- United States

- /

- Electrical

- /

- NasdaqCM:PPSI

Pioneer Power Solutions, Inc. (NASDAQ:PPSI) Stock Rockets 76% But Many Are Still Ignoring The Company

The Pioneer Power Solutions, Inc. (NASDAQ:PPSI) share price has done very well over the last month, posting an excellent gain of 76%. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

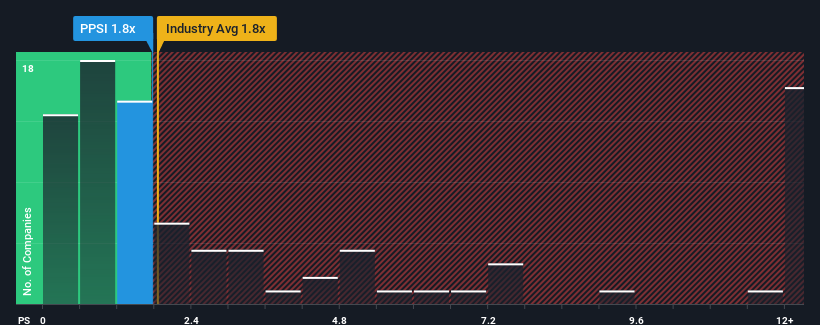

Although its price has surged higher, you could still be forgiven for feeling indifferent about Pioneer Power Solutions' P/S ratio of 1.8x, since the median price-to-sales (or "P/S") ratio for the Electrical industry in the United States is about the same. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Pioneer Power Solutions

What Does Pioneer Power Solutions' P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Pioneer Power Solutions has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Pioneer Power Solutions.How Is Pioneer Power Solutions' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Pioneer Power Solutions' is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 47% last year. The strong recent performance means it was also able to grow revenue by 31% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 50% per annum during the coming three years according to the sole analyst following the company. With the industry only predicted to deliver 33% per year, the company is positioned for a stronger revenue result.

In light of this, it's curious that Pioneer Power Solutions' P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Pioneer Power Solutions' P/S

Pioneer Power Solutions appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Looking at Pioneer Power Solutions' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Having said that, be aware Pioneer Power Solutions is showing 2 warning signs in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Pioneer Power Solutions, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:PPSI

Pioneer Power Solutions

Pioneer Power Solutions, Inc., together with its subsidiaries, design, manufacture, integrate, refurbish, distribute, sell, and service electric power systems, distributed energy resources, power generation equipment, and mobile EV charging solutions.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives