- United States

- /

- Construction

- /

- NasdaqGS:ROAD

A Look at Construction Partners (ROAD) Valuation Following New Guidance and Upbeat Growth Outlook

Reviewed by Simply Wall St

Construction Partners (ROAD) released new earnings guidance projecting strong gains in both revenue and net income for 2025 and 2026. This signals growing business momentum and a confident outlook from management.

See our latest analysis for Construction Partners.

The upbeat new guidance appears to have reinforced Construction Partners’ solid track record. The share price has climbed nearly 34% year-to-date. Steadily compounding value, its one-year total shareholder return sits at an eye-catching 47% and the three-year total return exceeds 270%, signaling strong momentum for long-term investors.

If Construction Partners’ surge has you searching for more growth stories, now is a great time to expand your horizons and browse fast growing stocks with high insider ownership.

Yet with shares having surged in recent months and new guidance highlighting rapid growth, the key question for investors is whether Construction Partners is still undervalued or if the market has already priced in this future success.

Most Popular Narrative: 5% Undervalued

With Construction Partners trading at $117.66 compared to a consensus fair value of $123.83, the most widely followed narrative points to modest upside from current levels, supported by new guidance and analyst targets.

Ongoing vertical integration, through investment in owned asphalt plants and material sourcing, combined with increasing scale, is already enhancing operational efficiencies and driving margin expansion. This is reflected in record adjusted EBITDA margins despite weather disruptions, and may contribute to higher net margins and improved earnings resilience in the future.

Ever wonder what financial assumptions power this consensus? There is a bold forecast for strong earnings growth and a profit margin increase that could impact ROAD’s valuation approach. Find out which future milestones are incorporated, and what the narrative still leaves unsaid.

Result: Fair Value of $123.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Construction Partners' heavy reliance on public infrastructure funding and exposure to regional economic risks could quickly reshape the long-term growth narrative.

Find out about the key risks to this Construction Partners narrative.

Another View: Multiples Paint a Different Picture

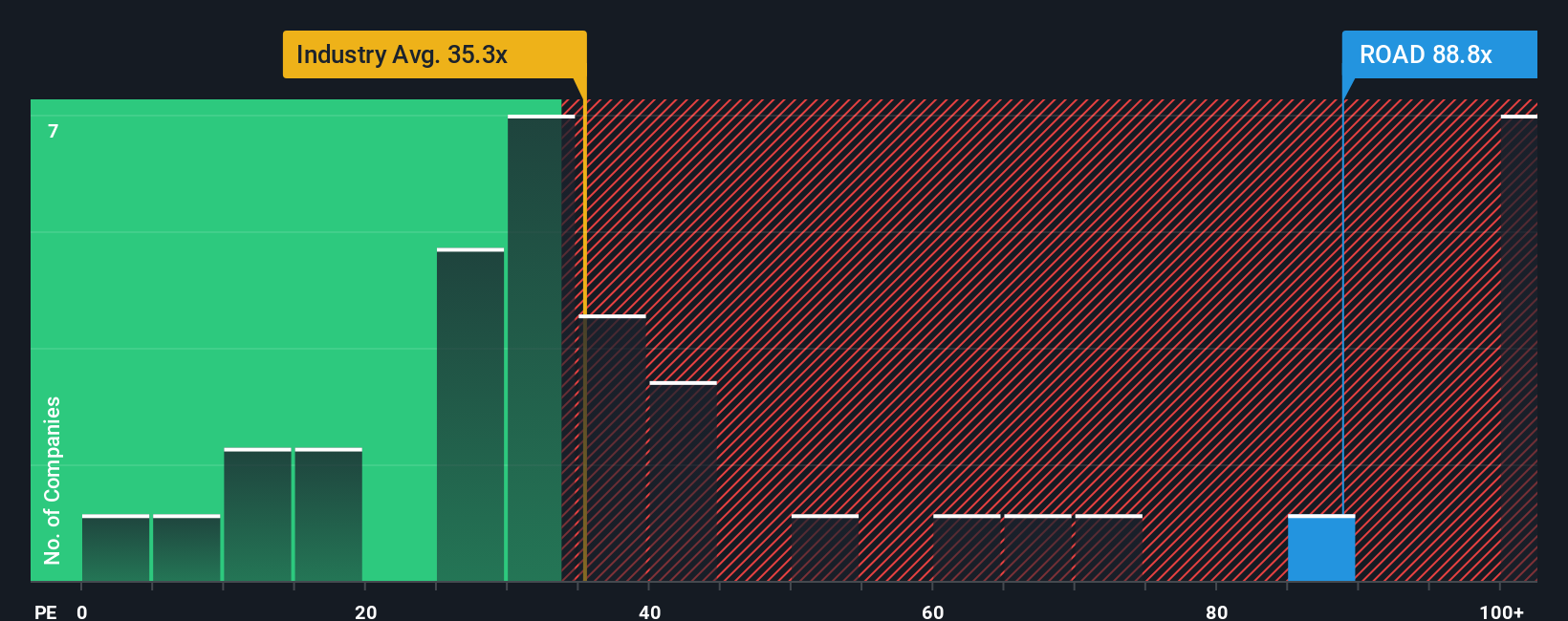

Looking at valuation through price-to-earnings ratios shows a far less optimistic story. Construction Partners trades at about 88.6 times earnings, which is much steeper than both the U.S. construction industry average of 35.1x and its peer average of 24x. The fair ratio, where the market could snap back toward, is also much lower at 37.2x. This big gap suggests that investors are paying a hefty premium for ROAD’s growth today. Is it justified, or could the premium shrink?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Construction Partners Narrative

If you see things differently or enjoy crafting your own view from the numbers, you can put together your own story in just a few minutes. Do it your way.

A great starting point for your Construction Partners research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors are always searching for the next opportunity. Uncover game-changing potential by browsing curated investment ideas handpicked from top-performing and often overlooked sectors.

- Tap into emerging tech trends and see which companies are thriving with these 26 AI penny stocks for innovative growth.

- Capture hidden value by checking out these 869 undervalued stocks based on cash flows that might be flying under the radar but offer solid fundamentals.

- Maximize your returns with steady income opportunities through these 21 dividend stocks with yields > 3% featuring companies with yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROAD

Construction Partners

A civil infrastructure company, constructs and maintains roadways in Alabama, Florida, Georgia, North Carolina, South Carolina, Tennessee, and Texas.

Reasonable growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives