- United States

- /

- Construction

- /

- NasdaqGS:ROAD

Is the Recent Contract Win Enough to Support Construction Partners’ Soaring Share Price in 2025?

Reviewed by Bailey Pemberton

- Wondering if Construction Partners could be a smart buy at today's price? You're not alone, especially if you want to know whether the current share price really offers value.

- Shares have soared over the past five years, climbing a remarkable 323.6%, with a healthy 21.6% year-to-date return. However, the stock did dip 4.1% over the last week and 7.1% in the past month.

- Recent news has highlighted the company's ongoing investments in infrastructure projects and several significant contract wins, which have bolstered its growth outlook. At the same time, mentions of rising construction costs and shifting demand have fueled some short-term volatility in the share price.

- On the valuation front, Construction Partners scores a 1 out of 6 in our undervalued checks. This suggests that finding the "right" value takes more than just a single metric. We'll break down how different methods assess the company's value. Plus, we'll share an even more insightful approach later on.

Construction Partners scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Construction Partners Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting future cash flows and discounting them back to their present value. For Construction Partners, this involves assessing its expected ability to generate Free Cash Flow (FCF) in the future, using both analyst estimates and extended projections.

Currently, Construction Partners generates $142.96 million in Free Cash Flow. Analyst forecasts indicate that by 2027, annual FCF could rise to $259.41 million, suggesting a strong trajectory over the next few years. Beyond this, Simply Wall St extrapolates FCF out to 2035, projecting continued growth, though at slightly slower rates.

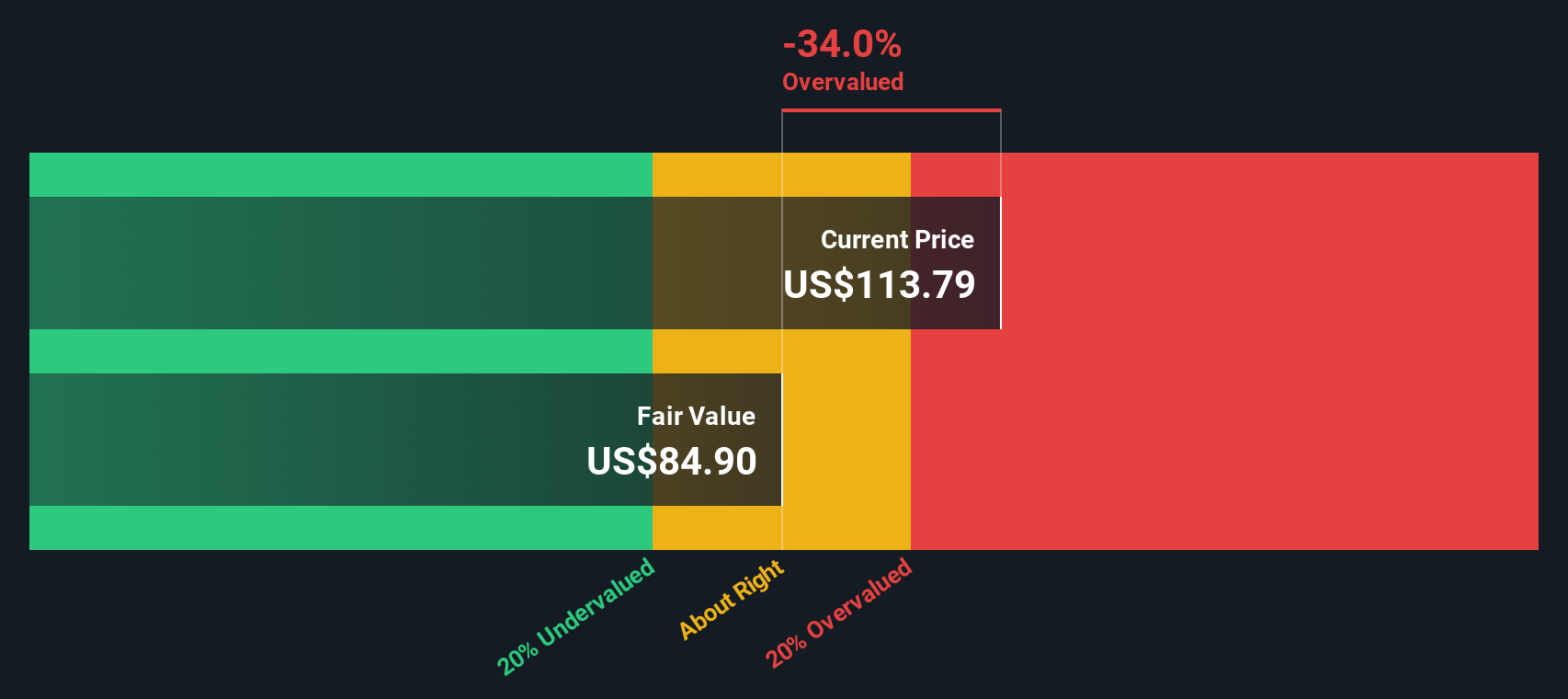

After applying the DCF method using the 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value for the stock is $83.27 per share.

Compared to the current market price, this DCF result implies the stock is trading about 28.3% above its fair value. In valuation terms, Construction Partners appears overvalued based on how much cash the business is likely to generate in the years ahead.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Construction Partners may be overvalued by 28.3%. Discover 886 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Construction Partners Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Construction Partners, since it shows how much investors are willing to pay for each dollar of current earnings. A higher PE can reflect expectations for strong future growth or lower risk, while a lower PE usually signals slower growth prospects or elevated risk compared to peers.

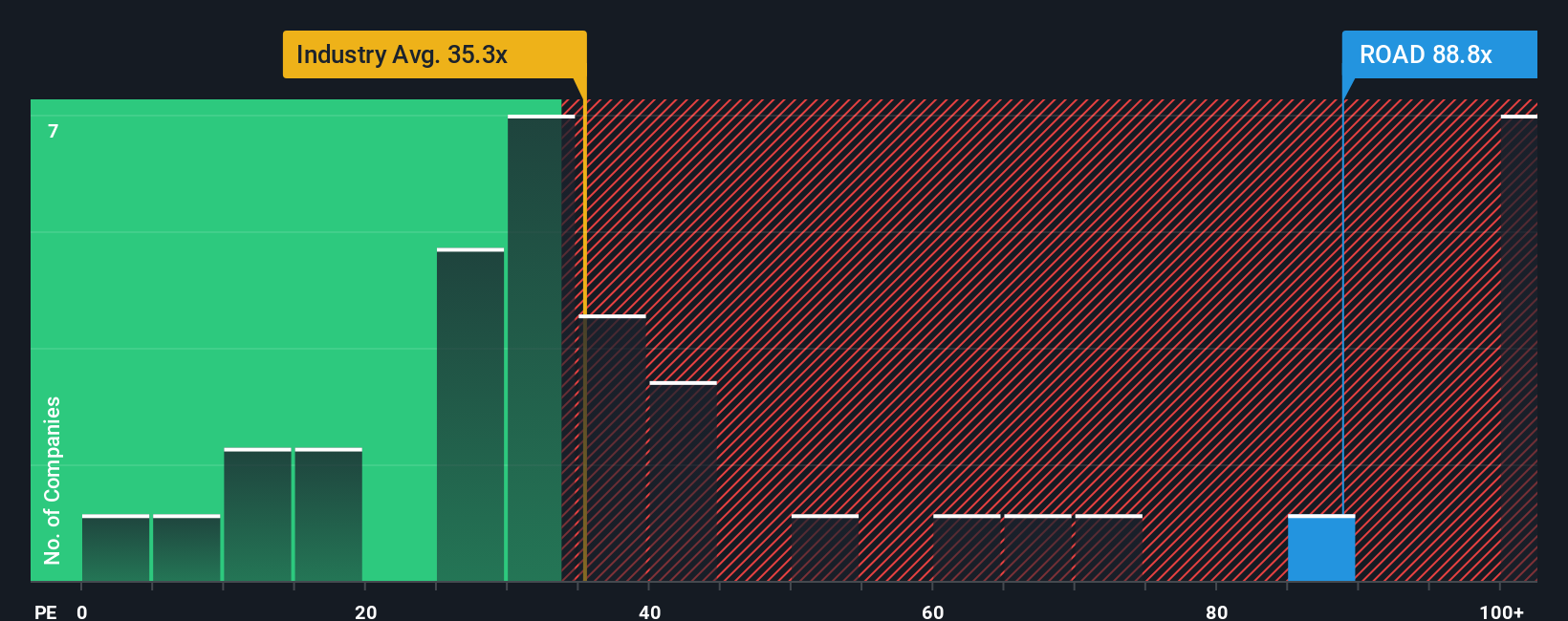

Construction Partners currently trades at an 80.4x PE ratio. This is significantly higher than both the construction industry average of 33.1x and the average among its public peers at 31.3x. Such a premium usually means investors are expecting much higher earnings growth or believe the company carries less risk than its industry counterparts.

However, instead of simply comparing with industry averages or peers, Simply Wall St’s proprietary "Fair Ratio" takes things a step further. This metric adjusts for key factors like Construction Partners’ expected growth, profitability, risk profile, market cap, and where it sits in the broader construction sector. For Construction Partners, the Fair PE Ratio is calculated at 35.6x, making the comparison more tailored and forward-looking than a straight industry average.

With an actual PE of 80.4x compared to a Fair Ratio of 35.6x, the stock appears significantly overvalued using this approach.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Construction Partners Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your own story for a company such as Construction Partners, backed by your expectations for future growth, profit margins, and a fair value, rather than relying solely on traditional ratios or averages.

With Narratives, you connect what is happening in the business, such as new contracts, acquisitions, or sector trends, to a concrete financial forecast, which instantly updates your fair value estimate. They are easy to use and accessible right on Simply Wall St's Community page, where millions of investors share and compare their perspectives.

By creating or choosing a Narrative, you directly link your understanding of the company's future to a valuation that lets you see if the current share price looks cheap, expensive, or fairly priced. Best of all, Narratives update dynamically as events unfold, so your view stays relevant with new information, earnings, or news headlines.

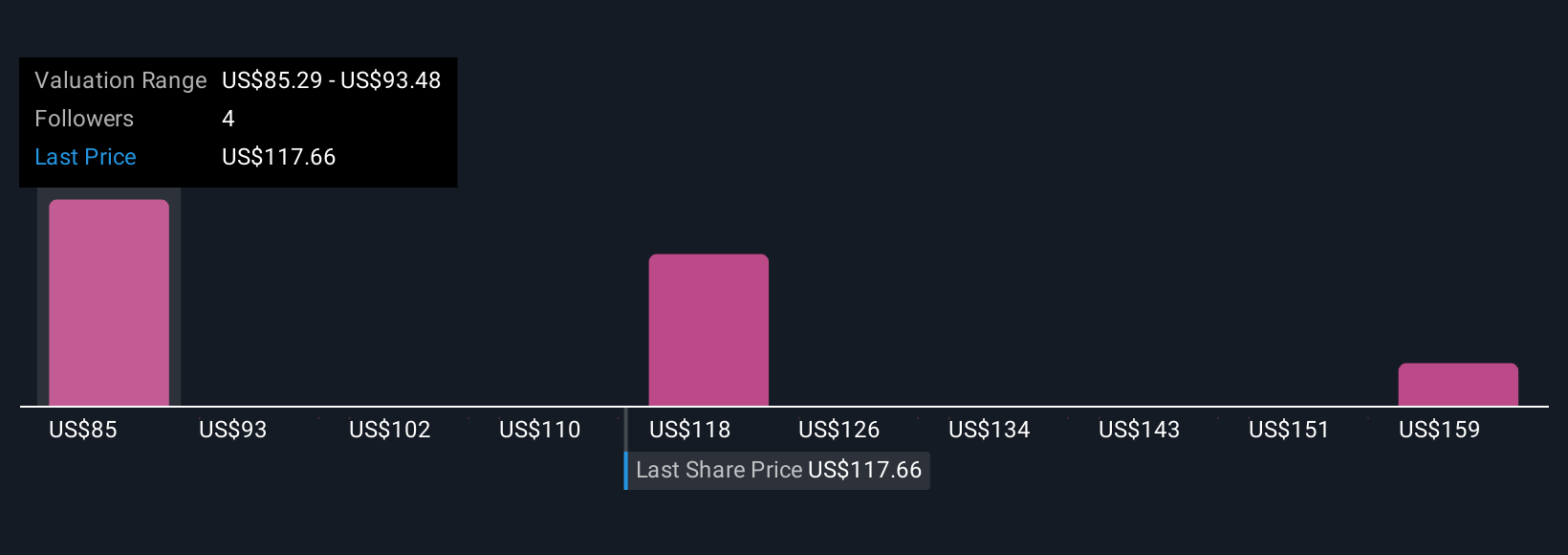

For Construction Partners, investors using Narratives recently set fair values ranging from $120.17 to $131.17, depending on whether they believe outsized growth from new acquisitions will be sustained or if headwinds like rising costs and regional risks may limit profits. This shows how different stories create different valuations.

Do you think there's more to the story for Construction Partners? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROAD

Construction Partners

A civil infrastructure company, constructs and maintains roadways in Alabama, Florida, Georgia, North Carolina, South Carolina, Tennessee, and Texas.

Reasonable growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives