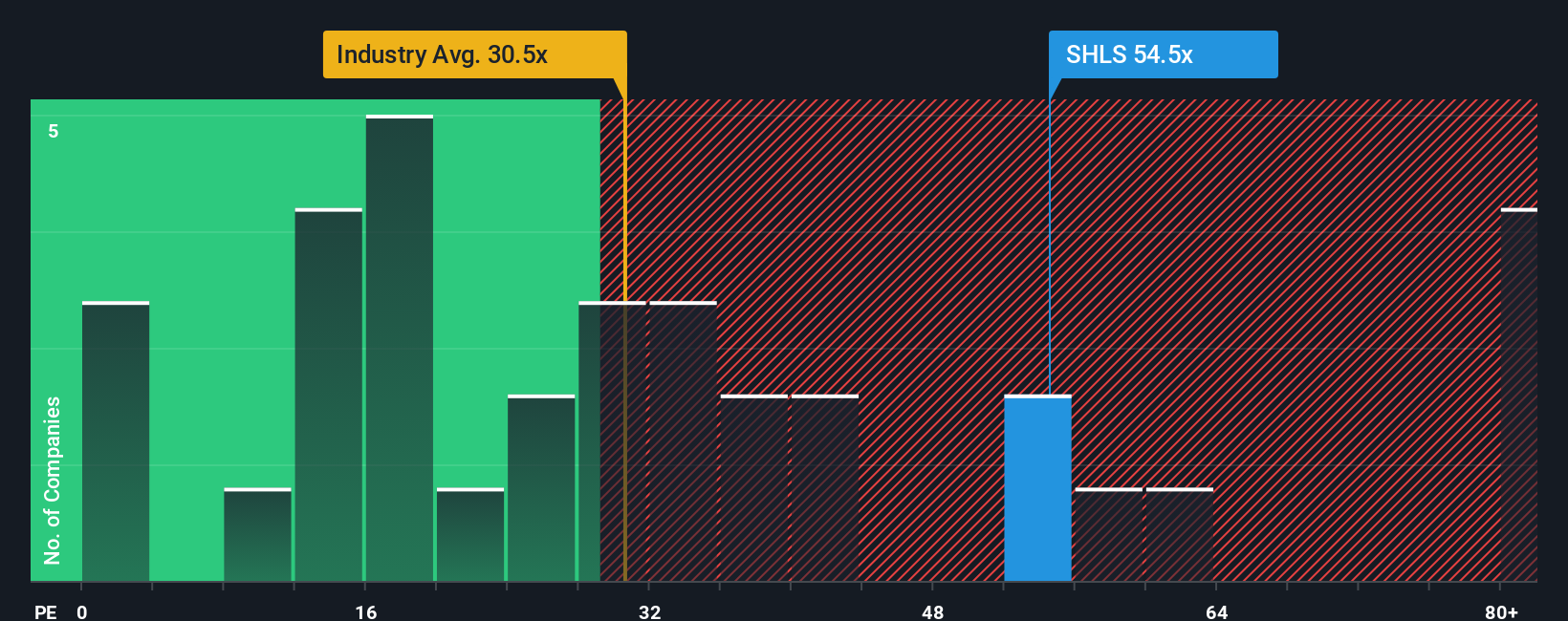

Find out about the key risks to this Shoals Technologies Group narrative.Another View: Market Multiples Tell a Different Story

While the first approach sees Shoals as undervalued, looking at where the shares trade compared to industry norms suggests a different outlook. Current market pricing appears stretched versus sector averages. Could investor optimism be running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Shoals Technologies Group Narrative

If you see things differently, or want to dive deeper into the numbers yourself, you can craft a customized Shoals Technologies Group outlook in under three minutes. Do it your way

A great starting point for your Shoals Technologies Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Opportunities do not wait around. Use the Simply Wall Street screener to uncover stocks other smart investors are watching right now and avoid missing the next big move.

- Tap into tomorrow’s technological breakthroughs by scanning a lineup of promising AI penny stocks that are reshaping business with artificial intelligence and automation.

- Catch high-potential bargains by reviewing undervalued stocks based on cash flows that are flying under the radar, selected for financial strength and attractive pricing.

- Unlock new passive income streams with access to dividend stocks with yields > 3% to explore options offering solid yields for a more predictable financial future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SHLS

Shoals Technologies Group

Provides electrical balance of system (EBOS) solutions and components in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives