- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:SATL

Market Participants Recognise Satellogic Inc.'s (NASDAQ:SATL) Revenues

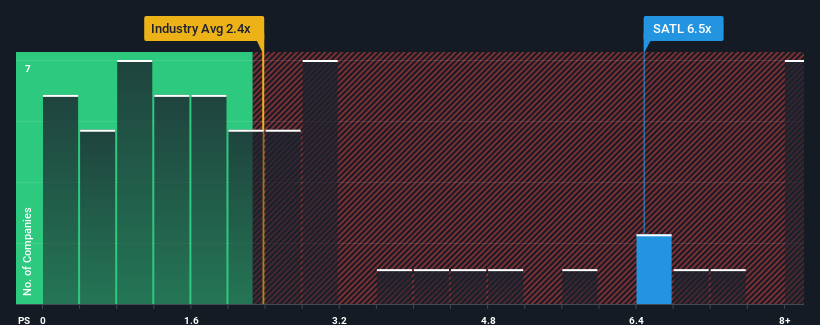

Satellogic Inc.'s (NASDAQ:SATL) price-to-sales (or "P/S") ratio of 6.5x may look like a poor investment opportunity when you consider close to half the companies in the Aerospace & Defense industry in the United States have P/S ratios below 2.4x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Satellogic

How Satellogic Has Been Performing

With revenue growth that's exceedingly strong of late, Satellogic has been doing very well. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Satellogic will help you shine a light on its historical performance.How Is Satellogic's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Satellogic's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 102% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to grow by 11% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we can see why Satellogic is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Satellogic revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

It is also worth noting that we have found 3 warning signs for Satellogic (1 is potentially serious!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SATL

Satellogic

Operates as an integrated geospatial company in the Asia Pacific, North America, and internationally.

Mediocre balance sheet minimal.

Similar Companies

Market Insights

Community Narratives