- United States

- /

- Banks

- /

- NasdaqGM:SMBC

Undiscovered Gems In The United States December 2024

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it boasts an impressive 32% increase over the past year, with earnings projected to grow by 15% annually in the coming years. In this dynamic environment, identifying stocks with strong fundamentals and growth potential can uncover undiscovered gems that may benefit from these favorable conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Southern Missouri Bancorp (NasdaqGM:SMBC)

Simply Wall St Value Rating: ★★★★★★

Overview: Southern Missouri Bancorp, Inc. is the bank holding company for Southern Bank, offering a range of banking and financial services to individuals and corporate clients in the United States, with a market cap of $740.35 million.

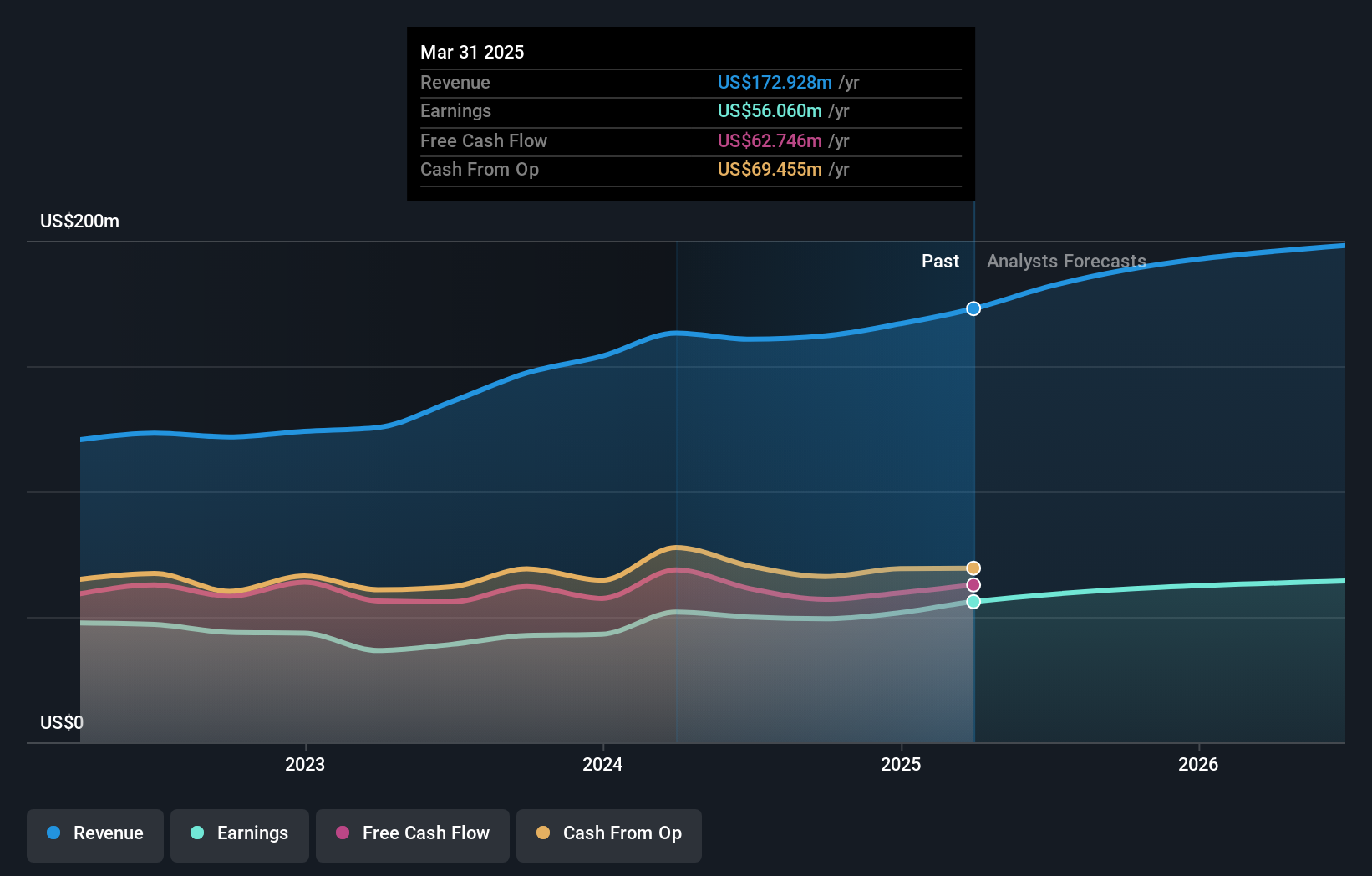

Operations: Southern Missouri Bancorp generates revenue primarily through its thrift and savings and loan institutions, totaling $162.06 million.

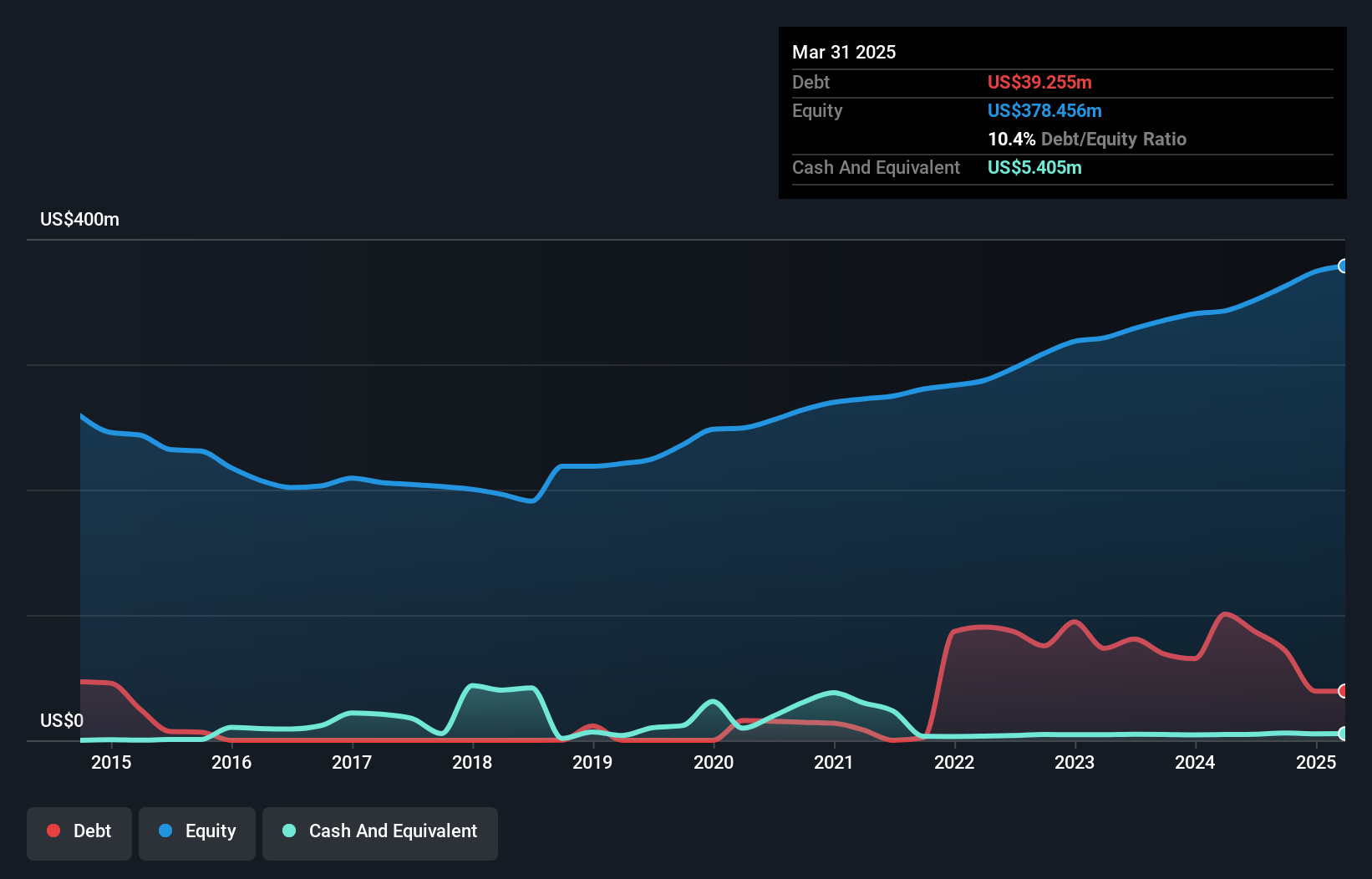

Southern Missouri Bancorp, with assets totaling $4.7 billion and equity of $505.6 million, showcases robust financial health through its sufficient allowance for bad loans at 0.2% of total loans and a net interest margin of 3.3%. Despite significant insider selling recently, the company trades at nearly 31% below estimated fair value, suggesting potential upside for investors seeking undervalued opportunities in the banking sector. Earnings grew by 15.6% last year, outpacing the industry average, while future earnings are projected to grow annually by over 15%, supported by strategic initiatives and strong loan growth prospects amidst competitive challenges.

Northwest Pipe (NasdaqGS:NWPX)

Simply Wall St Value Rating: ★★★★★☆

Overview: Northwest Pipe Company, with a market cap of $556.09 million, manufactures and supplies water-related infrastructure products in North America.

Operations: Northwest Pipe generates revenue primarily from two segments: Engineered Steel Pressure Pipe, contributing $330.54 million, and Precast Infrastructure and Engineered Systems, adding $152.54 million.

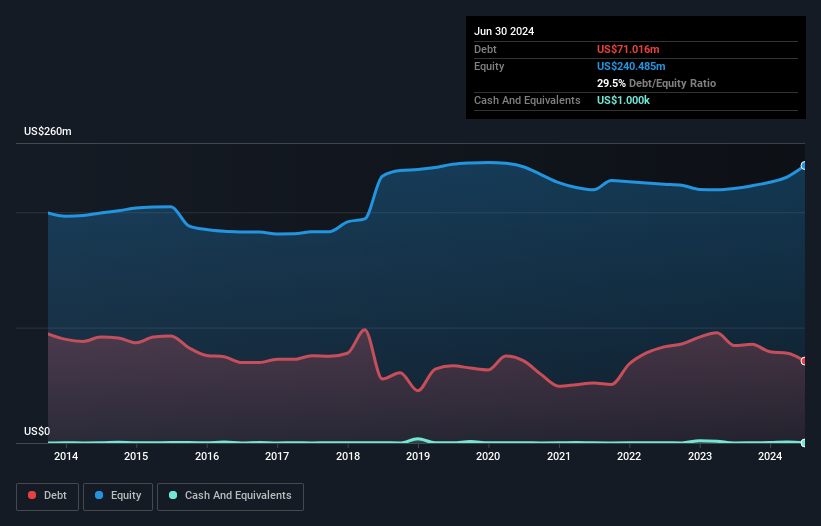

Northwest Pipe, a player in the construction sector, has shown promising financial health with net income rising to US$10.25 million for Q3 2024 from US$5.82 million the previous year. The company's recent revenue of US$130.2 million marks an increase from last year's US$118.72 million, indicating solid performance amidst a strong bidding environment. With its net debt to equity ratio at 18%, Northwest Pipe maintains satisfactory leverage while covering interest payments comfortably at 7.9 times EBIT. As it explores M&A opportunities in the Precast space, potential growth is on the horizon despite challenges like price volatility and strategic risks.

Universal Stainless & Alloy Products (NasdaqGS:USAP)

Simply Wall St Value Rating: ★★★★★★

Overview: Universal Stainless & Alloy Products, Inc. manufactures and markets semi-finished and finished specialty steel products both in the United States and internationally, with a market cap of $413.55 million.

Operations: USAP generates revenue primarily from metal processors and fabrication, amounting to $327.43 million.

Universal Stainless & Alloy Products, a nimble player in the metals industry, recently reported impressive financial results. Sales for the third quarter reached US$87.25 million, up from US$71.28 million the previous year, while net income surged to US$11.05 million from just US$1.93 million last year. The company trades at 71.8% below its estimated fair value and boasts high-quality earnings with a satisfactory net debt to equity ratio of 24.6%. Additionally, interest payments are well covered by EBIT at 4.9 times coverage, indicating solid financial health as it navigates an acquisition by Aperam S.A., valued at approximately $540 million enterprise-wide.

Taking Advantage

- Discover the full array of 231 US Undiscovered Gems With Strong Fundamentals right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SMBC

Southern Missouri Bancorp

Operates as the bank holding company for Southern Bank that provides banking and financial services to individuals and corporate customers in the United States.

Flawless balance sheet with solid track record and pays a dividend.