- United States

- /

- Building

- /

- NasdaqGS:ROCK

Gibraltar Industries (ROCK): Reassessing Valuation After Strategic Refocus and Growth Catalysts Drive Investor Optimism

Reviewed by Simply Wall St

Gibraltar Industries (ROCK) caught the market’s attention this week after management highlighted better operational efficiency, a strategic shift into higher margin engineered systems, and a debt-free balance sheet. Investors are also monitoring potential growth catalysts related to Agtech, residential roofing, and federal infrastructure investment.

See our latest analysis for Gibraltar Industries.

After management’s upbeat commentary and a renewed focus on higher margin engineered systems, Gibraltar’s share price has built real momentum, jumping 12.5% in the past month and 19% year-to-date. That said, with a one-year total shareholder return of nearly 7% and a 41% three-year return, investors seem to be weighing near-term volatility against a solid longer-term track record and clearer growth catalysts.

If Gibraltar’s fresh strategic direction has you curious about other market opportunities, now is a smart time to discover fast growing stocks with high insider ownership

With shares up sharply and strong fundamentals on display, investors now face a key question: Is Gibraltar Industries trading at a bargain given its future prospects, or is all that upside already reflected in today’s price?

Most Popular Narrative: 18% Undervalued

Compared to Gibraltar Industries’ closing price of $69.49, the most widely followed narrative pins fair value at $85. That is a sizable gap, grounded in expectations for profit growth, margin expansion, and benefits from a business realignment. Here is a centerpiece insight that is driving bullish views.

The divestiture of the Renewables segment and renewed focus on core Building Products and Structures businesses are set to simplify operations, better allocate resources, and position the company to capitalize on long-term growth in North American infrastructure and urbanization. This supports both top-line revenue acceleration and margin expansion.

Curious what else drives that valuation? The narrative’s fair value rests on a combination of bold margin improvements, shrinking share count, and a powerful shift in business focus. But there is a pivotal assumption about future earnings that could surprise you. Do not miss the underlying numbers that could make all the difference.

Result: Fair Value of $85 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, weakness in residential construction and the company’s reliance on acquisitions could challenge Gibraltar’s growth expectations if housing and integration trends worsen.

Find out about the key risks to this Gibraltar Industries narrative.

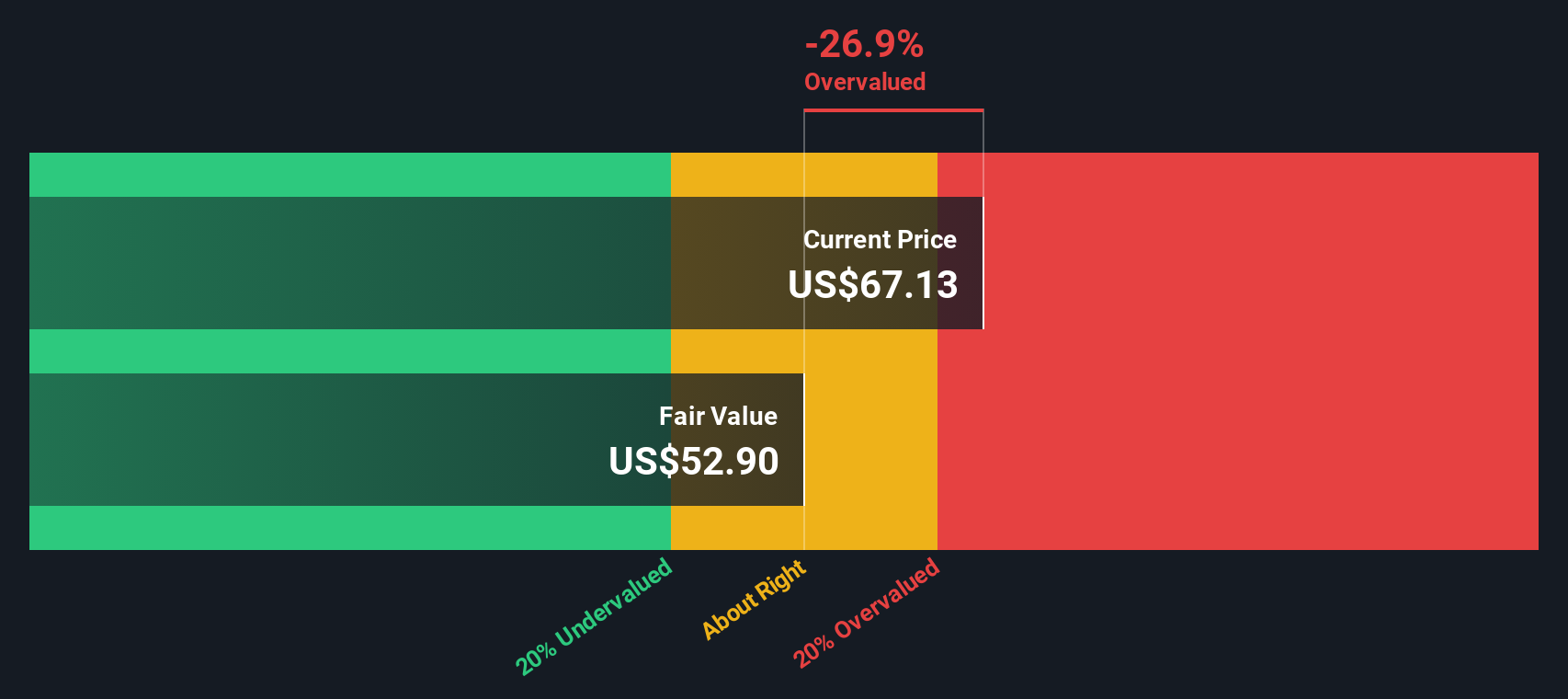

Another View: Discounted Cash Flow Perspective

Taking a different approach, the SWS DCF model values Gibraltar Industries at $52.98 per share, which is noticeably below its recent price of $69.49. This method suggests the stock could be overvalued. This view contrasts with the upbeat, narrative-driven fair value. Could the market be too optimistic, or are the forecasts too cautious?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Gibraltar Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Gibraltar Industries Narrative

If you see the numbers differently or want to follow your own insights, it is easy to build your narrative and shape the bigger picture yourself in just minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Gibraltar Industries.

Looking for more investment ideas?

Don't let opportunity pass you by. Take a closer look at companies poised for growth, stability, or innovation with the right investment screeners today.

- Capture overlooked value and target businesses trading at compelling prices with these 875 undervalued stocks based on cash flows.

- Kickstart your strategy with these 26 AI penny stocks where artificial intelligence is fueling rapid market disruption and industry transformation.

- Boost your passive income potential and lock in consistent returns by checking out these 17 dividend stocks with yields > 3% offering yields over 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROCK

Gibraltar Industries

Manufactures and provides products and services for the residential, renewable energy, agtech, and infrastructure markets in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives