- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:LUNR

Will Intuitive Machines’ (LUNR) Acquisition and Narrowed Losses Reshape Its Competitive Edge?

Reviewed by Sasha Jovanovic

- Intuitive Machines reported third-quarter revenue of US$52.44 million and a net loss of US$10.29 million, both improving compared to the same period last year, and announced plans for further business expansion following its acquisition of Lanteris.

- The reduction in net losses and broadening of service capabilities suggest the company is seeking operational improvement while integrating new business lines to strengthen its position in the space sector.

- We'll examine how the Lanteris acquisition and improved quarterly results could influence Intuitive Machines' investment narrative and sector outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

Intuitive Machines Investment Narrative Recap

Investors considering Intuitive Machines are betting on the company’s ability to scale in the high-stakes commercial space sector, where demand for lunar and deep space infrastructure is rising. The latest quarterly results, marked improvement in net loss and narrowing losses per share, despite softer revenue, may not dramatically shift the thesis that the main near-term catalyst remains execution of existing contracts, while large, concentrated government exposure continues to be the principal risk.

The October contract extension with the U.S. Air Force, worth US$8.2 million and tied to lunar nuclear power systems, highlights management’s push to broaden the government services portfolio beyond NASA. For shareholders, these wins support growth ambitions but do not completely mitigate revenue volatility linked to program funding cycles and performance milestones.

However, investors should be aware that, despite such diversification, the company’s reliance on a few government clients still leaves it exposed if federal priorities shift or lunar awards...

Read the full narrative on Intuitive Machines (it's free!)

Intuitive Machines' outlook anticipates $502.2 million in revenue and $41.2 million in earnings by 2028. Achieving this would require annual revenue growth of 30.5% and an earnings increase of $283 million from the current level of -$241.8 million.

Uncover how Intuitive Machines' forecasts yield a $15.38 fair value, a 91% upside to its current price.

Exploring Other Perspectives

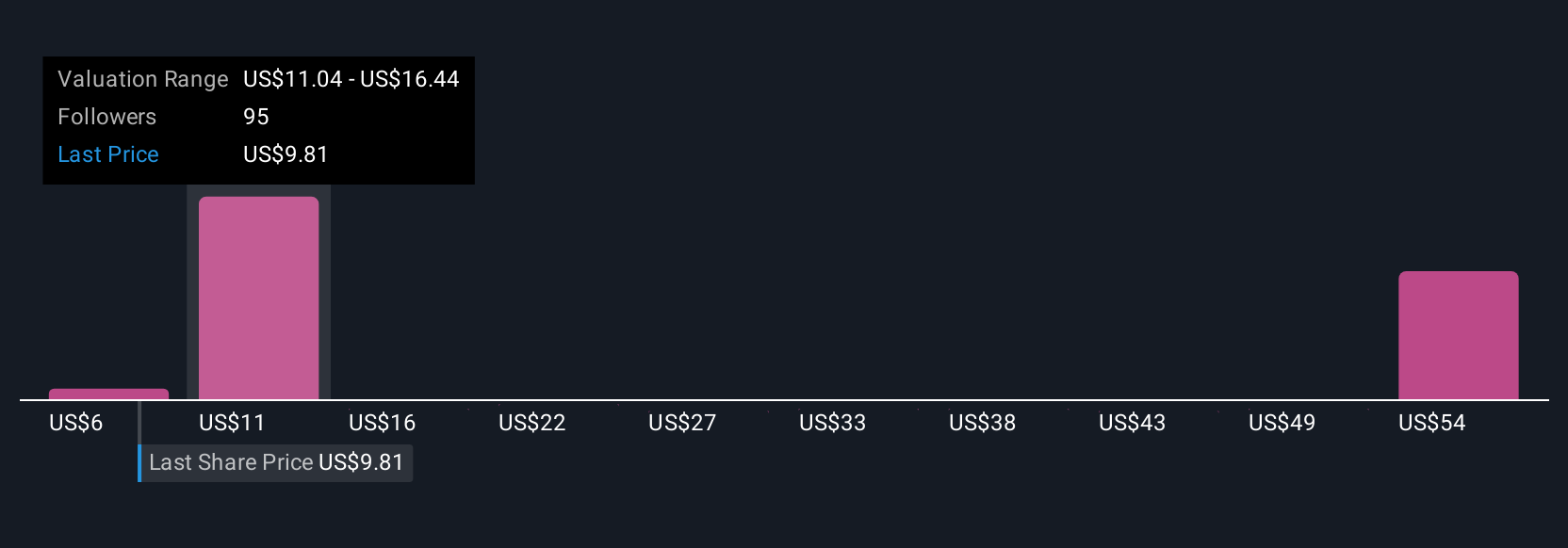

Twenty-eight members of the Simply Wall St Community estimate Intuitive Machines' fair value from US$5.69 to US$58.77 per share. While opinions span a wide range, concentrated contract risk may present ongoing challenges as stakeholders balance optimism with the realities of government funding swings.

Explore 28 other fair value estimates on Intuitive Machines - why the stock might be worth over 7x more than the current price!

Build Your Own Intuitive Machines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Intuitive Machines research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Intuitive Machines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Intuitive Machines' overall financial health at a glance.

No Opportunity In Intuitive Machines?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LUNR

Intuitive Machines

Designs, manufactures, and operates space products and services in the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives