- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:MRCY

Will Mercury Systems' (MRCY) Defense Contract Win Strengthen Its Position in Future Military Tech Integration?

Reviewed by Sasha Jovanovic

- Mercury Systems recently received a US$12.3 million development contract from a leading defense prime contractor to create an avionics subsystem for a new U.S. military aircraft, with the project expected to span three years.

- This collaboration highlights Mercury’s role in integrating advanced communication management for next-generation military platforms, underscoring its alignment with evolving defense technology demands.

- We'll examine how this contract win further supports Mercury Systems' positioning in defense modernization and future program integration initiatives.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Mercury Systems Investment Narrative Recap

To be a Mercury Systems shareholder, one must believe in the company's ability to shift its business mix away from low-margin legacy programs by securing new, higher-value defense contracts. The recent US$12.3 million avionics subsystem deal signals continued demand in military modernization but is not likely to materially change the near-term revenue growth outlook or address immediate risks, such as the backlog of older, low-margin work and the challenge of converting new program wins into sizable earnings momentum.

Among recent developments, the US$8.5 million award for next-generation RF signal conditioning products reflects Mercury's steady traction in future-focused defense technologies. This reinforces catalysts tied to expanding penetration in radar and electronic warfare applications, which remain vital for longer-term margin improvement but, like the new avionics contract, do not appear sufficient to significantly accelerate current period growth.

By contrast, the company’s still-sizeable unbilled receivables and legacy contract backlog pose a concern that investors should be aware of if...

Read the full narrative on Mercury Systems (it's free!)

Mercury Systems' outlook anticipates $1.1 billion in revenue and $44.5 million in earnings by 2028. This is based on a 6.1% annual revenue growth rate and a $82.4 million increase in earnings from the current -$37.9 million.

Uncover how Mercury Systems' forecasts yield a $72.62 fair value, a 12% downside to its current price.

Exploring Other Perspectives

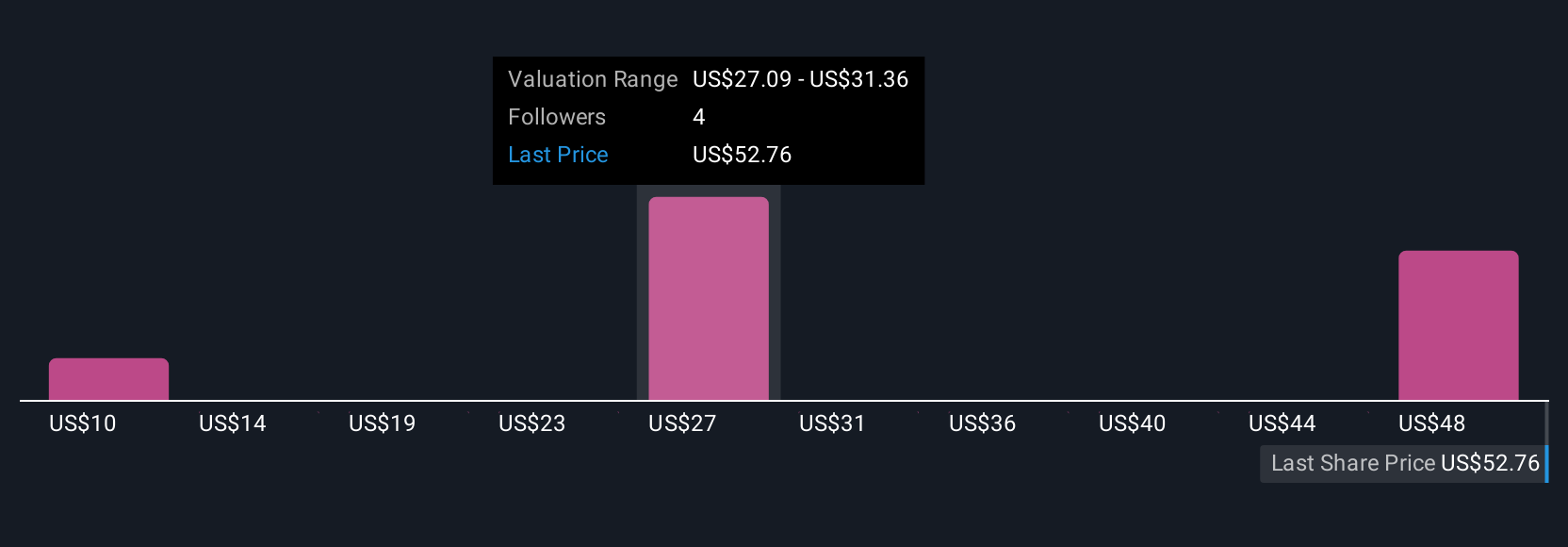

Simply Wall St Community members estimate fair values for Mercury Systems ranging from US$10 to US$72.63 based on four viewpoints. While most agree on growth opportunities in defense modernization, persistent low-margin contract exposure could present headwinds for sustained earnings progress.

Explore 4 other fair value estimates on Mercury Systems - why the stock might be worth less than half the current price!

Build Your Own Mercury Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mercury Systems research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Mercury Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mercury Systems' overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRCY

Mercury Systems

A technology company, manufactures and sells components, products, modules, and subsystems for defense prime contractors, original equipment manufacturers, government, and commercial aerospace companies.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives