- United States

- /

- Electrical

- /

- NasdaqCM:NNE

Why NANO Nuclear Energy (NNE) Is Up 24.0% After $6.2 Million ODIN Reactor Design Sale Agreement

Reviewed by Simply Wall St

- Earlier this month, Nano Nuclear Energy entered a US$6.2 million agreement to sell its ODIN reactor design to a U.K. company and participated in several high-profile international energy conferences.

- This marks a milestone for the prerevenue company, highlighting international interest in its reactor technology despite regulatory approval still pending.

- We'll explore how the ODIN reactor design sale agreement may influence Nano Nuclear Energy's long-term investment narrative and global positioning.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is NANO Nuclear Energy's Investment Narrative?

To believe in Nano Nuclear Energy as a shareholder right now means betting on the shift toward next-generation nuclear technology and the company’s ability to capture a meaningful role in that story. The recent US$6.2 million ODIN reactor design sale to a U.K. firm is a significant confidence boost, but, as the company remains prerevenue with no regulatory approval for its reactors, this deal may not bring near-term financial transformation. Nonetheless, the headline has meaningfully increased short-term optimism, igniting a nearly 40% price surge and driving momentum around catalysts like future licensing, regulatory milestones, and further global partnerships. At the same time, core risks have not vanished: unprofitability persists, cash burn is high, and dilution risk remains after substantial capital raises. If the ODIN deal helps build credibility or unlocks further commercial negotiations sooner, it could meaningfully update the risk profile and shorten the timeline to revenue.

However, investors should be aware that revenue remains at US$0 and profit is not expected soon.

Exploring Other Perspectives

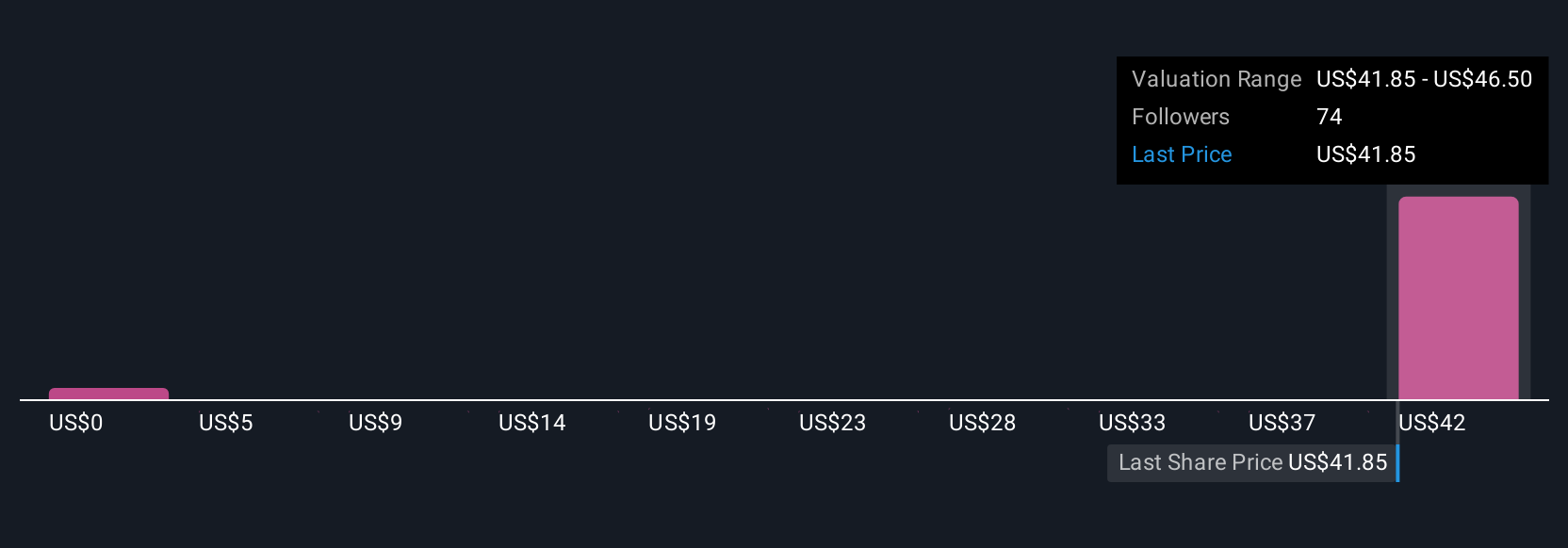

Explore 15 other fair value estimates on NANO Nuclear Energy - why the stock might be worth less than half the current price!

Build Your Own NANO Nuclear Energy Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NANO Nuclear Energy research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free NANO Nuclear Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NANO Nuclear Energy's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NANO Nuclear Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NNE

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives