- United States

- /

- Building

- /

- NasdaqGS:ROCK

How Investors May Respond To Gibraltar Industries (ROCK) Exiting Renewables to Refocus on Building Products

Reviewed by Simply Wall St

- Earlier this year, Gibraltar Industries announced it would exit the renewables sector and realign around building products, which now make up 70% of its portfolio.

- This shift not only refocuses resources on the sizable US$6 billion metal roofing market but also sets the stage for share buybacks and acquisitions concentrated within building products.

- Next, we will explore how Gibraltar's exit from renewables and renewed focus on building products could alter the company's investment narrative.

Rare earth metals are the new gold rush. Find out which 31 stocks are leading the charge.

Gibraltar Industries Investment Narrative Recap

To be a shareholder in Gibraltar Industries today is to believe in the company’s ability to generate consistent returns by concentrating on the established US$6 billion metal roofing market and building products. While the exit from renewables and portfolio simplification should sharpen this focus, it also makes Gibraltar more sensitive to cycles in residential construction, a major short-term catalyst for growth, but one currently facing affordability issues and higher interest rates. The most significant risk remains the company’s increased dependence on this mature, cyclical sector, which may weigh on revenue if construction demand softens.

Among recent announcements, Gibraltar’s plan to expand its direct-to-contractor metal roofing sales stands out as most relevant. This highlights an effort to capture a larger share within a market that is core to the new business focus and may help offset sector-specific softness, but it also heightens the importance of execution in the residential segment, which is experiencing both margin and revenue pressures.

In contrast, investors should pay close attention to how the company manages margin compression in its now dominant Residential segment, as...

Read the full narrative on Gibraltar Industries (it's free!)

Gibraltar Industries is projected to reach $1.1 billion in revenue and $135.8 million in earnings by 2028. This outlook reflects a yearly revenue decline of 6.0% and a slight earnings decrease of $0.2 million from current earnings of $136.0 million.

Uncover how Gibraltar Industries' forecasts yield a $85.00 fair value, a 37% upside to its current price.

Exploring Other Perspectives

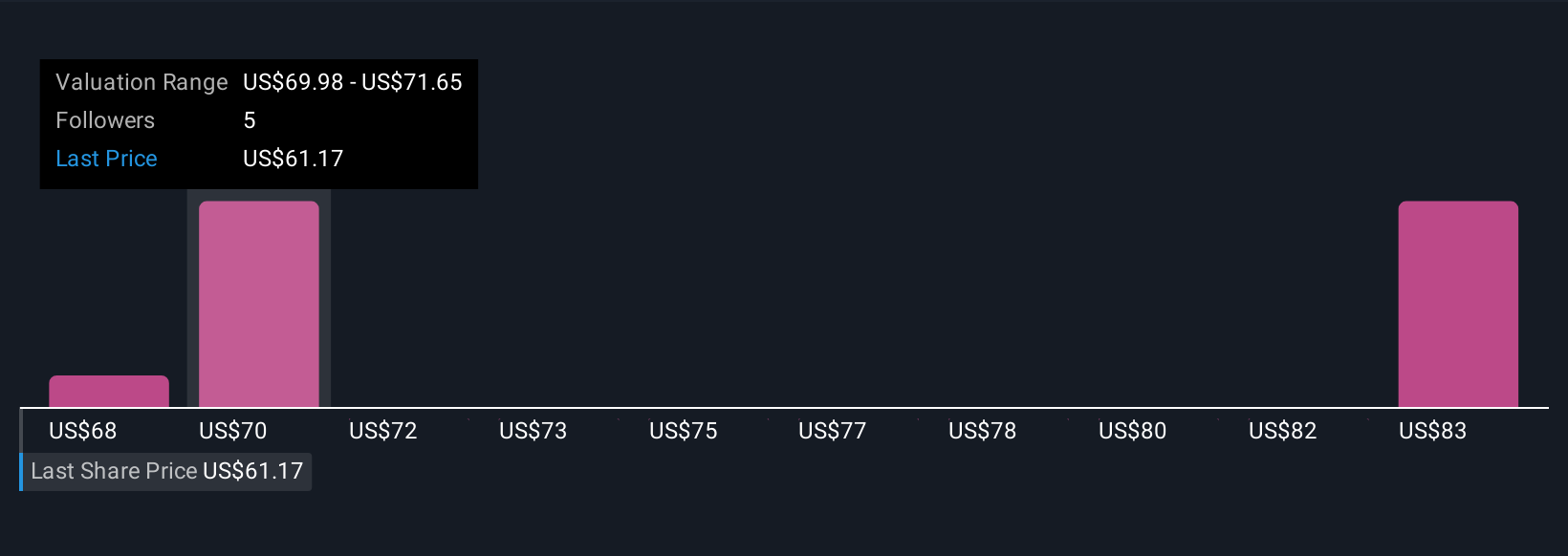

The Simply Wall St Community’s three fair value estimates for Gibraltar Industries range from US$68.31 to US$85 per share. With diverse viewpoints, consider how the company’s increased exposure to cyclical building products might amplify earnings swings as housing markets shift.

Explore 3 other fair value estimates on Gibraltar Industries - why the stock might be worth as much as 37% more than the current price!

Build Your Own Gibraltar Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gibraltar Industries research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Gibraltar Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gibraltar Industries' overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROCK

Gibraltar Industries

Manufactures and provides products and services for the residential, renewable energy, agtech, and infrastructure markets in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives