- United States

- /

- Construction

- /

- NasdaqGS:ROAD

The Bull Case For Construction Partners (ROAD) Could Change Following Upbeat Multi-Year Earnings Guidance Update

Reviewed by Sasha Jovanovic

- In October 2025, Construction Partners, Inc. issued new earnings guidance, projecting fiscal 2025 revenue between US$2.80 billion and US$2.82 billion and net income of approximately US$101 million to US$101.8 million, with further increases anticipated in fiscal 2026.

- This outlook suggests accelerated growth compared to the prior year, highlighting expectations of stronger demand and improved financial performance.

- We'll examine how this strong multi-year guidance update could alter the company's investment narrative and outlook for earnings growth.

AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Construction Partners Investment Narrative Recap

To be a shareholder in Construction Partners today, you need conviction in the long-term durability of U.S. infrastructure spending and the company's ability to capture a growing share of Sunbelt contracts. The recent upward earnings guidance for 2025 and 2026 reinforces the view that public funding momentum remains the primary short-term catalyst, but also highlights that exposure to shifts in government budgets is the largest risk, this news does not materially change that risk profile.

Of all recent company news, the Houston-area asset acquisition in October 2025 is most relevant, as it expands network strength in a region benefiting from population growth and infrastructure outlays. This plant acquisition aligns with Construction Partners’ stated catalyst of increasing vertical integration and regional density to drive margin expansion and back up its robust topline guidance. Yet, even as business broadens, investors should weigh the contrasting possibility that unforeseen state or federal budget tightening might suddenly impact future contract flow…

Read the full narrative on Construction Partners (it's free!)

Construction Partners' outlook projects $4.1 billion in revenue and $286.4 million in earnings by 2028. This assumes an 18.3% annual revenue growth rate and a $211.9 million increase in earnings from the current $74.5 million.

Uncover how Construction Partners' forecasts yield a $123.83 fair value, a 7% upside to its current price.

Exploring Other Perspectives

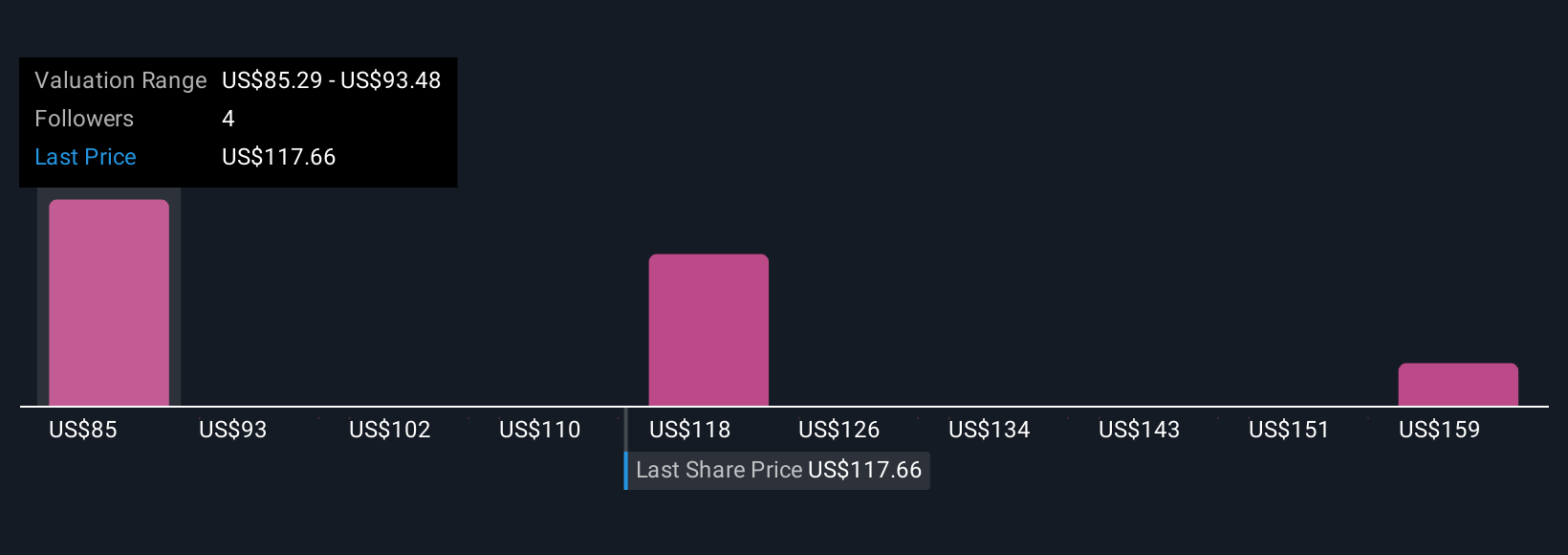

Simply Wall St Community contributors provided three fair value estimates for Construction Partners stock, ranging from US$85.34 to US$167.14 per share. While many focus on high revenue visibility from federal and state funding, opinions vary widely on the company's ultimate ability to translate backlog and acquisitions into sustainable earnings growth.

Explore 3 other fair value estimates on Construction Partners - why the stock might be worth 27% less than the current price!

Build Your Own Construction Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Construction Partners research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Construction Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Construction Partners' overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROAD

Construction Partners

A civil infrastructure company, constructs and maintains roadways in Alabama, Florida, Georgia, North Carolina, South Carolina, Tennessee, and Texas.

Reasonable growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives