- United States

- /

- Electrical

- /

- NasdaqCM:PLUG

Plug Power Inc. (NASDAQ:PLUG) Can Benefit From the Geopolitical Tailwinds

With a geopolitical crisis boiling up and energy prices reaching record highs, it is not surprising to see a renewed interest in clean energy.

Yet, it is energy and other commodities, especially battery components, that are under pressure, propelling the alternative solutions providers like Plug Power Inc. (NASDAQ: PLUG) to new intra-year highs.

View our latest analysis for Plug Power

Full-year 2021 results:

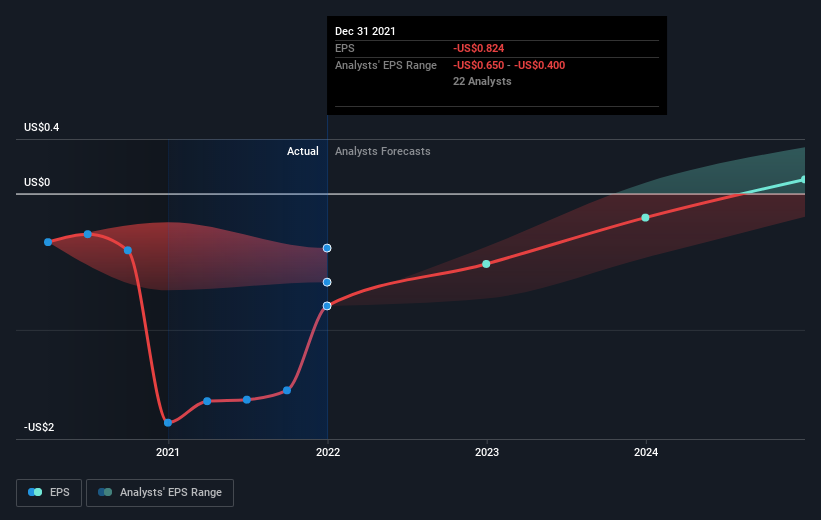

- US$0.82 loss per share (up from US$1.68 loss in FY 2020).

- Revenue: US$502.3m (down 639% from FY 2020).

- Net loss: US$460.0m (loss narrowed 23% from FY 2020).

For FY 2022, the company issued guidance of US$900-925m, which is slightly ahead of the consensus estimate of US$909.1m.

Revenue was in line with analyst estimates. Earnings per share (EPS) surpassed analyst estimates by 42%.

Over the next year, revenue is forecast to grow 81%, compared to a 20% growth forecast for the industry in the US. Meanwhile, over the last 3 years, on average, earnings per share have fallen by 53% per year, but the share price has increased by 127% per year, which means it is well ahead of earnings.

Institutions remained somewhat positive on the stock, with Cowen being the most optimistic one with an Outperform rating and a price target of US$44. RBC Capital Markets hold the same rating but with a slightly more conservative price target of US$39.

While aware of the short-term setbacks, institutions see positive developments in the second half of the year as the company prepares to ship its stationary power products.

How Far is Plug Power Away from Profitability?

The consensus from 26 American analysts is that Plug Power is on the verge of breakeven. They expect the company to post a final loss in 2023 before turning a profit of US$66m in 2024. The company is therefore projected to break even around 2 years from now.

Using a line of best fit, we calculated an average annual growth rate of 67%, which is rather optimistic.If this rate turns out to be too aggressive, the company may become profitable much later than analysts predict.

Underlying developments driving Plug Power's growth aren't the focus of this broad overview but take into account that, by and large, a high forecast growth rate is not unusual for a company that is currently undergoing an investment period.

Finally, it is essential to point out excellent debt management so far. The company has managed its capital prudently, with debt making up 12% of equity. This means that it has predominantly funded its operations from equity capital, and its low debt obligation reduces the risk around investing in the loss-making company.

Next Steps:

Closing up on the breakeven point is an exciting time for any high-growth company. Yet, given the constraints in the current global supply of metals that are critical components to the competing battery technology, the turning point could arrive sooner than expected.

At the moment, all eyes are up to the second half of the year, as lower average costs, new supplier agreements, normalization of the logistic costs - but above all, the geopolitically-driven need to restructure energy dependence.

This article is not intended as a comprehensive analysis of Plug Power. If you are interested in understanding the company at a deeper level, look at Plug Power's company page on Simply Wall St.

We've also compiled a list of crucial aspects you should look at:

- Valuation: What is Plug Power worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether the market currently misprices plug Power.

- Management Team: An experienced management team at the helm increases our confidence in the business – take a look at who sits on Plug Power's board and the CEO's background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqCM:PLUG

Plug Power

Develops hydrogen fuel cells product solutions in North America, Europe, Asia, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives