- United States

- /

- Machinery

- /

- NasdaqCM:MVST

3 Growth Companies With Insider Ownership Up To 30%

Reviewed by Simply Wall St

In the current U.S. market landscape, investors are closely monitoring mixed stock performances following significant trade discussions between President Trump and Chinese leader Xi Jinping, alongside critical earnings reports from major tech companies. Amidst this backdrop, growth companies with substantial insider ownership can offer unique insights into potential long-term value creation, as insiders often have a vested interest in the company's success.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.6% | 92.9% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Credo Technology Group Holding (CRDO) | 11% | 30.4% |

| Celsius Holdings (CELH) | 10.8% | 31.6% |

| Bitdeer Technologies Group (BTDR) | 37.3% | 96.9% |

| Atour Lifestyle Holdings (ATAT) | 18.2% | 23.7% |

| Astera Labs (ALAB) | 12.1% | 31.1% |

| AppLovin (APP) | 27.5% | 25.7% |

| Accelerant Holdings (ARX) | 24.9% | 66.5% |

Here's a peek at a few of the choices from the screener.

Aeluma (ALMU)

Simply Wall St Growth Rating: ★★★★★☆

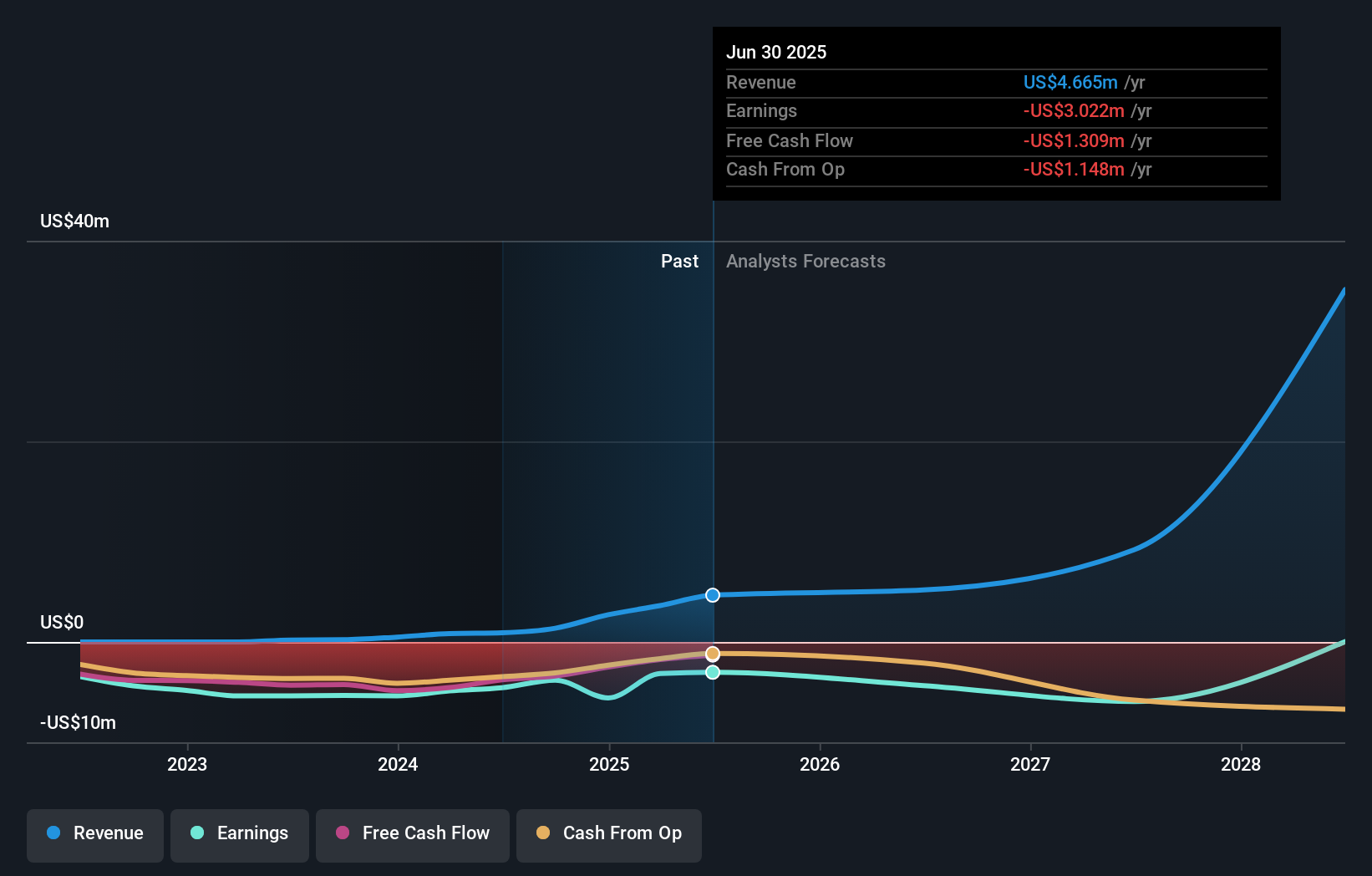

Overview: Aeluma, Inc. develops optoelectronic and electronic devices for sensing, communication, and computing applications in the United States and has a market cap of $280.96 million.

Operations: Revenue Segments (in millions of $): Semiconductor Equipment and Services: $4.67.

Insider Ownership: 30.1%

Aeluma, Inc. is positioned for significant growth with forecasted revenue expansion of 61.6% annually, surpassing the US market average. Despite recent insider selling and share price volatility, the company's addition to the S&P Global BMI Index highlights its growing prominence. Aeluma's recent $22.1 million equity offering aims to bolster its financial position amidst ongoing losses, while new CFO Christopher Stewart's extensive experience could enhance strategic execution as Aeluma targets profitability within three years.

- Navigate through the intricacies of Aeluma with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Aeluma is priced higher than what may be justified by its financials.

CuriosityStream (CURI)

Simply Wall St Growth Rating: ★★★★☆☆

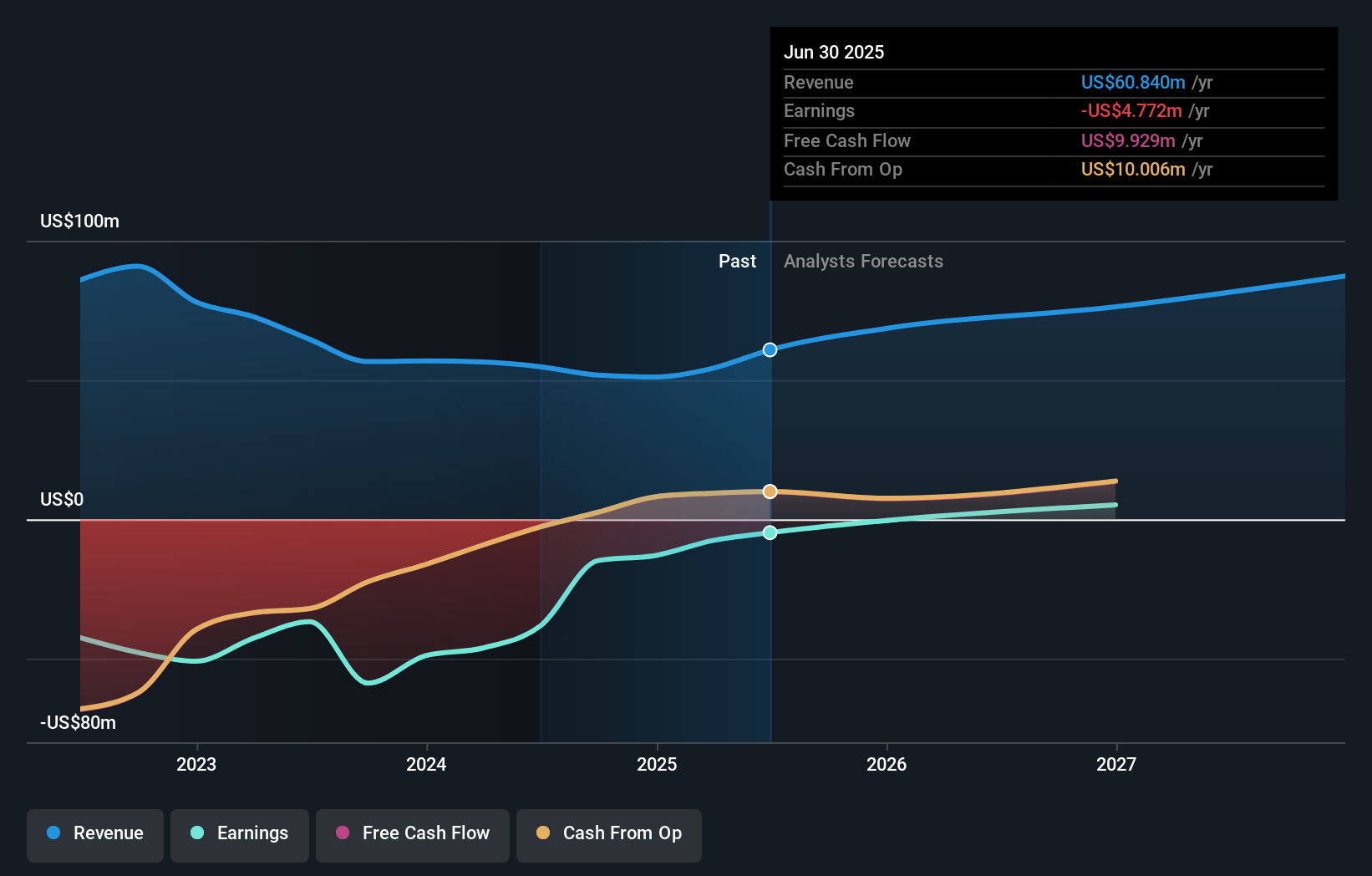

Overview: CuriosityStream Inc. is a media and entertainment company that offers factual content across various platforms, with a market cap of $257.79 million.

Operations: The company generates revenue primarily from its Curiosity Stream segment, amounting to $60.84 million.

Insider Ownership: 30.6%

CuriosityStream is poised for growth, with forecasted annual revenue expansion of 13.8%, outpacing the US market. Despite significant insider selling recently, CuriosityStream's strategic partnerships and licensing agreements across global platforms like Netflix and Prime Video bolster its market reach. The company has upgraded infrastructure to support AI training demands, reflecting strong industry positioning. Although trading below fair value estimates, its dividend yield of 6.81% remains unsustainable by earnings or free cash flows.

- Delve into the full analysis future growth report here for a deeper understanding of CuriosityStream.

- Upon reviewing our latest valuation report, CuriosityStream's share price might be too pessimistic.

Microvast Holdings (MVST)

Simply Wall St Growth Rating: ★★★★☆☆

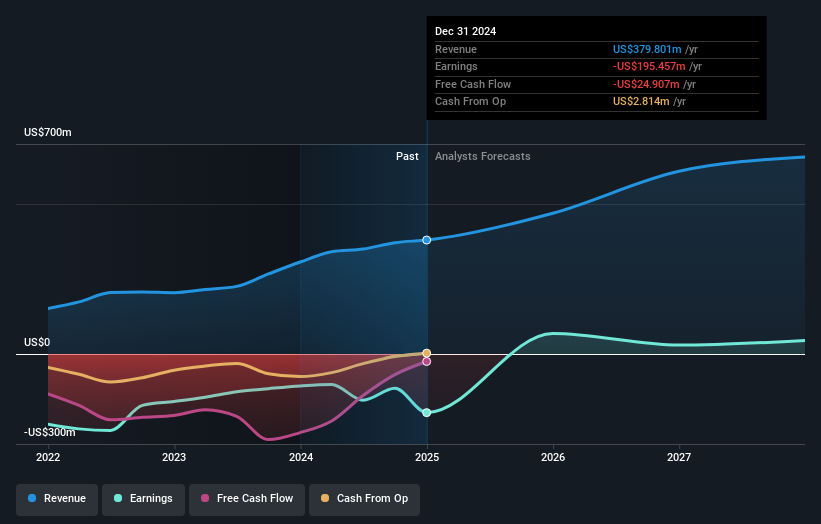

Overview: Microvast Holdings, Inc. specializes in battery technologies for electric vehicles and energy storage solutions, with a market cap of approximately $1.72 billion.

Operations: The company's revenue is primarily derived from its Batteries/Battery Systems segment, totaling $422.61 million.

Insider Ownership: 27.6%

Microvast Holdings anticipates revenue growth of 16.5% annually, surpassing the US market average. Recent presentations at international energy and battery events underscore its focus on high-performance battery solutions, with innovations like fast-charging batteries for heavy-duty applications. Despite a volatile share price and ongoing net losses (US$106.06 million in Q2), the company maintains robust insider ownership and aims to achieve profitability within three years, supported by a US$125 million equity offering to bolster its financial position.

- Take a closer look at Microvast Holdings' potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Microvast Holdings' share price might be too optimistic.

Where To Now?

- Delve into our full catalog of 202 Fast Growing US Companies With High Insider Ownership here.

- Ready To Venture Into Other Investment Styles? AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MVST

Microvast Holdings

Provides battery technologies for electric vehicles and energy storage solutions.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives