- United States

- /

- Electrical

- /

- NasdaqCM:PLUG

Can Plug Power’s Rebound Justify Its Valuation After Years of Steep Share Price Declines?

Reviewed by Bailey Pemberton

Recent Share Price Performance and Sentiment Check

Before diving into what Plug Power might actually be worth, it helps to look at how the market has been treating the stock in the short and long term. While valuation models aim to cut through noise, recent performance often signals shifting investor expectations and risk appetite.

Over the last week, Plug Power shares have climbed 9.5%, a sharp move that hints at renewed speculative interest despite a tough backdrop. Zooming out, the stock is still down 16.7% over the past month and 5.6% year to date, reminding investors that volatility has been the norm rather than the exception.

The longer term picture is even more sobering, with the share price having fallen 7.6% over the last year, 83.5% over three years, and 91.8% over five years. This kind of drawdown often reflects a painful reset in growth expectations, capital needs, and confidence in a company’s path to sustainable profitability.

That mix of a recent bounce against a deeply negative multi year trend sets the stage for a key question: is the market still too pessimistic, or not pessimistic enough? To answer that, the next sections will unpack Plug Power’s valuation from multiple angles, then wrap up with a more holistic way to judge whether the stock truly fits your portfolio.

Plug Power scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Plug Power Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it could generate in the future, then discounting those cash flows back to today in dollar terms. For Plug Power, the model used is a 2 Stage Free Cash Flow to Equity approach built on cash flow projections.

Right now, Plug Power is burning cash, with last twelve month free cash flow at roughly $904 million outflow. Analysts expect this to gradually improve, turning positive by 2028 and reaching about $1.34 billion in free cash flow by 2035, with the longer-term numbers extrapolated from earlier analyst forecasts rather than directly forecast by analysts themselves.

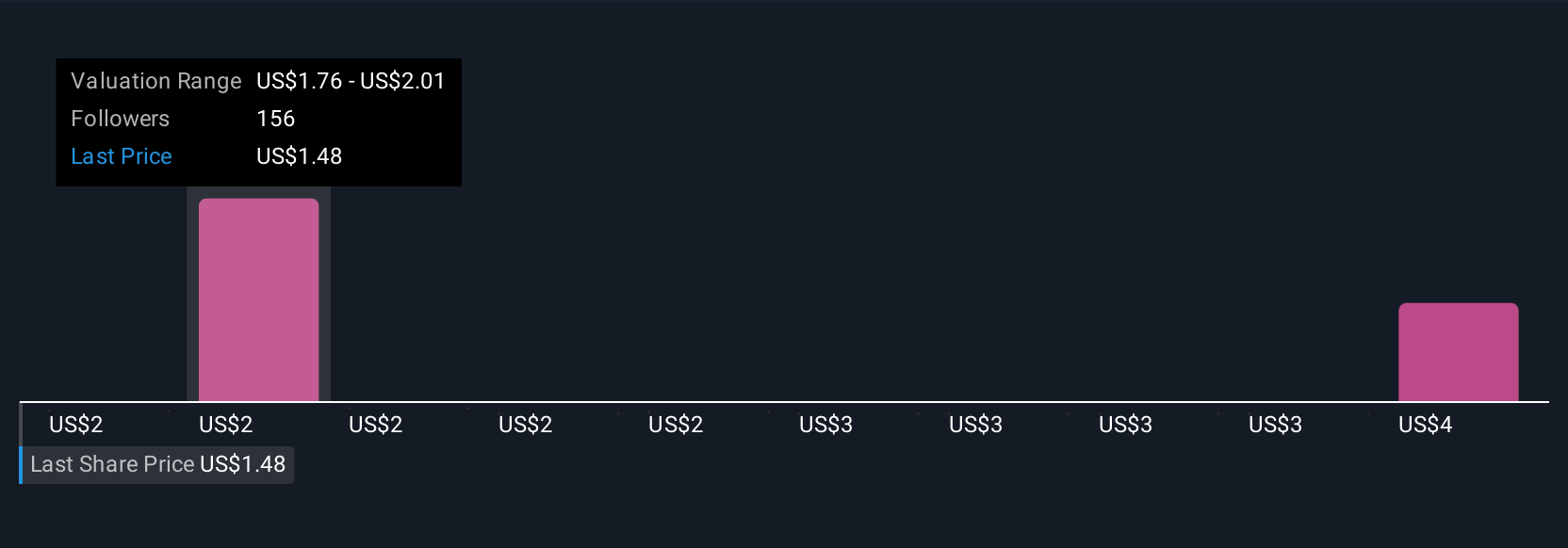

When all these projected cash flows are discounted back to today, the DCF model suggests an intrinsic value of about $7.06 per share. Compared to the current market price, that implies the stock is around 68.8% undervalued. This indicates that investors are heavily discounting Plug Power’s ability to execute on its growth plans.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Plug Power is undervalued by 68.8%. Track this in your watchlist or portfolio, or discover 906 more undervalued stocks based on cash flows.

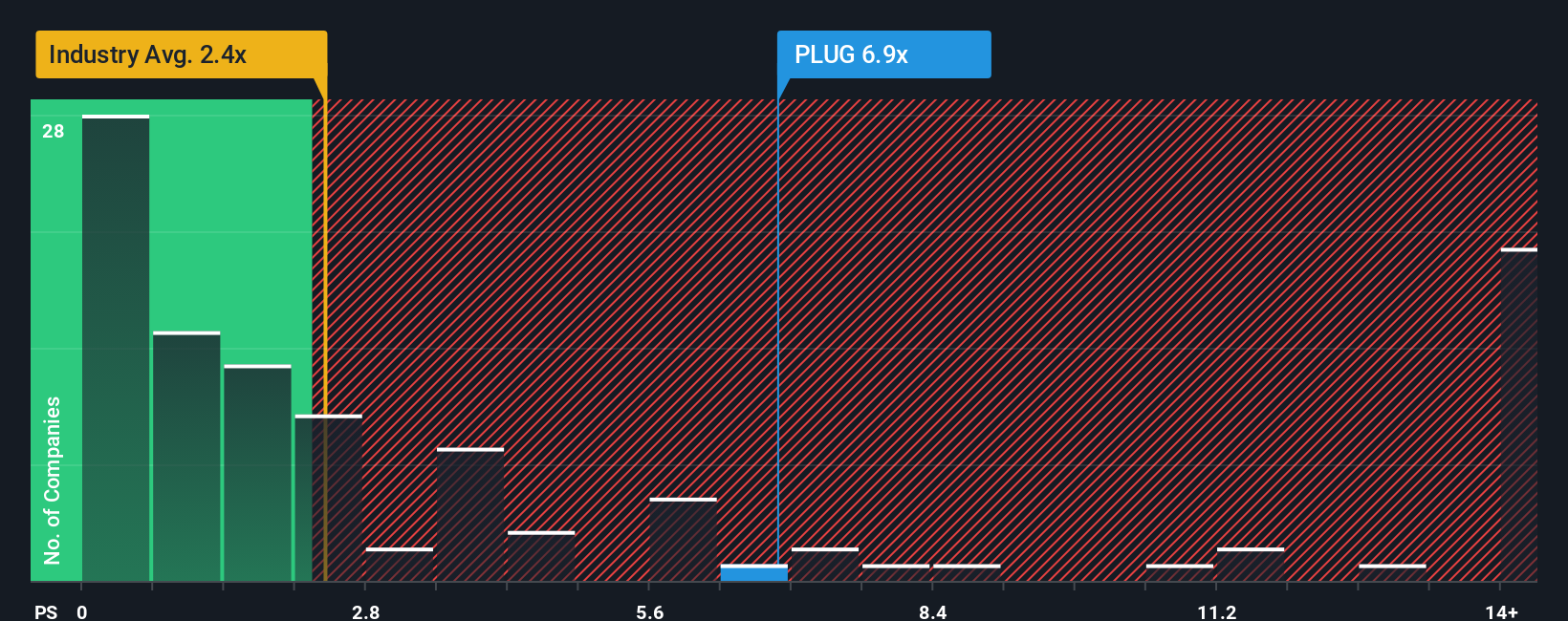

Approach 2: Plug Power Price vs Sales

For growth oriented companies that are not yet consistently profitable, the Price to Sales ratio is often a more practical valuation yardstick than earnings based multiples. It focuses on how much investors are paying for each dollar of current revenue, which is especially useful when profits are still some way off.

In general, faster revenue growth and lower perceived risk can justify a higher Price to Sales multiple, while slower growth and higher risk usually warrant a discount. Plug Power currently trades on a Price to Sales multiple of about 4.47x, which is higher than the Electrical industry average of roughly 2.19x and above the peer average of about 3.41x. This suggests the market is already pricing in substantial growth and improvement.

Simply Wall St’s Fair Ratio is a proprietary estimate of what Plug Power’s Price to Sales multiple should be once you factor in its growth outlook, margins, industry, market cap, and risk profile. This tailored approach is more nuanced than simply comparing with peers, because it adjusts for company specific strengths and vulnerabilities. For Plug Power, the Fair Ratio is just 0.17x versus the current 4.47x. This implies the shares are trading well above what those fundamentals would justify.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Plug Power Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect the story you believe about a company with a concrete financial forecast and a Fair Value estimate you can actually act on. A Narrative is your own explanation for why Plug Power’s future revenues, earnings, and margins might look a certain way, and it ties that story directly to numbers like forecast growth, profitability, and an implied fair share price. On Simply Wall St’s Community page, millions of investors use Narratives as an easy, accessible tool to compare their Fair Value against today’s market price and decide whether Plug Power looks like a buy, hold, or sell. Narratives are dynamic, automatically updating when new earnings, news, or guidance arrive, so your view does not go stale the moment conditions change. For Plug Power, one investor might build a bullish Narrative that leans on accelerating hydrogen adoption and sees fair value closer to the most optimistic target near 5 dollars. Another might focus on cash burn and policy risk, landing nearer the most cautious view around 0.55 dollars. Both perspectives are made explicit, comparable, and testable through their Narratives.

Do you think there's more to the story for Plug Power? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PLUG

Plug Power

Develops hydrogen fuel cells product solutions in North America, Europe, Asia, and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026