- United States

- /

- Electrical

- /

- NasdaqGS:PLPC

I Ran A Stock Scan For Earnings Growth And Preformed Line Products (NASDAQ:PLPC) Passed With Ease

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Preformed Line Products (NASDAQ:PLPC). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for Preformed Line Products

How Quickly Is Preformed Line Products Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That means EPS growth is considered a real positive by most successful long-term investors. As a tree reaches steadily for the sky, Preformed Line Products's EPS has grown 26% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

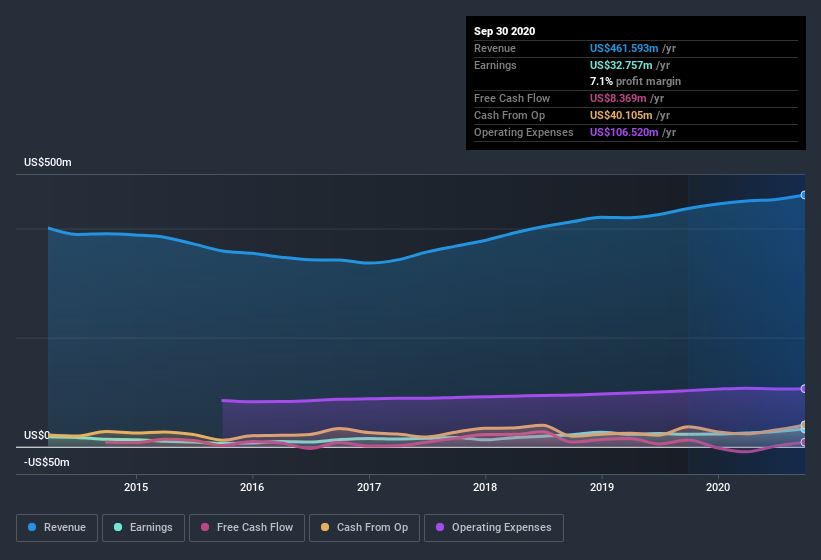

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Preformed Line Products's EBIT margins were flat over the last year, revenue grew by a solid 5.7% to US$462m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Preformed Line Products's balance sheet strength, before getting too excited.

Are Preformed Line Products Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Any way you look at it Preformed Line Products shareholders can gain quiet confidence from the fact that insiders shelled out US$217k to buy stock, over the last year. When you contrast that with the complete lack of sales, it's easy for shareholders to brim with joyful expectancy. We also note that it was the Chief Financial Officer, Andrew Klaus, who made the biggest single acquisition, paying US$192k for shares at about US$51.15 each.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Preformed Line Products insiders own more than a third of the company. In fact, they own 48% of the shares, making insiders a very influential shareholder group. I'm always comforted by solid insider ownership like this, as it implies that those running the business are genuinely motivated to create shareholder value. With that sort of holding, insiders have about US$152m riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

Is Preformed Line Products Worth Keeping An Eye On?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Preformed Line Products's strong EPS growth. On top of that, insiders own a significant stake in the company and have been buying more shares. So it's fair to say I think this stock may well deserve a spot on your watchlist. Of course, identifying quality businesses is only half the battle; investors need to know whether the stock is undervalued. So you might want to consider this free discounted cashflow valuation of Preformed Line Products.

As a growth investor I do like to see insider buying. But Preformed Line Products isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Preformed Line Products, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:PLPC

Preformed Line Products

Designs and manufactures products and systems that are used in the construction and maintenance of overhead, ground-mounted, and underground networks for the energy, telecommunication, cable, data communication, and other industries.

Flawless balance sheet and slightly overvalued.