- United States

- /

- Electrical

- /

- NasdaqCM:NNE

A Look at NANO Nuclear Energy's Valuation Following U.S. Air Force AFWERX Contract Win

Reviewed by Simply Wall St

Thinking about what to do next with NANO Nuclear Energy (NNE)? The company just landed a Direct to Phase II Small Business Innovation Research contract from AFWERX, the U.S. Air Force's innovation hub. This project focuses on developing NANO Nuclear’s advanced KRONOS MMR Energy System at Joint Base Anacostia-Bolling in Washington, D.C. It is a solid endorsement of the company’s technology for military use and could accelerate how quickly its microreactors progress from drawing board to real-world deployment.

This contract is the latest in a string of catalysts for NANO Nuclear Energy, which has been making quiet but steady waves in the advanced nuclear space. Year-to-date, NNE’s stock has climbed 31%, and over the past year, it’s up a dramatic 190%, signaling a surge in market confidence following this and other recent partnerships, such as its ten-year research agreement with Idaho National Laboratory. The share price has cooled off in the past month, down 10%, after a challenging summer, so the timing of this latest win could matter for the stock’s short-term performance.

So after this big jump in the past year, is NANO Nuclear Energy’s value finally catching up to its promise, or is the market already looking ahead and pricing in future growth?

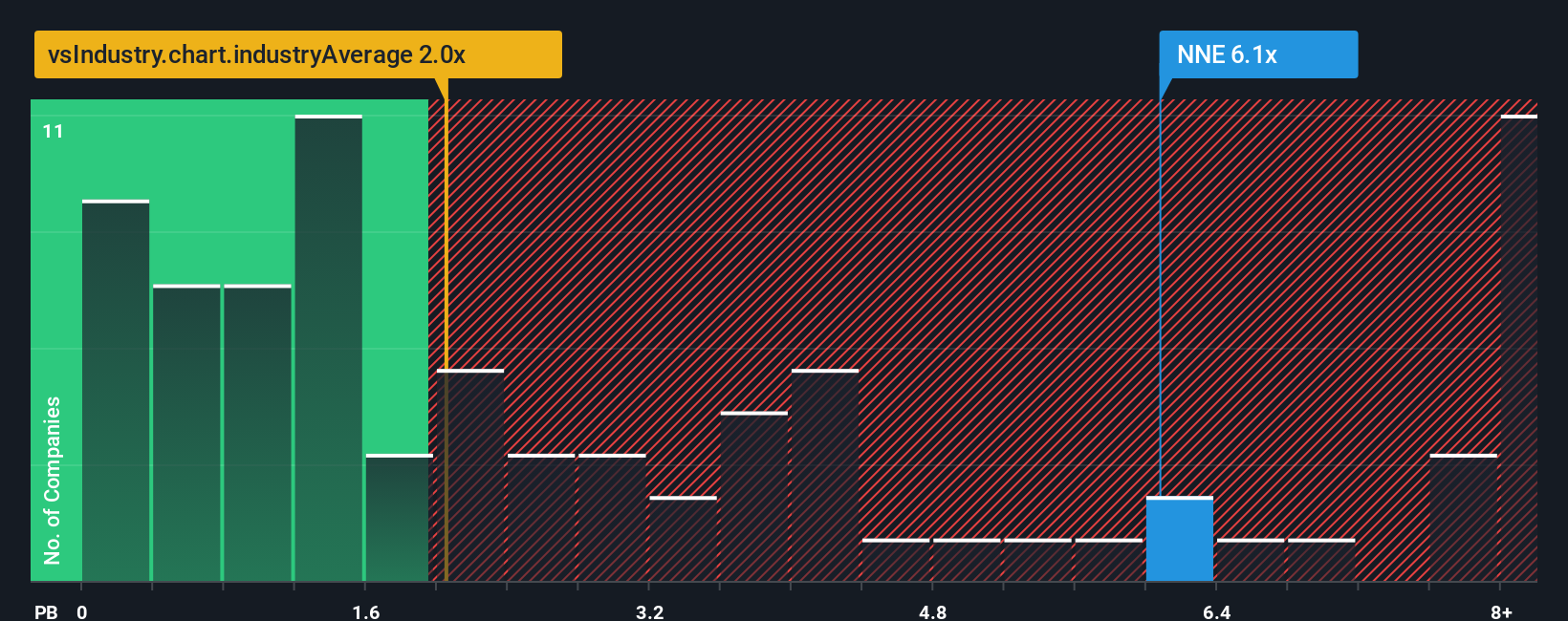

Price-to-Book of 5.8x: Is it justified?

NANO Nuclear Energy is currently trading at a price-to-book ratio of 5.8 times, which is considered expensive compared to the US Electrical industry average of 2 times. This indicates that investors are paying a significant premium relative to the company's book value, well above what is typical for peers in the same sector.

The price-to-book ratio is a widely used metric for companies like NANO Nuclear Energy, especially those in capital-intensive industries. It measures a company's market value against its net asset value and helps investors assess whether a stock is over- or undervalued based on its fundamental worth.

Given this elevated ratio, the market appears to be pricing in strong future prospects for NANO Nuclear Energy, even though the company has yet to generate meaningful revenue or profits. Investors should consider whether this optimism is warranted or if the stock is being overvalued based on current fundamentals.

Result: Fair Value of $31.44 (OVERVALUED)

See our latest analysis for NANO Nuclear Energy.However, uncertainty around NANO Nuclear's lack of revenue and ongoing losses could weigh on investor sentiment if progress stalls or expectations are not met.

Find out about the key risks to this NANO Nuclear Energy narrative.Another View: Analyst Targets Tell a Different Story

While the high price-to-book ratio suggests NANO Nuclear Energy is overvalued, analyst price targets indicate a potential for meaningful upside. Consensus expectations are for the stock to rise further from current levels. Which outlook will prove right?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NANO Nuclear Energy Narrative

If you see things differently, or want to dig into the numbers and draw your own conclusions, you can easily build a custom view of NANO Nuclear Energy in just a few minutes. Do it your way.

A great starting point for your NANO Nuclear Energy research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Serious about finding your next big opportunity? Open doors to new growth stories by using these tailored tools and stay a step ahead in today’s fast-moving market.

- Target tomorrow's tech leaders and ride the surge of artificial intelligence breakthroughs by checking out AI penny stocks.

- Capture value before the crowd does and find companies trading beneath their real worth with the help of undervalued stocks based on cash flows.

- Grow your portfolio’s income potential by zeroing in on companies offering steady returns over 3% through dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NANO Nuclear Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NNE

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives