- United States

- /

- Life Sciences

- /

- NasdaqGS:BRKR

3 Growth Companies Insiders Own With Earnings Growth Up To 78%

Reviewed by Simply Wall St

As the U.S. stock market experiences slight fluctuations amid ongoing trade discussions with China and recent tariff developments, investors are keenly observing sectors poised for growth. In such a climate, companies with strong insider ownership and significant earnings growth potential can offer unique insights into confidence levels within the firm, making them intriguing candidates for those seeking robust investment opportunities.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (NasdaqGS:SMCI) | 14.1% | 39.6% |

| Duolingo (NasdaqGS:DUOL) | 14.3% | 39.9% |

| FTC Solar (NasdaqCM:FTCI) | 32.2% | 61.8% |

| AST SpaceMobile (NasdaqGS:ASTS) | 13.3% | 60.7% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.1% | 65.1% |

| Astera Labs (NasdaqGS:ALAB) | 15.3% | 43.7% |

| Niu Technologies (NasdaqGM:NIU) | 36% | 82.8% |

| BBB Foods (NYSE:TBBB) | 16.2% | 29.9% |

| Clene (NasdaqCM:CLNN) | 19.4% | 67% |

| Upstart Holdings (NasdaqGS:UPST) | 12.5% | 102.6% |

Let's dive into some prime choices out of the screener.

Microvast Holdings (NasdaqCM:MVST)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Microvast Holdings, Inc. develops battery technologies for electric vehicles and energy storage solutions, with a market cap of approximately $624.40 million.

Operations: The company generates revenue from its Batteries / Battery Systems segment, amounting to $379.80 million.

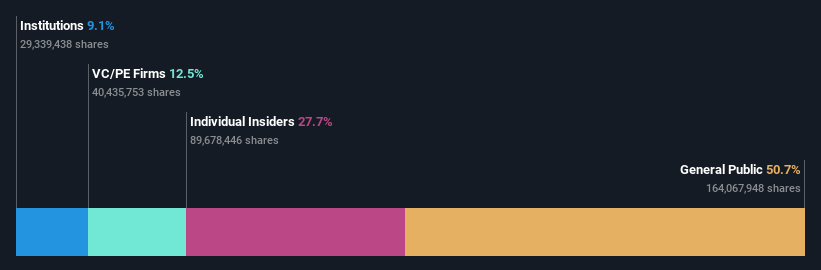

Insider Ownership: 27.7%

Earnings Growth Forecast: 78.7% p.a.

Microvast Holdings is poised for significant growth, with earnings expected to increase by 78.75% annually and revenue projected to grow at 14.2% per year. Despite this, the company faces challenges such as a highly volatile share price and less than one year of cash runway. Recent executive changes include appointing Carl T Pat Schultz as CFO, which may bolster strategic financial management amid auditor concerns about its going concern status following substantial net losses in 2024.

- Dive into the specifics of Microvast Holdings here with our thorough growth forecast report.

- Our valuation report here indicates Microvast Holdings may be overvalued.

Bruker (NasdaqGS:BRKR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bruker Corporation, with a market cap of $6.18 billion, develops, manufactures, and distributes scientific instruments and analytical and diagnostic solutions across the United States, Europe, the Asia Pacific, and internationally.

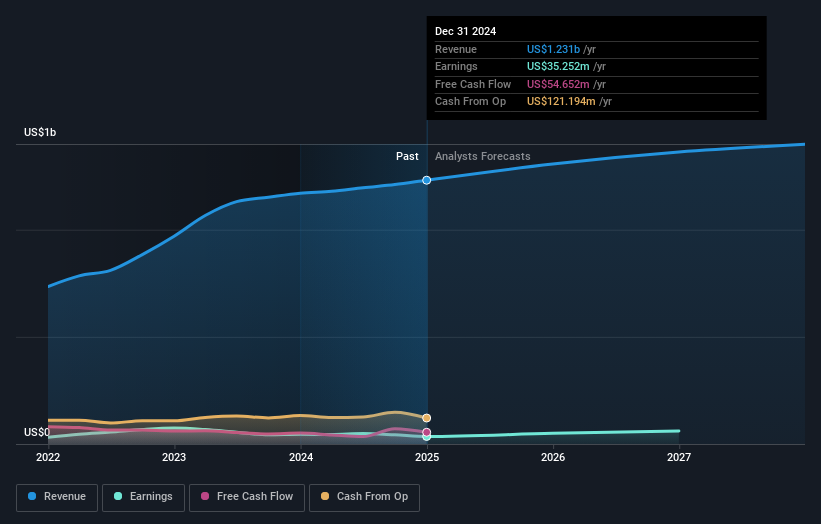

Operations: Bruker's revenue is primarily derived from its BSI CALID segment at $1.15 billion, BSI Nano at $1.11 billion, BSI BioSpin at $930.70 million, and BEST at $269.20 million.

Insider Ownership: 28.2%

Earnings Growth Forecast: 38% p.a.

Bruker Corporation's insider ownership aligns with its growth trajectory, as insiders have been buying shares recently. Despite a decline in net income to US$17.4 million in Q1 2025 from US$50.9 million the previous year, Bruker's earnings are expected to grow significantly at 38% annually, outpacing the broader market. The company forecasts modest revenue growth between US$3.48 billion and US$3.55 billion for 2025, supported by innovative product launches and strategic advancements in spatial biology and multiomics research platforms.

- Take a closer look at Bruker's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Bruker's share price might be too optimistic.

Accel Entertainment (NYSE:ACEL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Accel Entertainment, Inc. operates as a distributed gaming and local entertainment company in the United States with a market cap of approximately $979.30 million.

Operations: The company's revenue primarily comes from its Casinos & Resorts segment, generating approximately $1.25 billion.

Insider Ownership: 11.6%

Earnings Growth Forecast: 21.1% p.a.

Accel Entertainment's recent earnings report shows strong net income growth, with Q1 2025 results revealing a jump to US$14.64 million from US$7.42 million the previous year. The company's earnings are expected to grow significantly at 21.1% annually, outpacing the broader market. However, revenue growth is slower than market averages at 4.5% per year, and interest payments remain a concern for financial stability despite trading slightly below fair value estimates.

- Navigate through the intricacies of Accel Entertainment with our comprehensive analyst estimates report here.

- Our valuation report here indicates Accel Entertainment may be undervalued.

Where To Now?

- Reveal the 200 hidden gems among our Fast Growing US Companies With High Insider Ownership screener with a single click here.

- Curious About Other Options? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Bruker might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BRKR

Bruker

Develops, manufactures, and distributes scientific instruments, and analytical and diagnostic solutions in the United States, Europe, the Asia Pacific, and internationally.

Reasonable growth potential low.

Similar Companies

Market Insights

Community Narratives