- United States

- /

- Electrical

- /

- NasdaqCM:PLUG

Plug Power (PLUG): Reassessing Valuation After New Hydrogen Deals and Capital Restructuring Moves

Reviewed by Simply Wall St

Plug Power (PLUG) just paired fresh commercial wins with a big governance and capital move, proposing charter changes that would make it easier to raise equity while it scales green hydrogen projects.

See our latest analysis for Plug Power.

Those contract wins and governance moves are landing against a mixed backdrop, with the share price at $2.29 and a roughly 14.5% 90 day share price return contrasting with a still deeply negative five year total shareholder return. Long term holders are waiting for evidence the turnaround is real.

If Plug’s story has you thinking about where else growth capital is flowing, this is a good moment to explore high growth tech and AI stocks that are reshaping the next wave of innovation.

With shares still far below their long term peak, yet recent wins improving liquidity and backlog, investors are left weighing the odds: is Plug finally a mispriced turnaround, or is the market already baking in that recovery?

Most Popular Narrative Narrative: 18% Undervalued

With Plug Power last closing at $2.29 versus a most popular narrative fair value near $2.79, the storyline leans toward a discounted recovery bet.

Operational improvements such as gross margin enhancements from Project Quantum Leap, restructuring, facility consolidation, and favorable hydrogen supply agreements are already yielding sharply better margins and targeting breakeven gross margin by Q4, which can lead directly to improved net margins and earnings. Expansion of Plug Power's vertically integrated hydrogen production and distribution network (new facilities in Georgia, Louisiana, and soon Texas) is strengthening supply reliability, lowering production costs, and enhancing customer confidence supporting both volume driven revenue growth and future margin gains.

Curious how margin repairs, ambitious growth forecasts, and a premium future earnings multiple all line up to justify that higher fair value? The full narrative unpacks the bold revenue runway, the assumed shift from deep losses to healthy profitability, and the valuation math that turns today’s red ink into tomorrow’s potential upside.

Result: Fair Value of $2.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stubborn cash burn and delays converting its project pipeline into revenue could quickly erode confidence in that discounted turnaround story.

Find out about the key risks to this Plug Power narrative.

Another Lens on Valuation

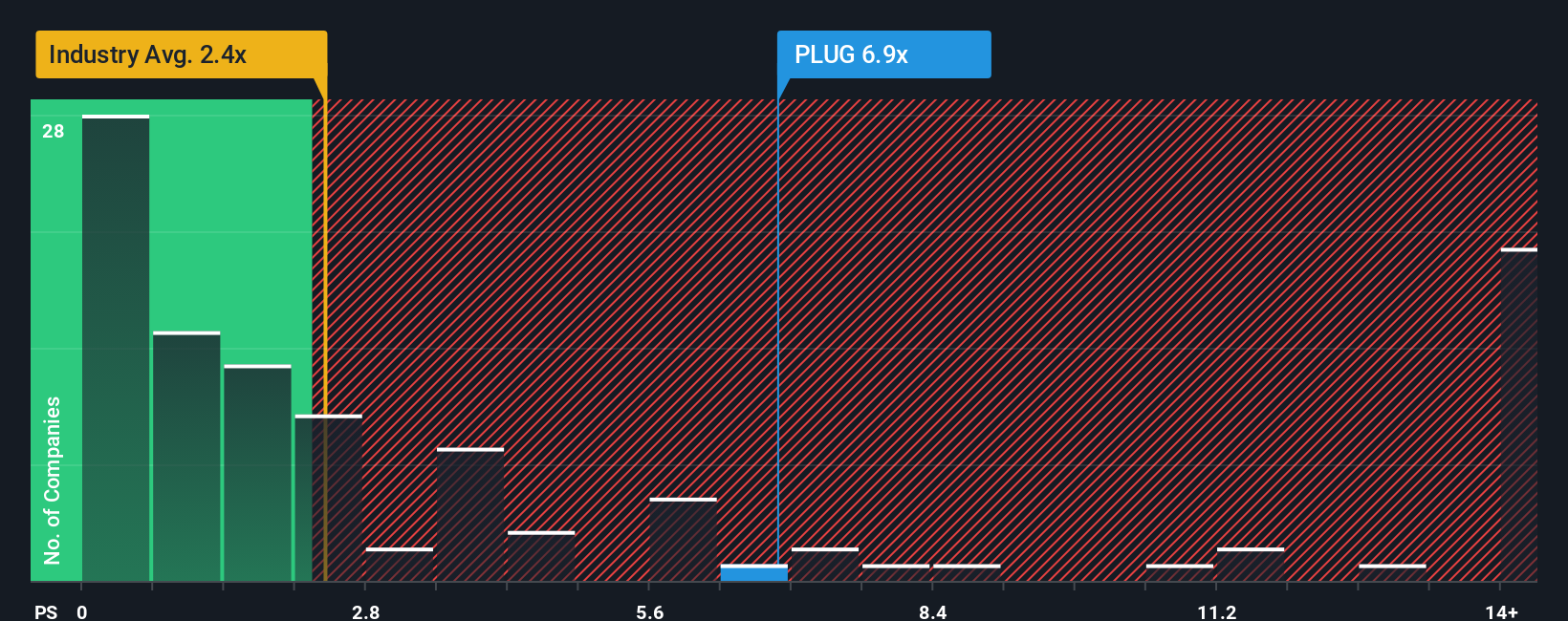

Step away from narrative fair value and the picture gets harsher. On price to sales, Plug trades at about 4.7 times versus 2.2 times for the US Electrical industry and 3.3 times for peers, while our fair ratio points nearer 0.2 times, flagging real de rating risk if sentiment sours.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Plug Power Narrative

If you see the story differently or want to dig into the numbers yourself, you can create a custom Plug Power thesis in minutes with Do it your way.

A great starting point for your Plug Power research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, lock in your next opportunities by using the Simply Wall St Screener to pinpoint stocks that match your strategy with precision.

- Capture potential mispricings by scanning these 915 undervalued stocks based on cash flows that could offer stronger upside if the market rerates their cash flows.

- Ride structural disruption by targeting these 25 AI penny stocks positioned at the heart of real world artificial intelligence adoption.

- Boost your income game by focusing on these 13 dividend stocks with yields > 3% that can add resilient cash yields to your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PLUG

Plug Power

Develops hydrogen fuel cells product solutions in North America, Europe, Asia, and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion