- United States

- /

- Electrical

- /

- NasdaqCM:PPSI

Pioneer Power Solutions, Inc. (NASDAQ:PPSI) Analysts Are Pretty Bullish On The Stock After Recent Results

The investors in Pioneer Power Solutions, Inc.'s (NASDAQ:PPSI) will be rubbing their hands together with glee today, after the share price leapt 38% to US$4.04 in the week following its quarterly results. Revenues came in 36% better than analyst models expected, at US$6.0m, although statutory losses were 14% larger than expected, at US$0.08 per share. The analyst typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. We thought readers would find it interesting to see the analyst latest (statutory) post-earnings forecasts for next year.

View our latest analysis for Pioneer Power Solutions

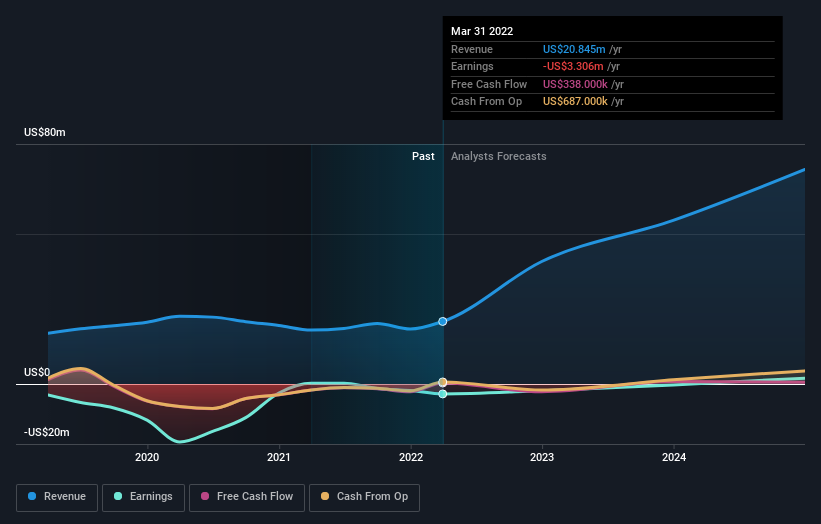

Taking into account the latest results, the current consensus from Pioneer Power Solutions' one analyst is for revenues of US$40.8m in 2022, which would reflect a sizeable 96% increase on its sales over the past 12 months. Losses are predicted to fall substantially, shrinking 33% to US$0.23. Yet prior to the latest earnings, the analyst had been forecasting revenues of US$39.8m and losses of US$0.20 per share in 2022. So it's pretty clear the analyst has mixed opinions on Pioneer Power Solutions even after this update; although they upped their revenue numbers, it came at the cost of a notable increase in per-share losses.

It will come as a surprise to learn that the consensus price target rose 45% to US$12.00, with the analyst clearly more interested in growing revenue, even as losses intensify.

Of course, another way to look at these forecasts is to place them into context against the industry itself. For example, we noticed that Pioneer Power Solutions' rate of growth is expected to accelerate meaningfully, with revenues forecast to exhibit 145% growth to the end of 2022 on an annualised basis. That is well above its historical decline of 43% a year over the past five years. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to grow 11% annually. So it looks like Pioneer Power Solutions is expected to grow faster than its competitors, at least for a while.

The Bottom Line

The most important thing to take away is that the analyst increased their loss per share estimates for next year. Happily, they also upgraded their revenue estimates, and are forecasting revenues to grow faster than the wider industry. There was also a nice increase in the price target, with the analyst clearly feeling that the intrinsic value of the business is improving.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have analyst estimates for Pioneer Power Solutions going out as far as 2024, and you can see them free on our platform here.

Before you take the next step you should know about the 3 warning signs for Pioneer Power Solutions that we have uncovered.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:PPSI

Pioneer Power Solutions

Pioneer Power Solutions, Inc., together with its subsidiaries, design, manufacture, integrate, refurbish, distribute, sell, and service electric power systems, distributed energy resources, power generation equipment, and mobile EV charging solutions.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026