- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:MRCY

Why Mercury Systems (MRCY) Is Up 12.9% After Landing $12.3 Million Military Aircraft Avionics Contract

Reviewed by Sasha Jovanovic

- In September 2025, a U.S. defense prime contractor announced awarding Mercury Systems a US$12.3 million contract to develop a Communication Management Unit (CMU) for a new military aircraft over three years.

- This project positions Mercury to contribute core avionics technology in the early stages of a high-profile U.S. military platform, potentially expanding its footprint in mission-critical systems.

- We'll examine how this recent contract underscores Mercury Systems' alignment with next-generation defense programs and its influence on the investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Mercury Systems Investment Narrative Recap

To buy into Mercury Systems today, investors need to believe that the company can transition out of its backlog of older, low-margin contracts and successfully capture growth from next-generation defense platforms. The new US$12.3 million avionics development contract spotlights Mercury’s technical role in a next-gen aircraft program, but given its modest size, it doesn't meaningfully alter near-term growth outlooks or mitigate the biggest revenue headwinds from legacy programs this year.

The most relevant recent announcement is Mercury’s US$8.5 million Department of Defense contract to develop advanced RF packaging for X-band AESA radars. This win is another signpost of Mercury’s expanding reach into high-value, mission-critical defense technologies, but these projects remain a small part of revenue and do not negate the immediate pressure from a sizeable legacy backlog.

By contrast, investors should keep in mind that a persistent load of low-margin contracts may ...

Read the full narrative on Mercury Systems (it's free!)

Mercury Systems' outlook projects $1.1 billion in revenue and $44.5 million in earnings by 2028. This is based on analysts' assumptions of 6.1% annual revenue growth and an increase in earnings of $82.4 million from the current level of -$37.9 million.

Uncover how Mercury Systems' forecasts yield a $72.62 fair value, a 12% downside to its current price.

Exploring Other Perspectives

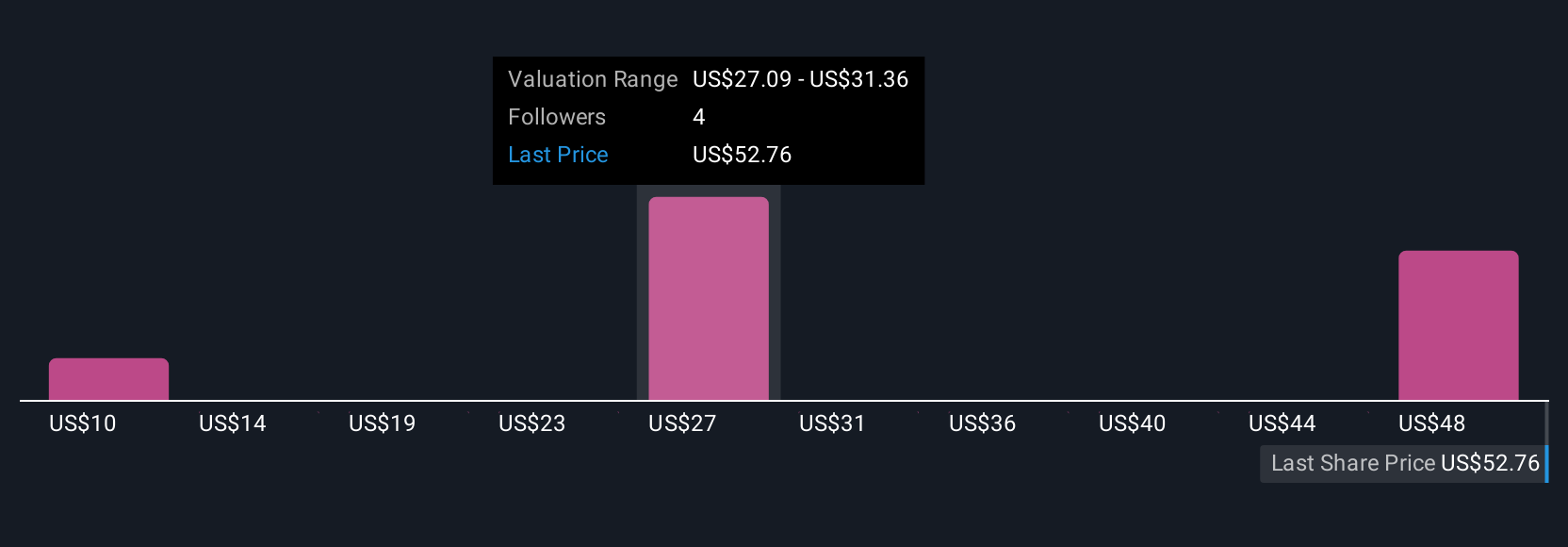

Simply Wall St Community members have posted four fair value estimates for Mercury Systems ranging from as low as US$10 to nearly US$73 per share. While some estimate significant upside, others continue to weigh constraints from the execution of legacy contracts as a broader concern for the company’s potential.

Explore 4 other fair value estimates on Mercury Systems - why the stock might be worth as much as $72.62!

Build Your Own Mercury Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mercury Systems research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Mercury Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mercury Systems' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRCY

Mercury Systems

A technology company, manufactures and sells components, products, modules, and subsystems for defense prime contractors, original equipment manufacturers, government, and commercial aerospace companies.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives