- United States

- /

- Electrical

- /

- NasdaqCM:PPSI

Will Pioneer Power Solutions (NASDAQ:PPSI) Spend Its Cash Wisely?

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. By way of example, Pioneer Power Solutions (NASDAQ:PPSI) has seen its share price rise 233% over the last year, delighting many shareholders. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

Given its strong share price performance, we think it's worthwhile for Pioneer Power Solutions shareholders to consider whether its cash burn is concerning. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

View our latest analysis for Pioneer Power Solutions

SWOT Analysis for Pioneer Power Solutions

- Currently debt free.

- Expensive based on P/S ratio compared to estimated Fair P/S ratio.

- Expected to breakeven next year.

- Has less than 3 years of cash runway based on current free cash flow.

How Long Is Pioneer Power Solutions' Cash Runway?

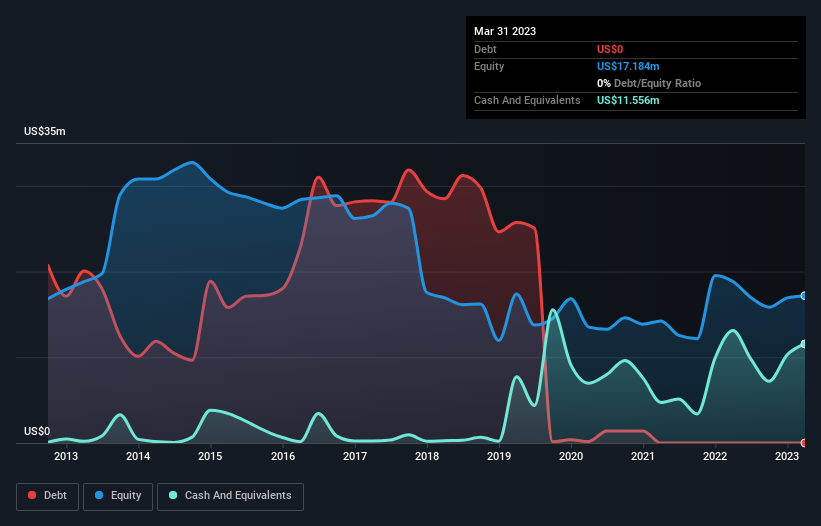

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. In March 2023, Pioneer Power Solutions had US$12m in cash, and was debt-free. Looking at the last year, the company burnt through US$7.9m. So it had a cash runway of approximately 17 months from March 2023. That's not too bad, but it's fair to say the end of the cash runway is in sight, unless cash burn reduces drastically. Depicted below, you can see how its cash holdings have changed over time.

How Well Is Pioneer Power Solutions Growing?

One thing for shareholders to keep front in mind is that Pioneer Power Solutions increased its cash burn by 1,442% in the last twelve months. On the bright side, at least operating revenue was up 38% over the same period, giving some cause for hope. Taken together, we think these growth metrics are a little worrying. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Hard Would It Be For Pioneer Power Solutions To Raise More Cash For Growth?

While Pioneer Power Solutions seems to be in a fairly good position, it's still worth considering how easily it could raise more cash, even just to fuel faster growth. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Pioneer Power Solutions has a market capitalisation of US$96m and burnt through US$7.9m last year, which is 8.3% of the company's market value. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

Is Pioneer Power Solutions' Cash Burn A Worry?

Even though its increasing cash burn makes us a little nervous, we are compelled to mention that we thought Pioneer Power Solutions' revenue growth was relatively promising. Cash burning companies are always on the riskier side of things, but after considering all of the factors discussed in this short piece, we're not too worried about its rate of cash burn. Readers need to have a sound understanding of business risks before investing in a stock, and we've spotted 2 warning signs for Pioneer Power Solutions that potential shareholders should take into account before putting money into a stock.

Of course Pioneer Power Solutions may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:PPSI

Pioneer Power Solutions

Pioneer Power Solutions, Inc., together with its subsidiaries, design, manufacture, integrate, refurbish, distribute, sell, and service electric power systems, distributed energy resources, power generation equipment, and mobile EV charging solutions.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026