- United States

- /

- Electrical

- /

- NasdaqCM:PLUG

Why Plug Power (PLUG) Is Up After Supplying Europe’s Largest Green Hydrogen Project – And What’s Next

Reviewed by Sasha Jovanovic

- Plug Power has delivered its first 10MW GenEco electrolyzer array to Galp’s Sines Refinery in Portugal, kicking off one of Europe’s largest green hydrogen projects expected to ultimately reach 100MW capacity and produce up to 15,000 tons of renewable hydrogen annually.

- This milestone project highlights Plug Power’s expanding ability to provide industrial-scale green hydrogen solutions for the European market, aiming to replace a significant portion of fossil-based hydrogen and drive major emissions reductions.

- We’ll review how this initial electrolyzer delivery boosts Plug Power’s ability to compete for large-scale, global hydrogen infrastructure opportunities.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Plug Power Investment Narrative Recap

To back Plug Power as a shareholder, you must believe in the global shift toward green hydrogen and the company’s capacity to deliver utility-scale projects, like its new electrolyzer deployment in Portugal. While this milestone improves Plug’s credibility in scaling up, the immediate impact on the short-term catalyst, achieving gross margin breakeven, appears incremental rather than transformative. The central risk remains the company’s ability to reverse persistent negative gross margins despite operational progress and headline project wins.

Of Plug Power’s recent announcements, Project Quantum Leap stands out. This ongoing cost-cutting initiative aims for US$150 million to US$200 million in annual savings and a near-term target of breakeven gross margins. In the context of the Galp electrolyzer news, operational discipline and margin recovery remain crucial catalysts, as consistent profitability will underpin the company’s momentum from large-scale hydrogen project wins.

In contrast, there’s still the unresolved issue that investors should be aware of: ongoing cash burn and potential reliance on equity or debt financing, especially if operational...

Read the full narrative on Plug Power (it's free!)

Plug Power's narrative projects $1.2 billion in revenue and $124.7 million in earnings by 2028. This requires 22.2% yearly revenue growth and a $2.1 billion increase in earnings from current earnings of -$2.0 billion.

Uncover how Plug Power's forecasts yield a $2.08 fair value, a 26% downside to its current price.

Exploring Other Perspectives

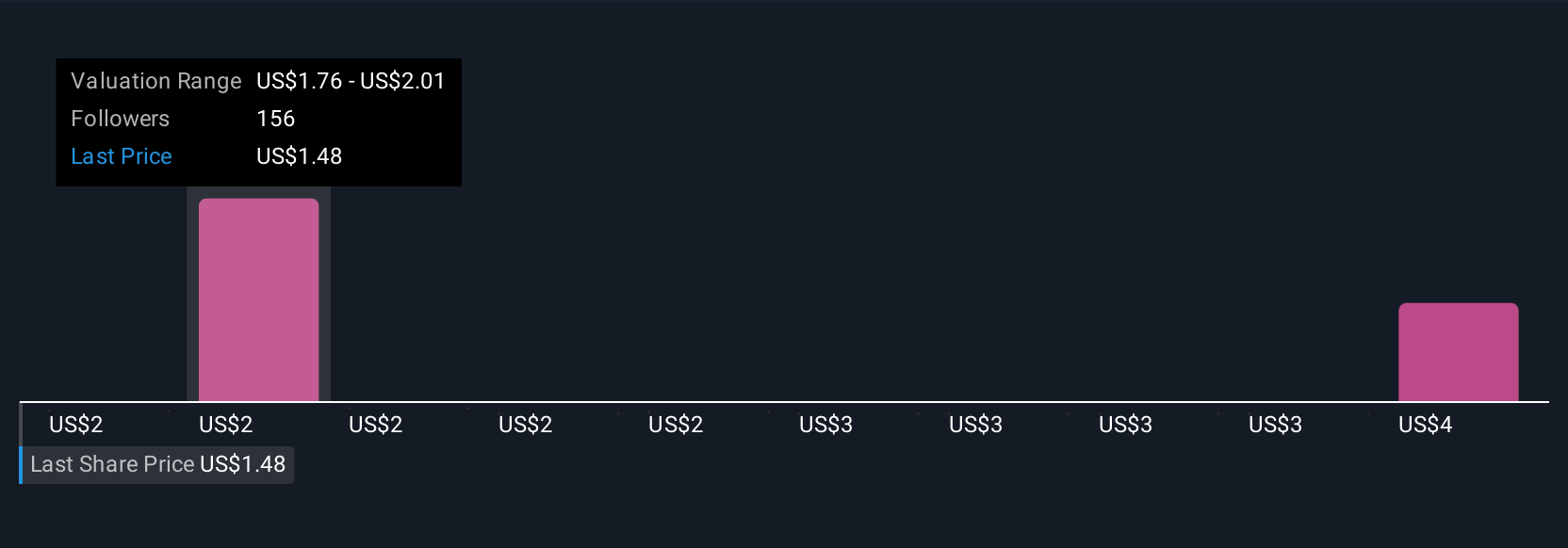

Seventeen Simply Wall St Community members estimate Plug Power's fair value between US$1.49 and US$3.96 per share. With margin improvements a key catalyst, many investors see profitability as the crucial test for long-term returns.

Explore 17 other fair value estimates on Plug Power - why the stock might be worth 47% less than the current price!

Build Your Own Plug Power Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Plug Power research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Plug Power research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Plug Power's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PLUG

Plug Power

Develops hydrogen fuel cells product solutions in North America, Europe, Asia, and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives