- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:RKLB

Assessing Rocket Lab Stock After 11% Drop and New Launch Milestones in 2025

Reviewed by Bailey Pemberton

- Wondering whether Rocket Lab stock is a bargain or overhyped? You are not alone, as a surge in interest has prompted many investors to take a fresh look at its true value.

- The stock is up an incredible 379.0% over the past year and more than 1000% over the last three years. However, it has slipped by 11.3% in just the last week, highlighting both its explosive growth potential and shifting market sentiment.

- Recent headlines around Rocket Lab’s launch cadence, satellite contract wins, and expansion plans have fueled both bullish bets and brief periods of volatility. Investors are parsing news of major partnership announcements and technical milestones, which seem to drive sharp moves in price.

- Despite all the buzz, Rocket Lab currently scores 0/6 on our valuation checks, meaning it is not considered undervalued in any of the standard metrics. Next, we will dig into whether traditional valuation approaches tell the full story and explore a better way to assess what this growth stock is truly worth.

Rocket Lab scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Rocket Lab Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future free cash flows and discounting them back to today’s dollars. This approach is useful for growth stocks like Rocket Lab because near-term profits might not fully reflect the business’s long-term potential.

Currently, Rocket Lab’s Free Cash Flow (FCF) stands at negative $208.5 million. Analysts only forecast FCF for up to five years, with $58.6 million projected by the end of 2027. Further estimates are extrapolated by Simply Wall St’s model. Over the next decade, Rocket Lab’s annual FCF is projected to grow sharply, moving from negative figures today to more than $585 million by 2035. All cash flows are reported in US dollars.

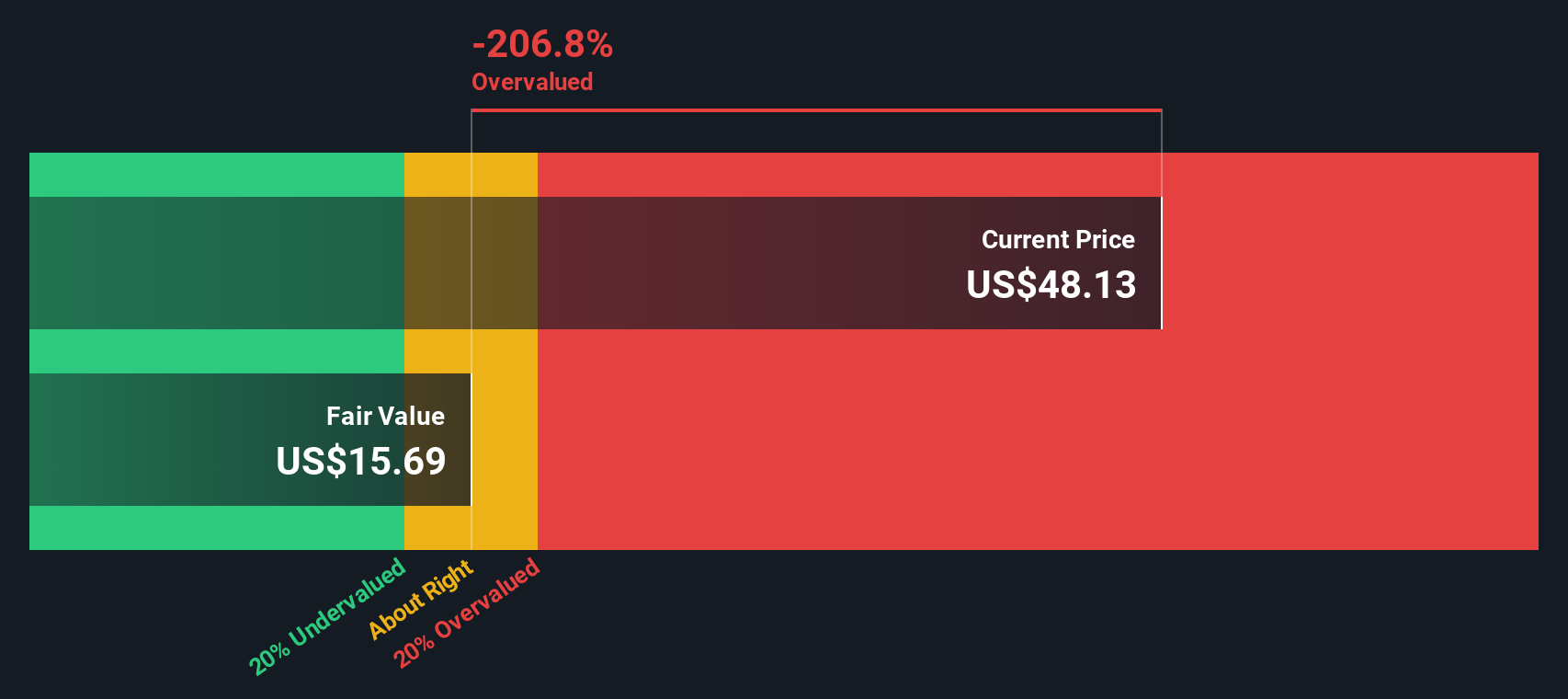

Based on these projections, Rocket Lab’s estimated intrinsic value per share is $17.76. However, with the current share price far above this level, the DCF model implies Rocket Lab is 218.5% overvalued. Even accounting for aggressive growth assumptions, the stock trades much higher than its calculated fair value.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Rocket Lab may be overvalued by 218.5%. Discover 842 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Rocket Lab Price vs Book

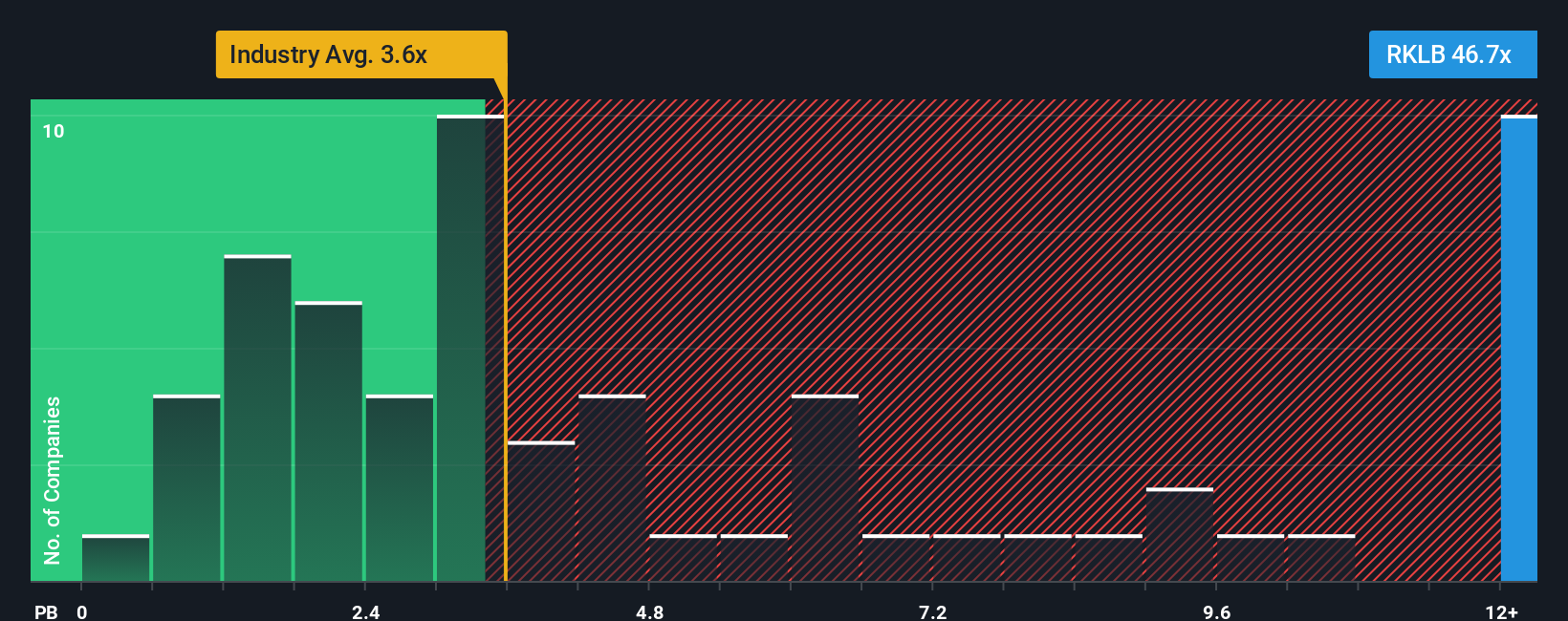

The Price-to-Book (PB) ratio is traditionally used for valuing companies where profits are not yet consistent or positive. This makes it a useful option for high-growth firms like Rocket Lab. This multiple compares a company’s market value to its net assets, helping investors understand how much they are paying for the underlying value of the business.

Growth expectations and the risk profile of a company can push its PB ratio higher than average if markets believe future prospects are strong. However, an extremely high PB can also signal over-optimism or excessive risk-taking compared to typical industry valuations.

Currently, Rocket Lab trades at a PB ratio of 39.77x, which is much higher than both the Aerospace & Defense industry average of 3.64x and the peer group average of 10.79x. Such a significant premium might appear concerning at first glance. Simply Wall St’s proprietary “Fair Ratio” seeks to address this by factoring in Rocket Lab’s specific growth outlook, profit margins, risk, market cap, and industry positioning. Unlike a basic industry or peer comparison, the Fair Ratio offers a more holistic, company-tailored benchmark for valuation.

By comparing Rocket Lab’s actual PB ratio to the Fair Ratio, we can form a clearer view of its valuation. In this case, Rocket Lab’s PB ratio is well above what would be considered fair, suggesting the stock is priced for extremely optimistic outcomes.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1409 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Rocket Lab Narrative

Earlier we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a powerful yet simple framework that allows you to tell the story behind a company using your own assumptions. This links your perspective on Rocket Lab’s business drivers, future revenue, profit margins, and fair value to build a clear, forward-looking forecast. With Narratives on Simply Wall St’s Community page, you can easily map your outlook for Rocket Lab, compare your Fair Value to the current Price to decide if it is time to buy or sell, and see your Narrative update dynamically whenever new information or earnings are released.

Narratives help investors move beyond static metrics by making it easy to model and test different scenarios, so you can see how changes in growth rates, margins, or industry news impact your investment thesis in real time.

For example, one Rocket Lab investor might forecast aggressive revenue growth, high margins, and set a Fair Value as high as $58.67, while a more cautious investor, concerned about risks and execution, may believe the Fair Value is closer to $20. Narratives make these perspectives visible and actionable, empowering you to invest with confidence and insight, rather than relying solely on headline numbers.

For Rocket Lab, however, we'll make it really easy for you with previews of two leading Rocket Lab Narratives:

Fair Value: $58.67

Current Price Discount: -3.6%

Forecast Revenue Growth: 37.36%

- Analysts believe Rocket Lab’s expansion into end-to-end space solutions and increased vertical integration will unlock major government and defense contracts, driving margin improvement and long-term growth.

- Strong backlog from satellite manufacturing, frequent launches, and the coming Neutron rocket are expected to accelerate revenue growth, boosting Rocket Lab’s market position and access to higher-value contracts.

- Risks include heavy R&D spending, execution challenges, and new competition. The consensus price target suggests Rocket Lab is fairly valued if the company achieves planned revenue and margin gains over the next several years.

Fair Value: $31.72

Current Price Premium: 78.5%

Forecast Revenue Growth: 30.0%

- The space economy is set for major growth, but Rocket Lab’s high stock price means success with the new Neutron rocket, cost management, and ramping up high-margin 'Space Systems' are critical to justify current valuation.

- Failure to achieve scale with Neutron or manage working capital could threaten profitability and risk the company's long-term viability amid intense competition, especially from SpaceX.

- Rocket Lab’s competitive position depends on keeping launch costs low and improving margins. The current market price assumes flawless execution and high growth, so investors face significant downside if growth stalls.

Do you think there's more to the story for Rocket Lab? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RKLB

Rocket Lab

A space company, provides launch services and space systems solutions in the United States, Canada, Japan, and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives